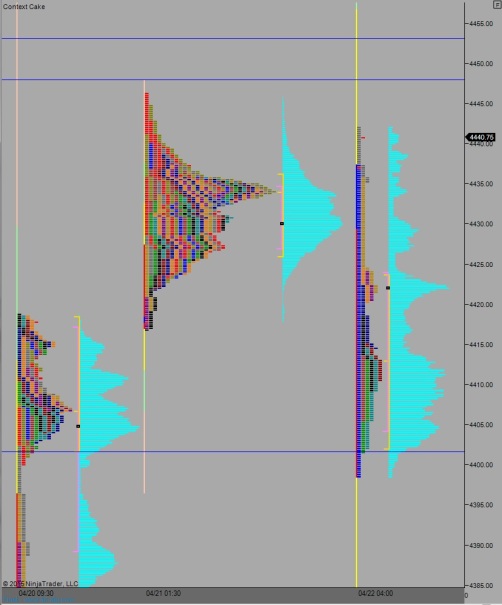

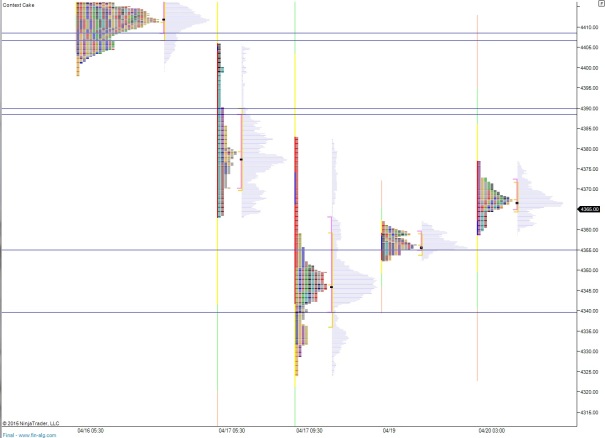

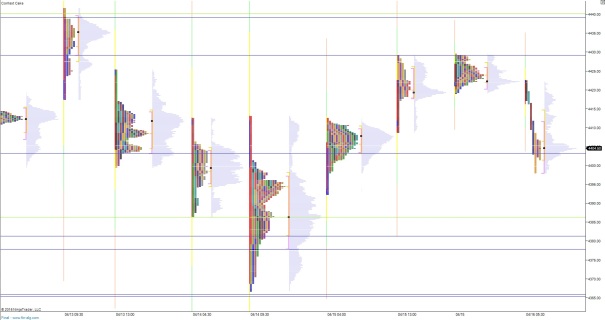

The Nasdaq globex session was one again busy and once again the scene of aggressive selling until early this morning when buyers stepped in and stabilized the action just ahead of yesterday’s session lows.

The economic calendar is seemingly busy today but mostly with low/medium impact events including the initial/continuing jobless claims (came in lower than expected) at 8:30am (muted reaction), Markit Manufacturing PMI at 9:45am, New Home Sales at 10am, Natural Gas storage stats at 10:30am, and Kansas City Fed at 11am.

The Nasdaq’s behavior is likely to take its cues today from the behavior the FB shares after they reported yesterday evening. Its shares have been active overnight as well. Also, after market close we will here from tech juggernauts Google, Microsoft, and Amazon.

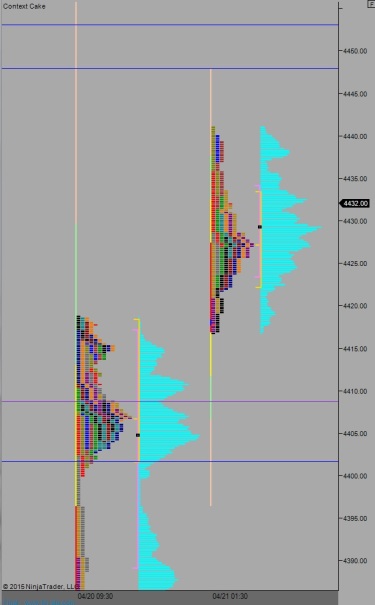

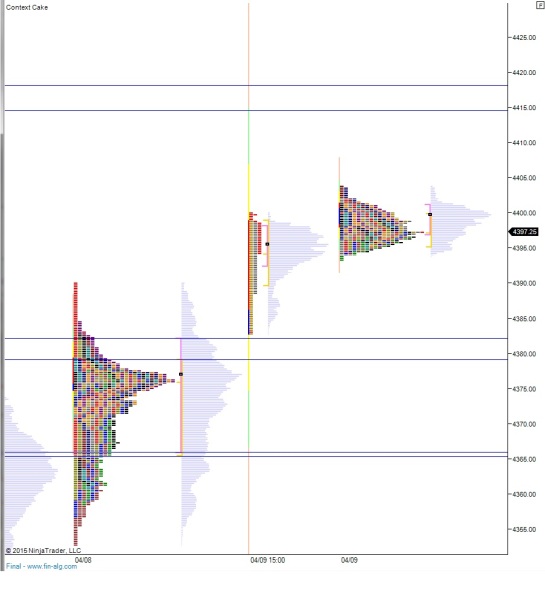

Yesterday we printed a normal variation up marking the third up day (2.5 up day perhaps, given Tuesday’s normal print) in a row. Sellers were active at the open but the auction reversed during the initial balance and worked higher. Sellers pushed in near the close.

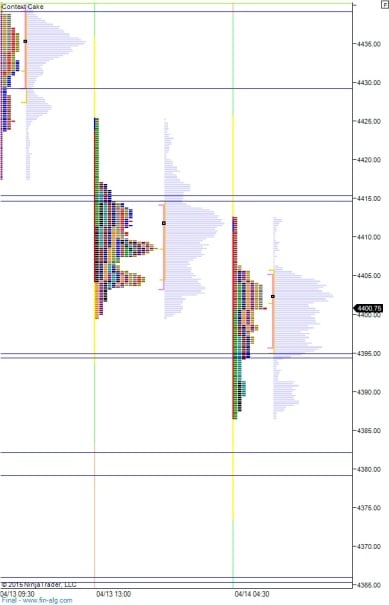

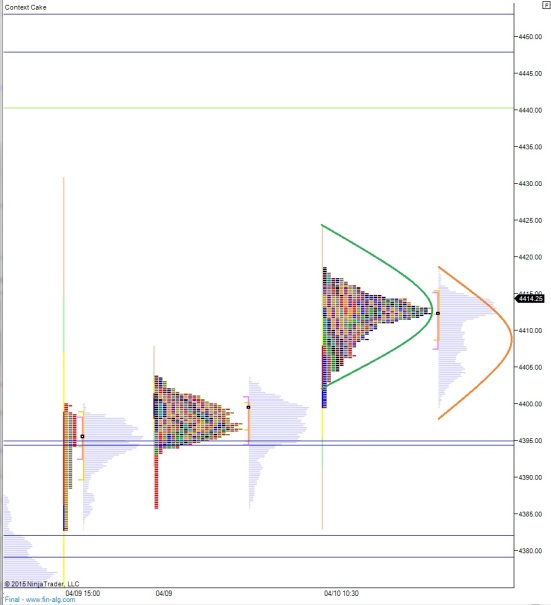

Heading into today, my primary expectation is for buyers to push into the overnight inventory to close the overnight gap up to 4446. I will look for them to overshoot this area before finding sellers up near 4453.75 who work us back down to 4429 and two way trade ensues.

Hypo 2 is sellers push off the open to take out overnight low 4418. Look for responsive buyers near 4415 and two way trade ensues with sellers sustaining price below 4441.

Hypo 3 is a drive up through yesterday’s high 4457.50 and a push to target the open gap left behind on March 2nd up at 4478.75.

Hypo 4 is drive down through 4414.75. If seller can take trade down through 4400 a liquidation may take hold and push us down to 4355.

Levels:

Comments »