Nasdaq futures are down overnight on an elevated range and normal volume. Price managed to exceed yesterday’s RTH high by 2-ticks before falling back through the entire daily range.

Pre-market we had Initial/Continuing jobless claims data which was mixed and Housing Starts which came in lower than expected. At 10am the Philadelphia Fed data is out and at 10:30am Natural Gas storage.

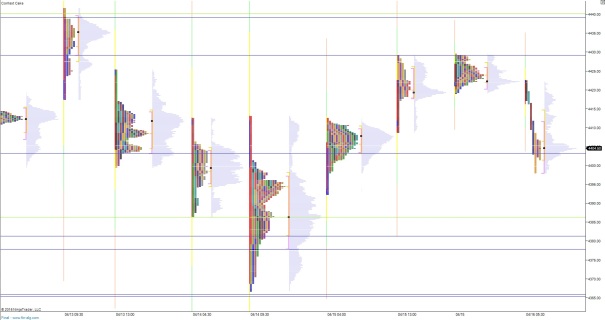

Yesterday we printed a neutral-extreme up day after the range extension down was quickly rejected and buyers put together an afternoon rally. The profile left behind had a pronounced pocket from 4417.25 – 4411.75. I would expect this area to trade fast on a revisit and afterward we’re likely to spend some time filling it out.

Heading into today we are set to open on the low end of yesterday’s range. My primary expectation is for buyers to work into the overnight inventory and attempt at gap fill. If they can trade up through 4411.75 they likely don’t see much friction on their quest to 4421.50. Then I will look for 2-way trade chop to ensue.

Hypo 2 is sellers defend the volume pocket and start working lower to target 4386.25 then choppy conditions.

Hypo 3 is buyers push the gap fill and continue on to take out the overnight high 4429.50 and target the NVPOC at 4435.

Hypo 4 sellers take out 4380 before finding a responsive bid.

Levels:

If you enjoy the content at iBankCoin, please follow us on Twitter