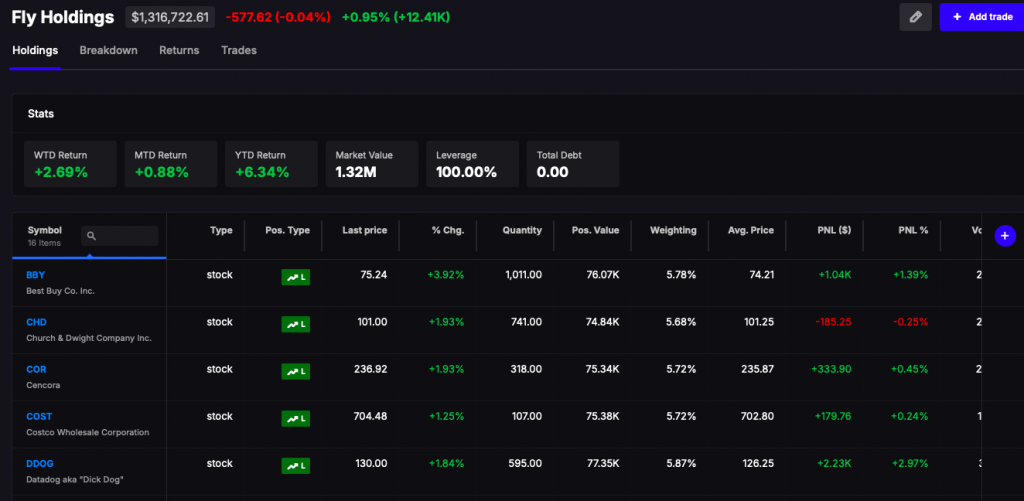

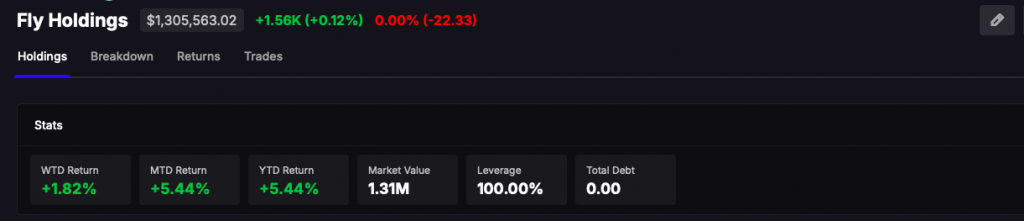

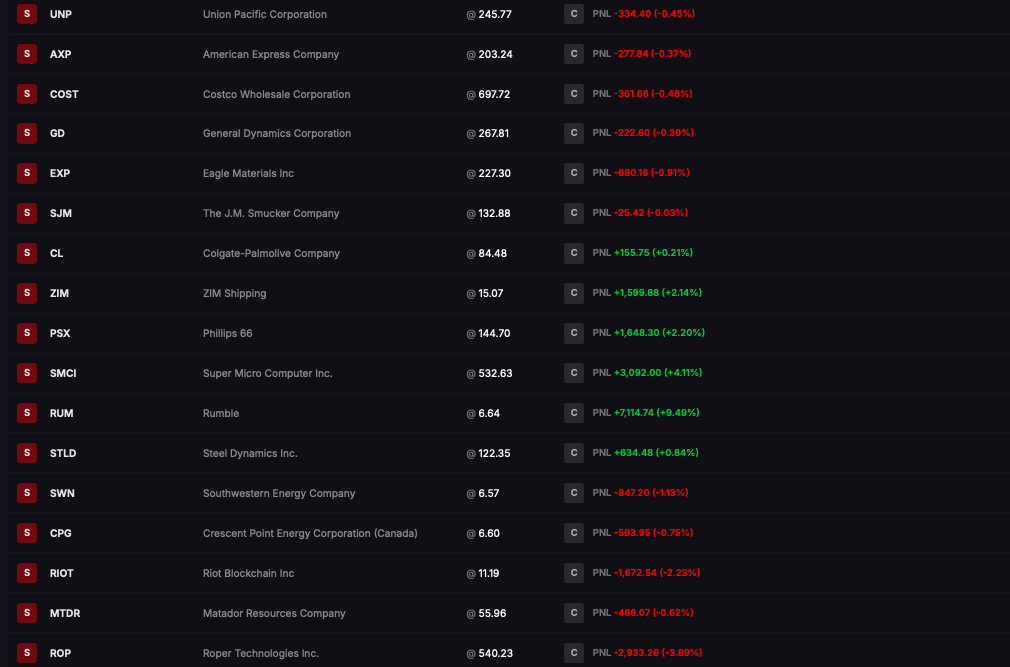

I was a strong risk day and all involved made some coin. I netted the week up more than 2.5% in what I consider sub par trading. My gains are above 6% for the year, so I am on pace to DOUBLE my account, which makes me happy, not for the money I am going to enjoy, but for the anger it will invoke in many of my enemies.

To be clear, I will never liquidate my account and spend it on things Mrs. Fly wants. The money I invest will outlive me and be domiciled in dynasty trusts, guided by me from beyond the grave.

I closed the session with a high risk profile, a portfolio with a beta in excess of 1.8. I do not fear drawdowns because I am a highly skilled, highly competent, highly professional trader of the very first magnitude. You should know, and I hope you now believe it, “The Fly” always wins and during the rare occasions when he doesn’t — things are about to swing back to the upside for him — lavishing House Fly with the many comforts and accoutrements one expects from a man of such standing.

GOOD SIRS —

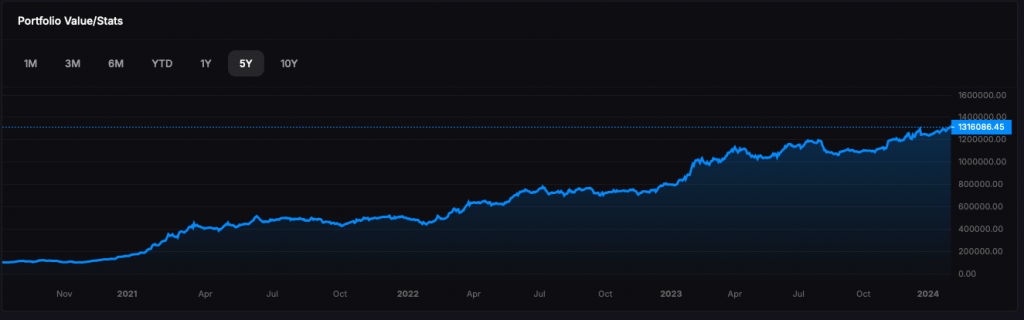

I stand before you once again at RECOURD HIGHS. Nothing can stop me from manifesting my life from bottom left to upper right.

On a closing note, I am very bullish on shares of Rumble and have clear visions of the future with this one — laying waste to the shorts — cutting their heads off and placing them on pikes as a warning for all others to fuck off and leave he free speech platform alone.

Have a good weekend.

Comments »