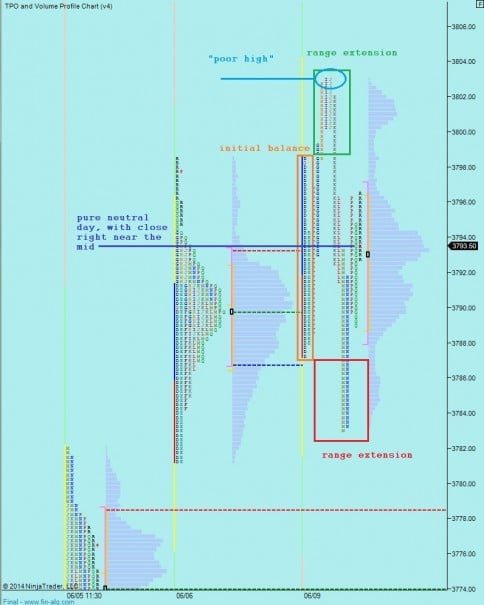

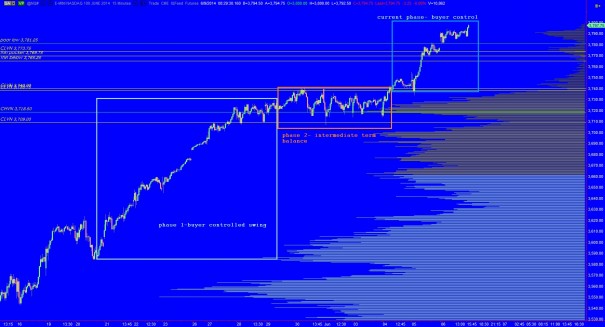

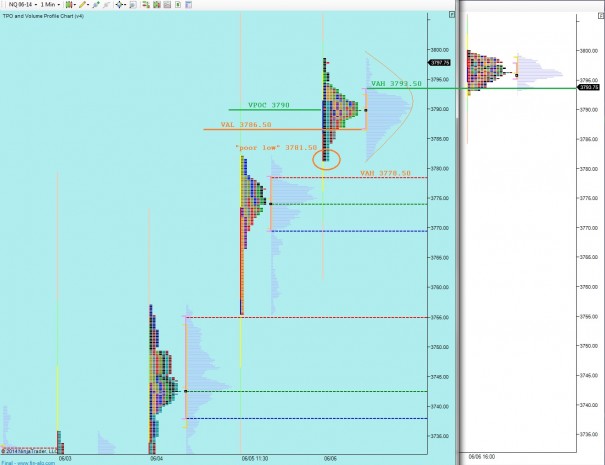

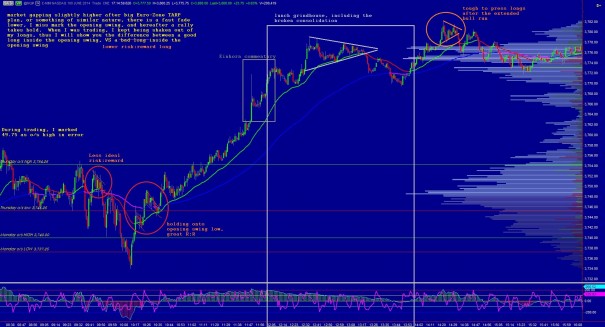

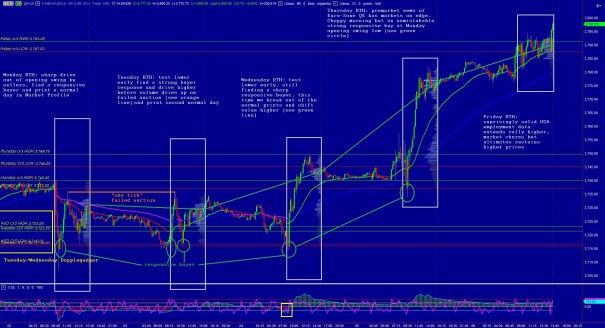

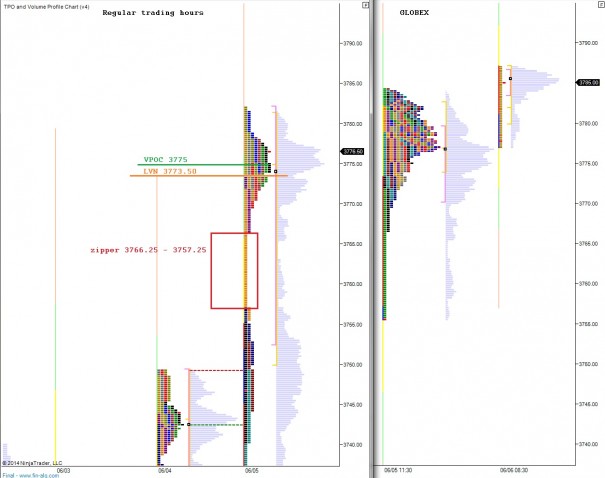

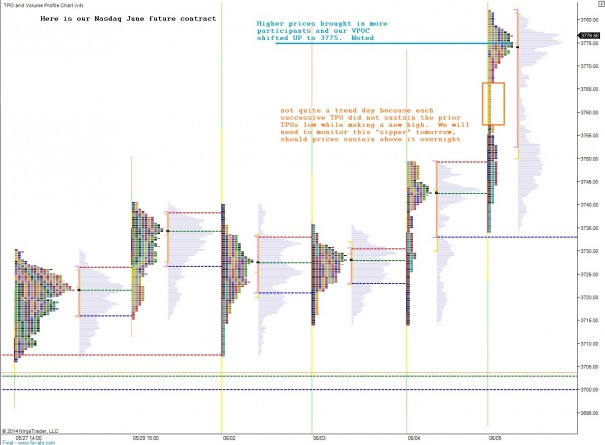

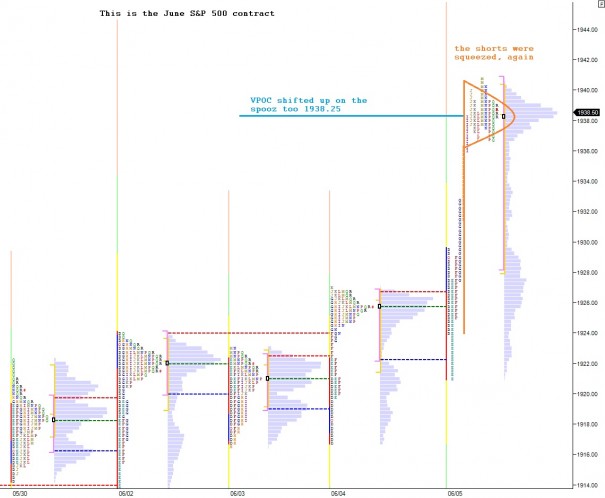

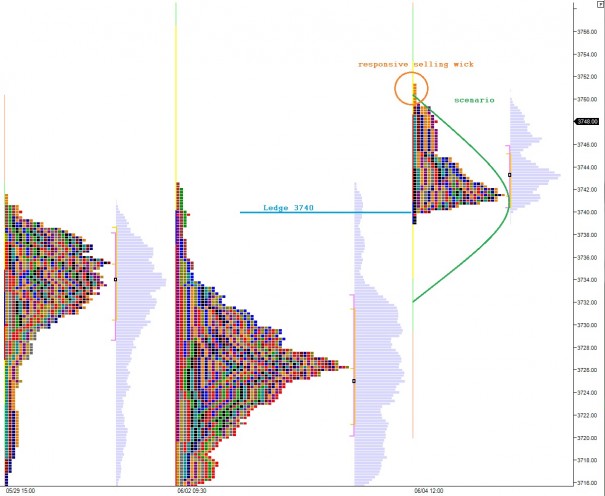

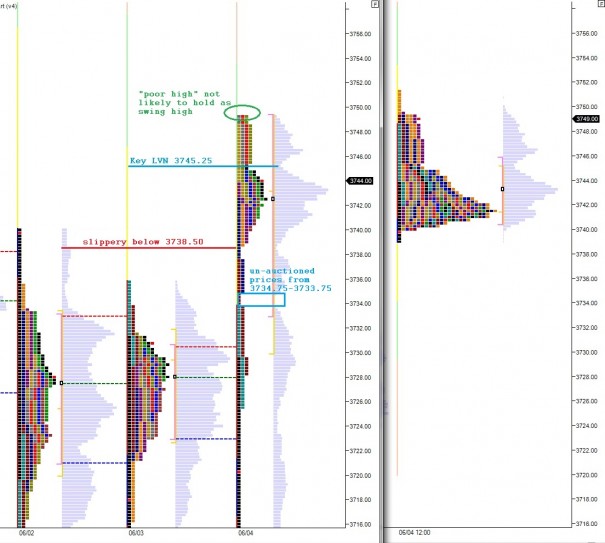

The S&P printed a troubling candle on the daily chart today, a candle which often shows up near inflection points. The Nasdaq suggests inflection too, printing the infamous neutral day. See below:

That print makes my ears tingle a bit, so I went to market looking for a short and came back with NFLX. Aside from that I did very little adjusting to swing portfolio. Instead I allowed my book of longs to effervesce as the major indices cling on to the peaks of swing high. I recall being flabbergasted by the continued momentum downward in, ehm momentum stocks, even when the indices balanced out along the swing lows. The environment allowed any chart to break lower as it was the path of least resistance. That seems to be the case with longs, right now. To press into the eyeballs of shorts, you go out and find stocks which are less extended and still seeing buying interest.

My slow swings are especially enjoyable, a bit less oversight without fear of a -12% surprise. My current slow swings are LO, HOS, and WM. We always need us some smokes which is why I like LO (plus their early lead in the mass marketing of eCigs), HOS is like a shipper and a driller amalgamated, and we always need to toss out trash and WM is there to play with it.

I am eying a reentry into the shipping space this week, as the group could see additional inflows even if the market comes in a bit. Top pick remains EGLE, even though I am currently without position. They are one of the most violent tickers in the space, so you may want to make sure that is something you are willing to accept before you participate.

Comments »