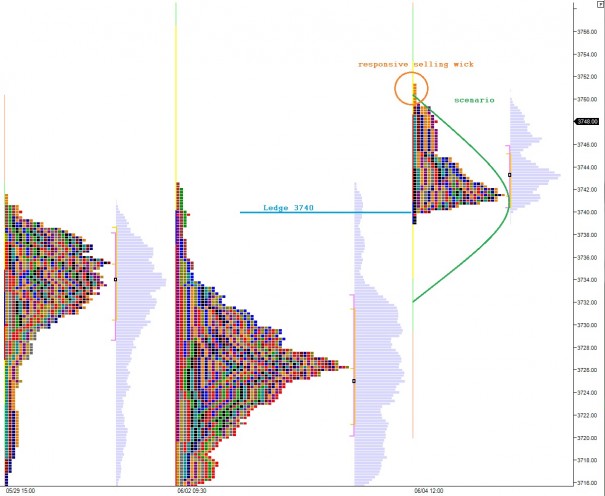

The big economic news overnight, or rather early this morning was out of the Euro-Zone, where their central bank pushed their lending rates up a bit higher than was expected. The initial reaction was some fast selling on the Nasdaq which found responsive buyers just one tick above the overnight low at 3740. 3740 also was Monday’s opening swing high (hmm…) and you will see a very sharp ledge has formed at this level when we observe the 24 hour profile. The economic docket is jam-packed this morning as I type, with a Draghi presser at 8:30 along with USA Jobless claims. In short, prices could really be on the move premarket today.

If we take a look at the 24-hour profile, you can see we broke out from intermediate term balance yesterday and as a result, we began printing a new profile. The most notable piece of context on our current profile is the sharp ledge at 3740. You can see how unnatural this shape is, relative to our beautiful and symmetrical bell-curves. This tells us one of two things—it is likely to break and price spill over the ledge, BUT if it does not, buyers are unusually strong and we should heed their power. See below:

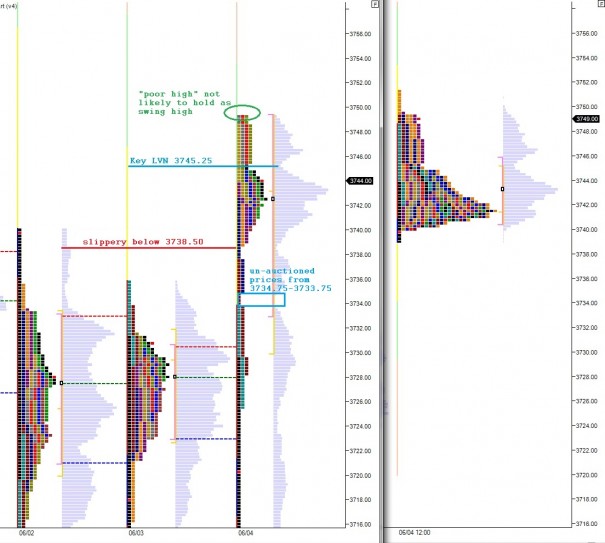

I have marked up the regular trading hour profile to denote significant price levels. The question I was debating with myself at the end of yesterday was whether yesterday was in fact a trend day. This is the classic, “If it looks like a duck, quacks like a duck, and walks like a duck, then it probably isn’t a chicken” scenario. Breadth was weak and the afternoon showed indecision, likely due to the overnight Euro-Zone news. With that headline out of the way the markets seem more comfortable heading higher, at least early on. We have levels which will act as warning signs, should this big upward move be faded. I have noted these levels below on the RTH chart and also the intermediate term charts below:

If you enjoy the content at iBankCoin, please follow us on Twitter

Scenario 1 : sellers push for gap fill, 3744, find responsive buying and chop before taking out yesterday HOD 3749.25

Scenario 2: drive down, take out thin zone at 3738.50 and trend lower to test unacutioned range from 3734.75 -3733.75

Scen 3: test higher find responsive selling just above HOD 3749.25 and rotate gap fill down to 3744 and possibly red line at 3738.50