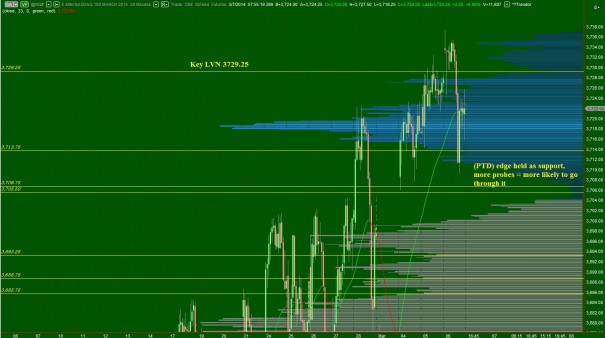

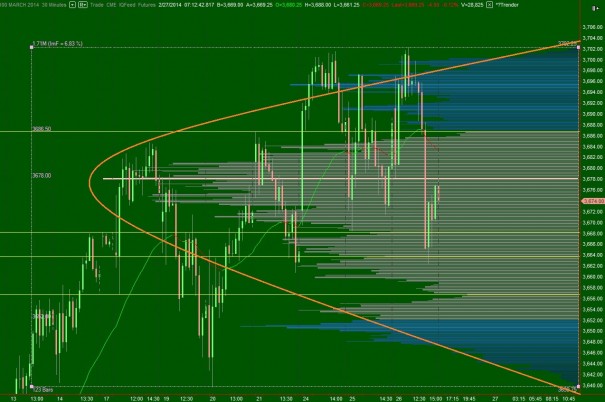

The buyers continue to flex their control of the long term timeframe in the NASDAQ composite. When we observe the daily chart, we can see their control as a series of higher highs and lows on the daily and weekly chart.

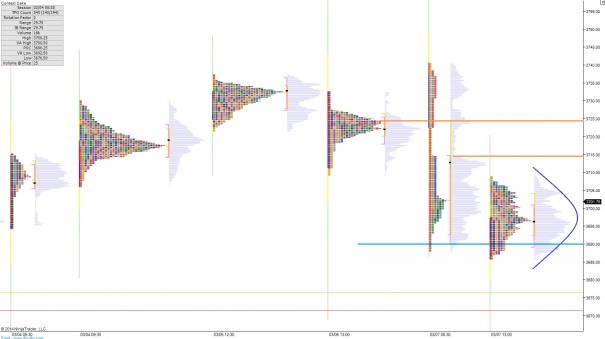

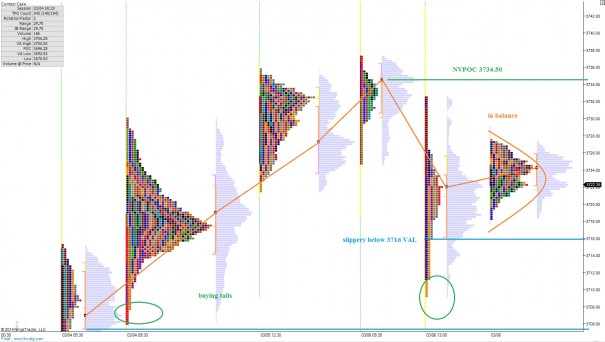

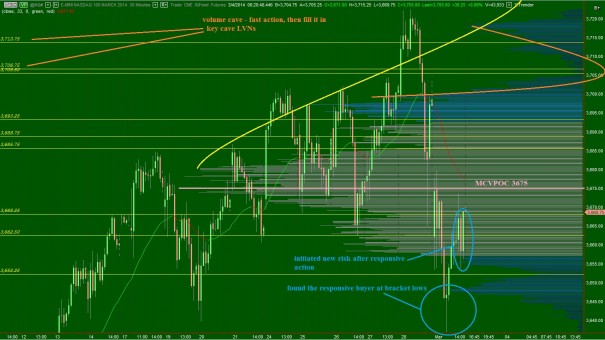

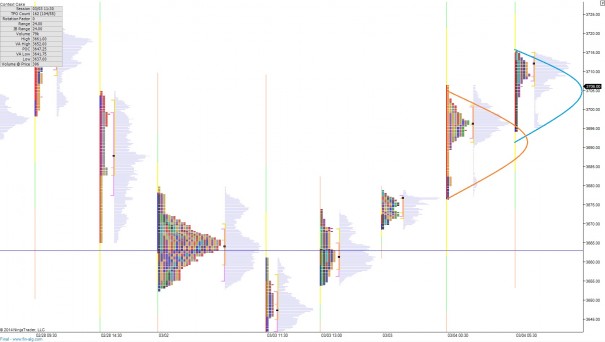

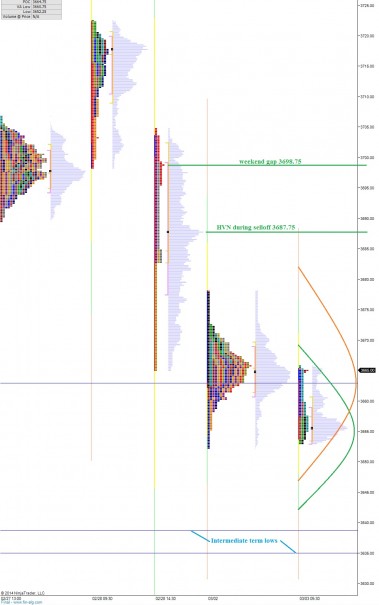

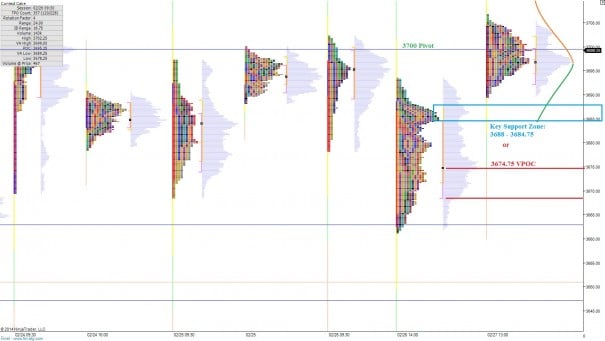

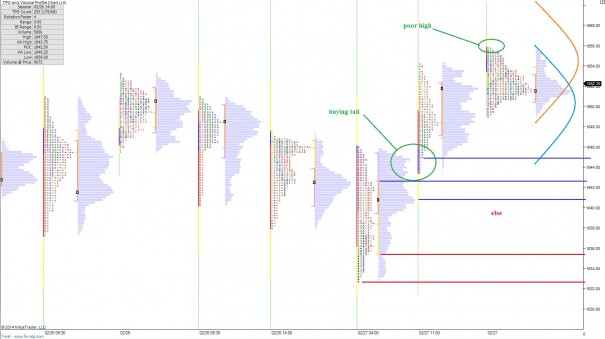

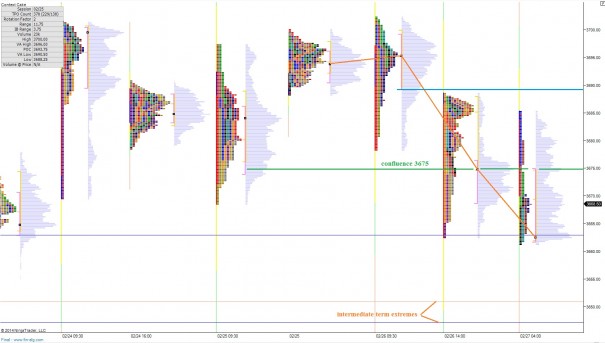

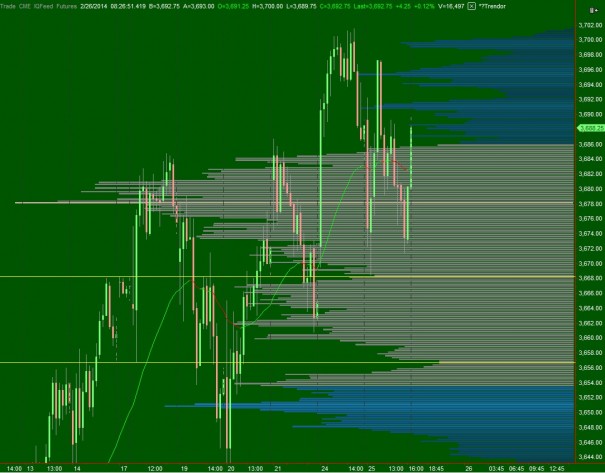

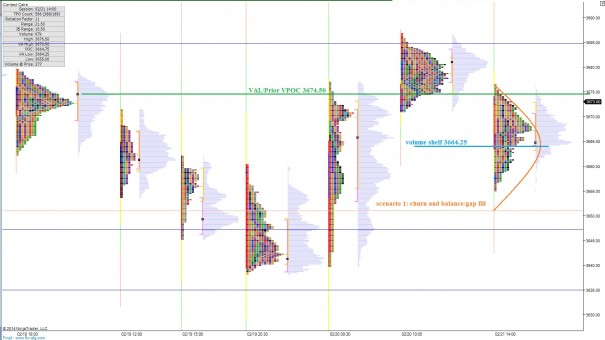

The intermediate term jerked back into balance after three days of showing potential that we would break the gridlock. The NASDAQ composite has been in intermediate term balance for 15 trading days dating back to February 13th. Last week’s action added a cave feature to the intermediate term balance, and we watched closely for the moment when price would slash through this low volume zone. Now the question becomes, do we take the time to auction this level and fill in the cave, or do sellers reject us away from it, leaving behind a shelf of supply, or “bag holders”. Volume point of control never managed to shift to our upper distribution. Whether value shifts higher or price reverts back to value will be telling. Price and value always converge, it is only a matter of how. We continue to trade in intermediate term balance and unless Buyers can hold Friday’s low, a trade back to the mean at 3674.75 is a distinct possibility. Here is my view of the intermediate term:

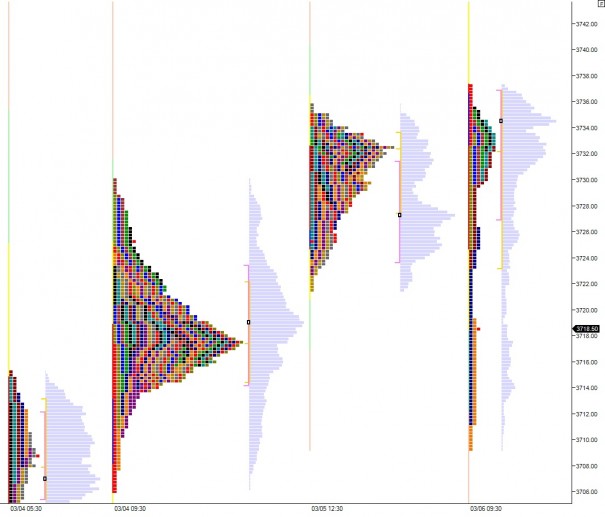

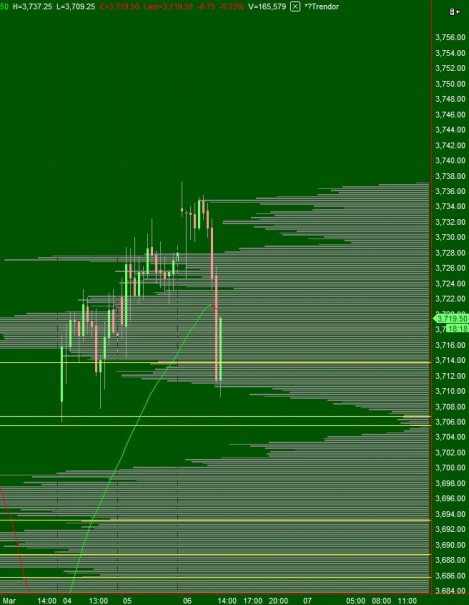

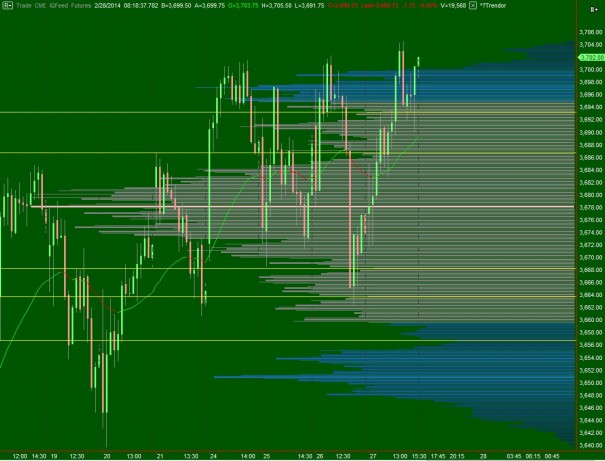

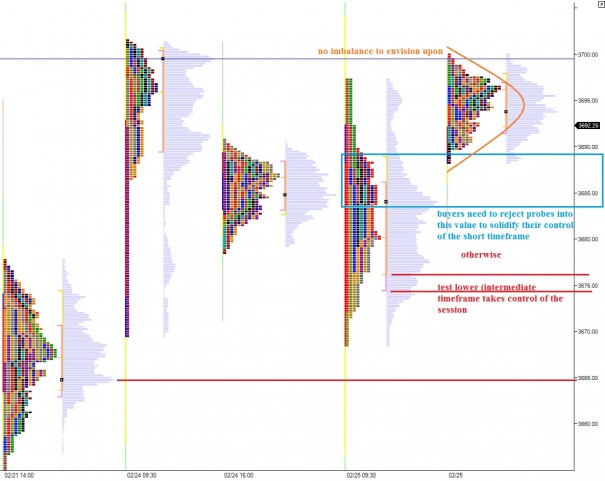

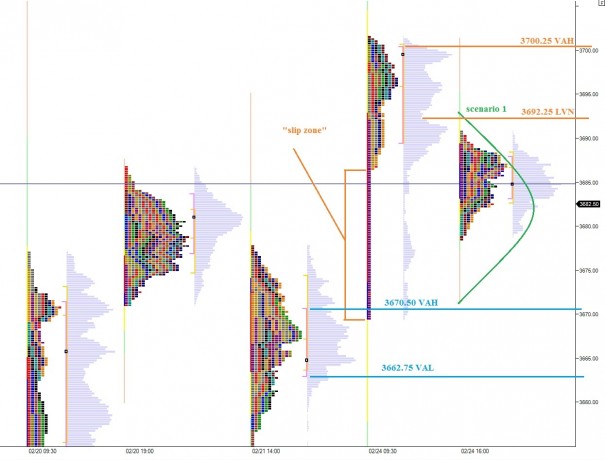

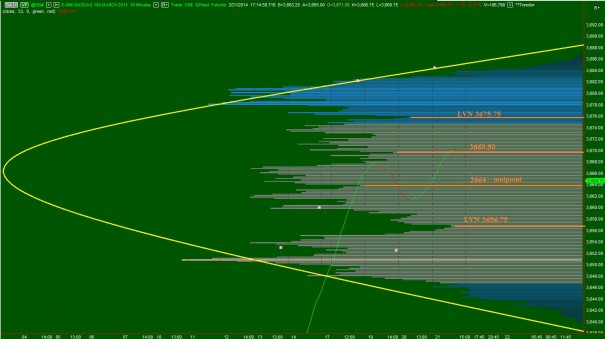

The short term auction balanced. The sellers printed what is known as an outside day Friday, where price exceeds both the high and low of the prior day. These can be reversal candles. The key is follow through. To me, follow through comes in the form of holding price below 3670. The short term auction is otherwise in balance. The following levels are how I envision early balance occurring:

Comments »