Good evening —

I had a long weekend entertaining some guests from NYC and happened to chance upon a rare comment inside my last blogs’ comments section. The comments have become increasingly rare for a number of reasons. If you go back into the archives of many years ago you’ll see hundreds of comments per post because that was prior to Stocklabs or Exodus where paid customers talk shit all day inside the Pelican Room.

Another reason is the readership is much smaller since I don’t push out non-financial news anymore and instead of having other bloggers writing for me — it’s just me. The last reason is X/Twitter — where much of the conversation is happening. In a sense the blogosphere is a relic of another era, pre social media. Back when I started blogging, circa 2002, many people I knew had blogs. If you wanted to express yourself — you started a blog and when you wanted to converse with other people you’d go to other blogs and talk in their comments section. I’d argue that iBankCoin is one of the very few OG blogs left from the pre Twitter era and I’ve really done a terrible job at updating the site — but that’s a conversation for another day.

At any rate, here is the comments from a Mr. “Rigged Game”.

Since I don’t have much going on right now I will dissect this comment and offer a reply.

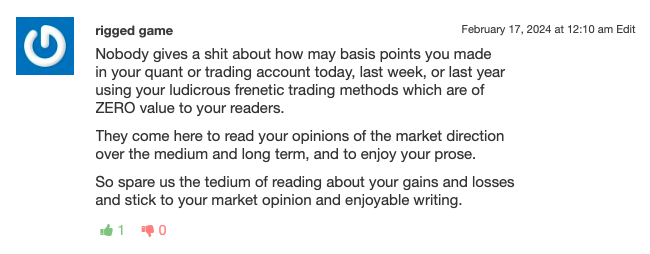

“Nobody gives a shit about how many basis points you made in your quant or trading account today, last week, or last year using your ludicrous frenetic trading methods which are of ZERO value for your readers.”

I vividly recall this almost identical comments left before — maybe by the same person. Naturally my gains aren’t yours so who the fuck cares how much money I made for the day, week, month, etc.? But you’re wrong on several point here.

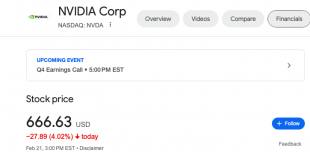

- My Quant and Strategic Accounts do not trade often and can easily be followed by people. My trading account’s trades are also down 30% in 2024, as I am trying to trade less so members can follow me more closely. The quant is allocated once per month and the strategic holdings are at a minimum 1 week to multi months holds.

- If I do not tell people about my returns, whether they be up or down, no one will really know if my opinions hold weight. I get new readers daily and those people should understand the type of person that they are dealing with — a man who is able to bank extreme amounts of coin in any tape and cannot be stopped by any market environ.

“They come here to read your opinions of the market direction over the medium and long term, and to enjoy your prose.”

This comments tells me “Rigged Game” isn’t hostile and is a fan — but just wants me to SHUT THE FUCK UP and to tell him where stocks are going without me fixating on my performance. Truth is, the best way for a Mr. Rigged Game to access me in that manner is through buying a membership inside Stocklabs. Since I do not advertise for the business, he should know that iBankCoin is a free blog that also advertises for Stocklabs and has done so since 2008. I have always written in this manner and will continue to do so.

“So spare us the tedium of reading about your gains and losses and stick to your market opinion and enjoyable writing.”

Well, thank you for the compliment and the passive aggressive behavior. I always enjoy dissecting human behavior. I can see Rigged Game is an intelligent person by the use of the word “tedium” and lack of grammatical errors. That being said, he should use some deductive reasoning here and take a different tact in reproaching me with content requests.

For example:

“Hey Fly — I appreciate your work — but how about your limit your trading gains and losses reports to just 1 blog per day and have the other 1 or 2 blogs discuss some macros trends and predictions for stocks?”

That I can do.

But, I’d also entreat you to SHUT THE FUCK UP since it’s my blog and I can do whatever the hell I wanted to do here. I might be reporting my gains and losses for posterity, so that my great grandchildren can one day come here and see I made 0.62% on 2/16/24 — something that might be of EXTREME importance to him since he might be a data analyst and statistics is something of great interest to him. OR, perhaps I post my returns to flex on you FUCKED FACES every day so you can get angry and jealous, showing your seething rage in the comments section after the tedium boils over into outright red faced acrimony.

I can always convert iBankCoin into paid blog and greedily extract money from Rigged Game, since he doesn’t seem generous enough to support my work via a Stocklabs membership.

So you know, I will continue to irritate you Mr. Rigged Game and invite you to continue reading me nonetheless. Thank you for your patronage you cocksucking son of a bitch.

Comments »