I am naturally a very anxious person. At home I am usually rifling through news stories, learning to code, researching stocks, reading a book, listening to an Audible, and conversing with people online and writing, all at the same time. I am what some might call a polymath, a person with a keen interest in many different things. When I was young and single, my eyes would wander for variety. I exhibit similar behavior when trading — always on the hunt for newer/better stocks.

Many years ago I was wantonly criticized for these methods, described as easily changeable and amenable to prevailing winds. But since 2020 I’ve grown to appreciate my changeability, providing me with grandiose returns in a market rife with turmoil and tumult.

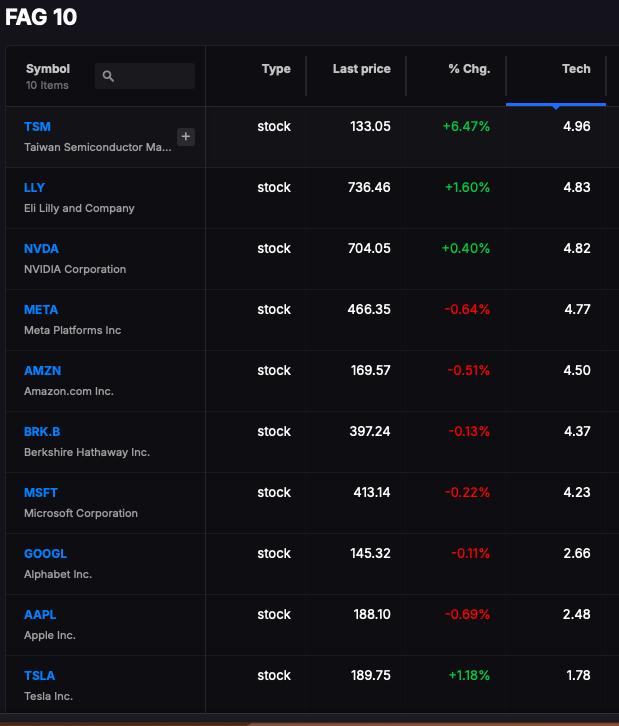

But following years of rapid fire trading, I am attempting to do a little less in 2024 — perhaps reducing the volume of my trades from 75-100 per day to 40-65. Whilst that might seem like a lot — it really isn’t. At 6% positions and fully invested, selling and going to cash is 16 trades before 10am. Trying some movers throughout the day might account for 10 and then another 10-16 by the close. When the market is really active, I should not limit my trading volume — but instead maximize it — even via leverage. But this tape isn’t conducive with high risk, as the YTD trends suggest more of the same from 2023 — concentrated returned in mega caps with intermittent fake breakouts in small caps and subsequent collapses followed by mean reversion melt ups.

In other words, if you’re allocated in great big companies — you can probably relax and expect decent returns. But if you’re trading and trying to beat the market, you must remain vigilant and watch for pivots in the risk profile.

Today is a mirror image of yesterday, with high beta stocks +2.6% and the larger lower beta stocks much weaker. If you’re betting on the rally to continue in the $IWM — you’ll need a little luck on your side because almost all small cap rallies have flopped since late December.

Comments »