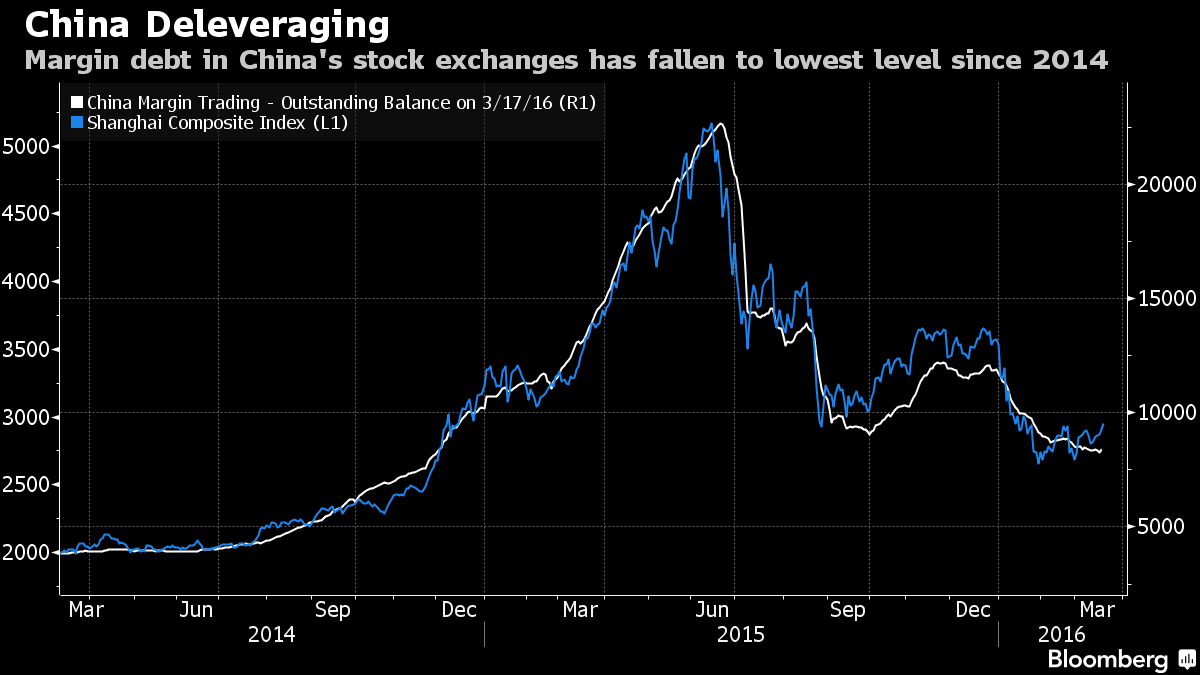

Since the collapse of the Chinese stock market last year, margin lending plunged by 60%, partly thanks to a complete wipeout of the predominant retail oriented investor from the field of battle and also due to restrictions placed on margin lending by the Chinese government. Over the past month or so, things have settled down and a calm normality has replaced the frantic ‘jump out the window’ to meet a margin call trading action.

Obviously, it’s time to lever up the farmer again, by permitting him to margin out his trading accounts to reach ‘peak velocity’ to take full advantage of the coming renaissance.

The rate for 182-day loans will be cut to 3 percent, while that for 91 days will be lowered to 3.2 percent, the agency said. The 28-day lending rate will be reduced to 3.3 percent, while 14-day and 7-day costs will fall to 3.4 percent, it said. In a margin trade, investors use their own money for just a portion of a stock purchase and borrow the rest. The loans are backed by their investments, meaning that they may be forced to sell to repay the debt when prices fall.

China Securities Finance Corp., the state-backed agency that provides funding to brokerages for margin trading, will restart offering loans to securities firms for periods ranging from 7 days to 182 days, according to a statement posted on its website Friday. The agency will cut interest rates on the debt to as low as 3 percent, it said. China’s offshore equity-index futures rose.

“The loosening could reignite interest in the equity market, particularly as the regulators’ actions last year — to rein back private sector broker leverage — helped trigger the correction in equity prices,” said Koon Chow, senior macro and currency strategist at Union Bancaire Privee in London. “”It does look like they want a second chance at growing the equity market. We shall all be watching very closely whether leveraged buying of the equity market balloons again.”

Money is cheap in China and so are people.

If you enjoy the content at iBankCoin, please follow us on Twitter

This was well known, no? China pumping whatever dogshit currency they use, for months on end adds up and means something.