We have a theme here. It is mythological, it is showing its teeth daily, and you might want to listen. There is a succubus in the marketplace. She swears no allegiance and is out for blood.

Her favorite haunts are at the cusp of breakdowns and breakouts.

If you choose to collude with the succubus, you would be wise to wear a mask and other protections and by all means do not give into her temptations.

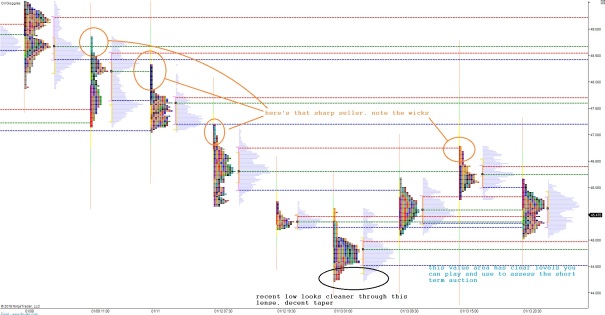

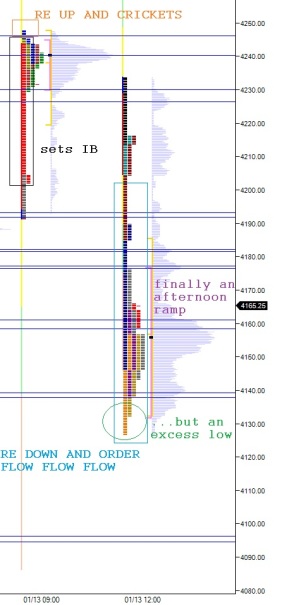

Today’s victim was AMZN. Never has the stock complex seen a more clearly setup short. Therefore it had to be bought.

Fun-goo-la, FUNGULA!

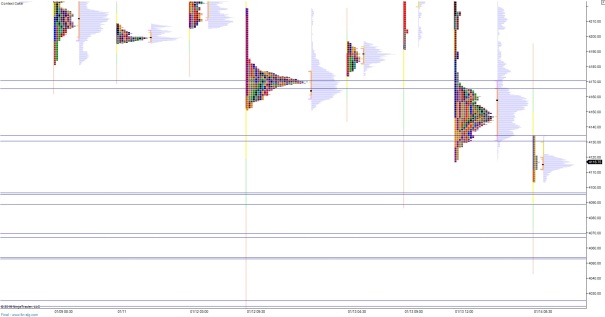

You know we keep it simple.

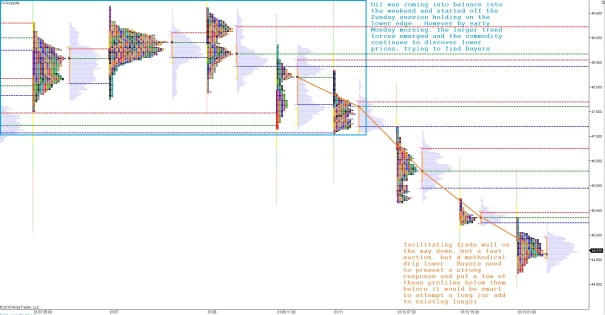

In other news, a vicious short covering rally took hold in energy names today as the January contract went into expiration. OPEX shenanigans continue. Gird up your loins and report for duty, this doesn’t end tomorrow.

Comments »