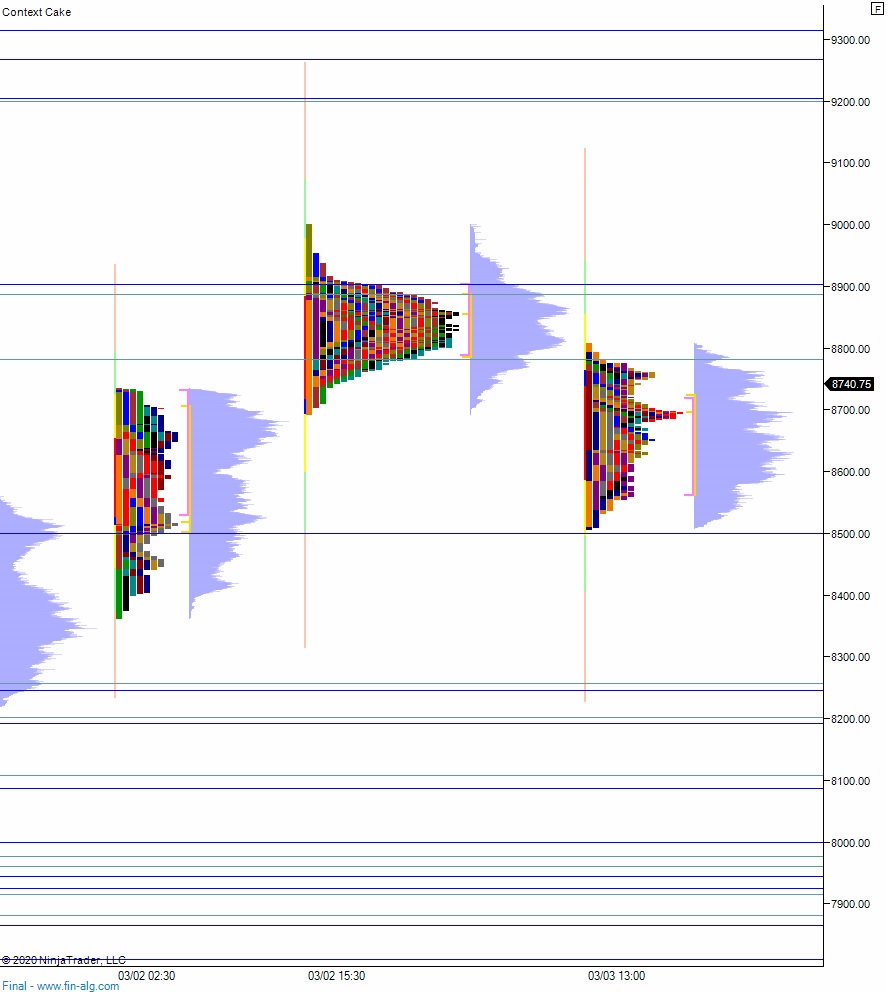

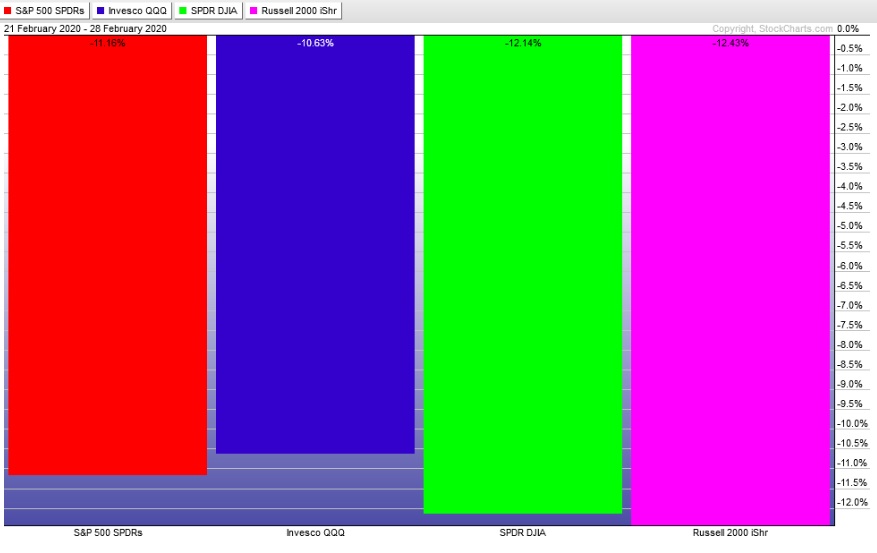

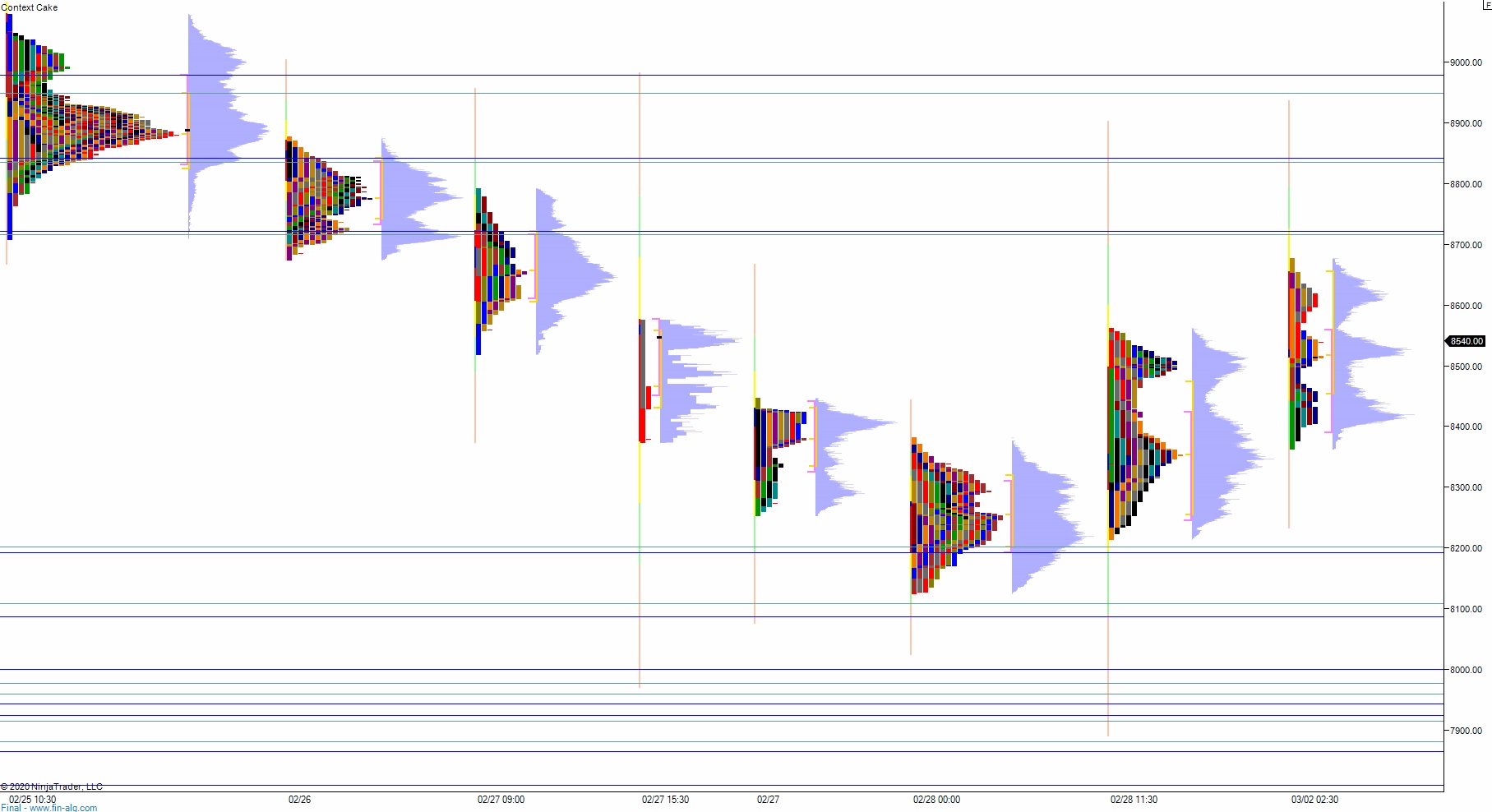

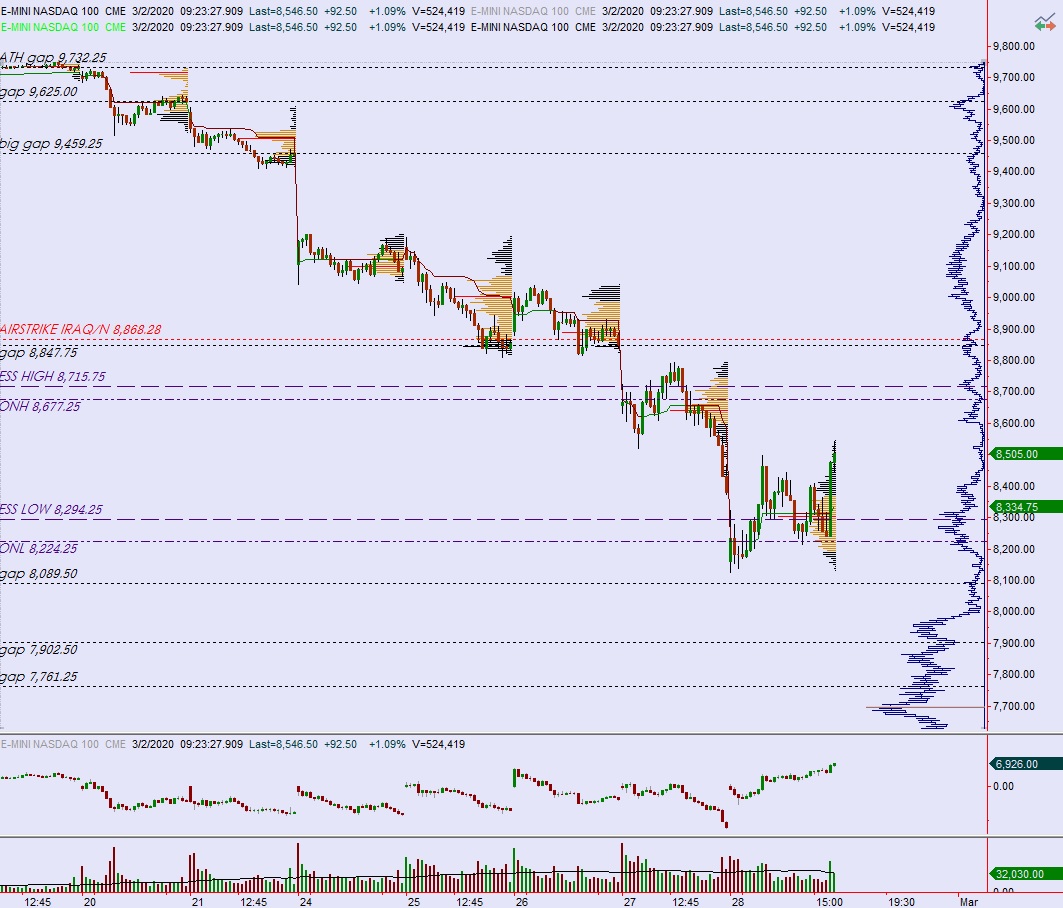

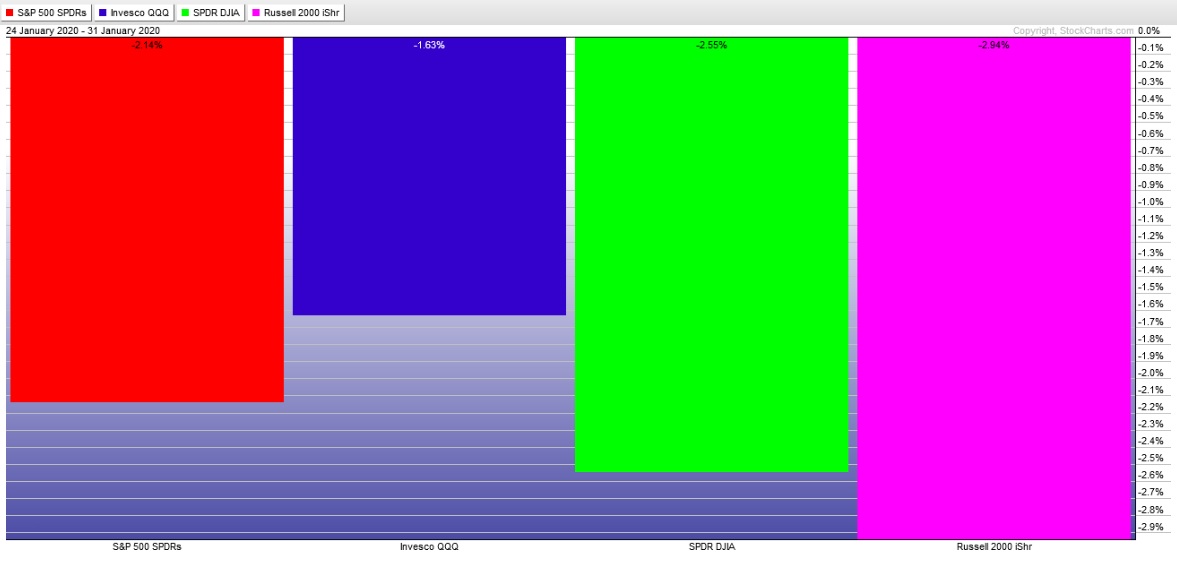

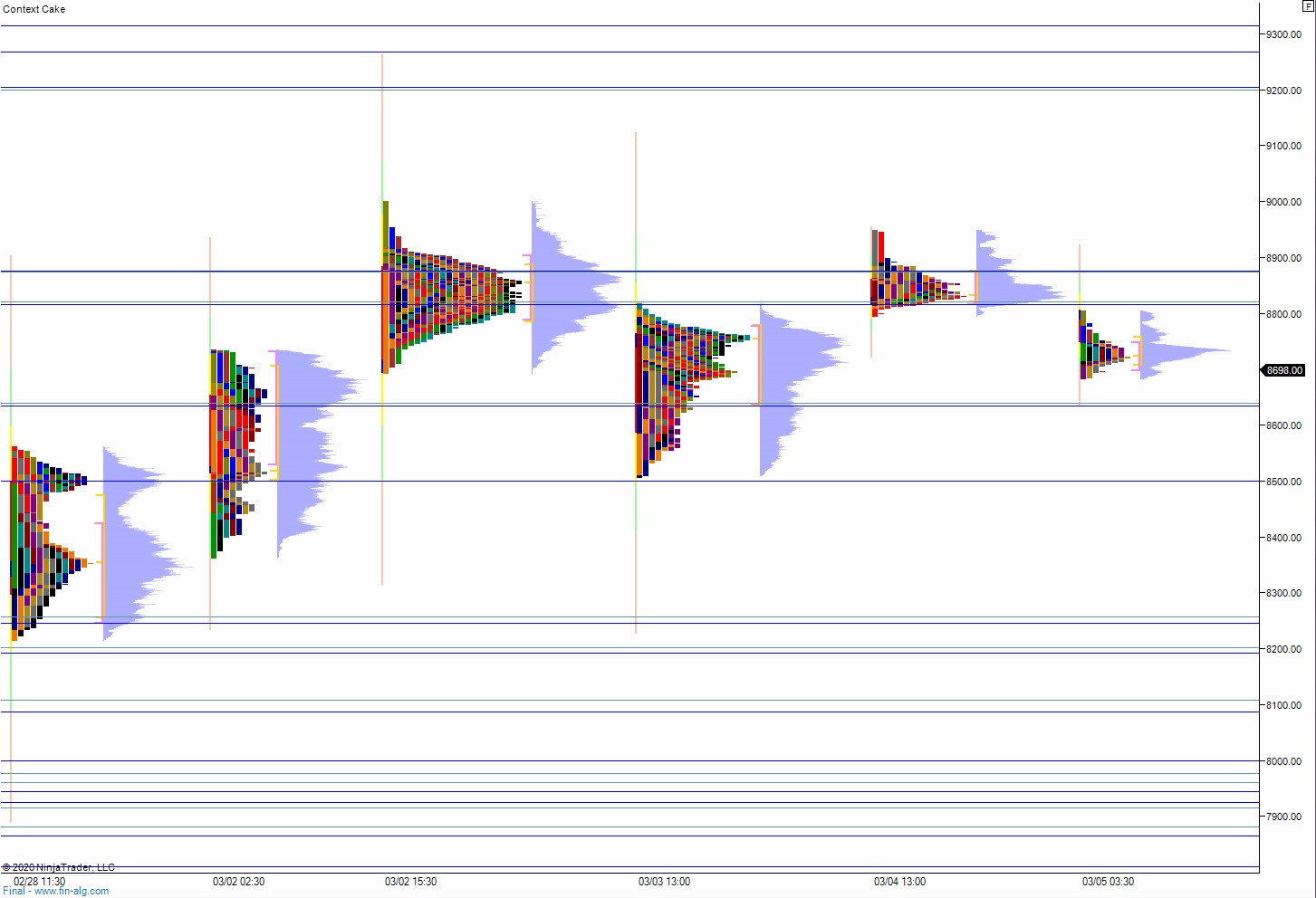

NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, unidirectional rotating down through the majority of Wednesday’s range, but staying within the cash range. As we approach cash open, price is hovering in the lower quadrant of Thursday’s range.

On the economic calendar today we have durable goods and factory orders at 10am and 4- and 8-week T-bill auctions at 11:30am.

Major retailer Costco is set to report earnings after the bell.

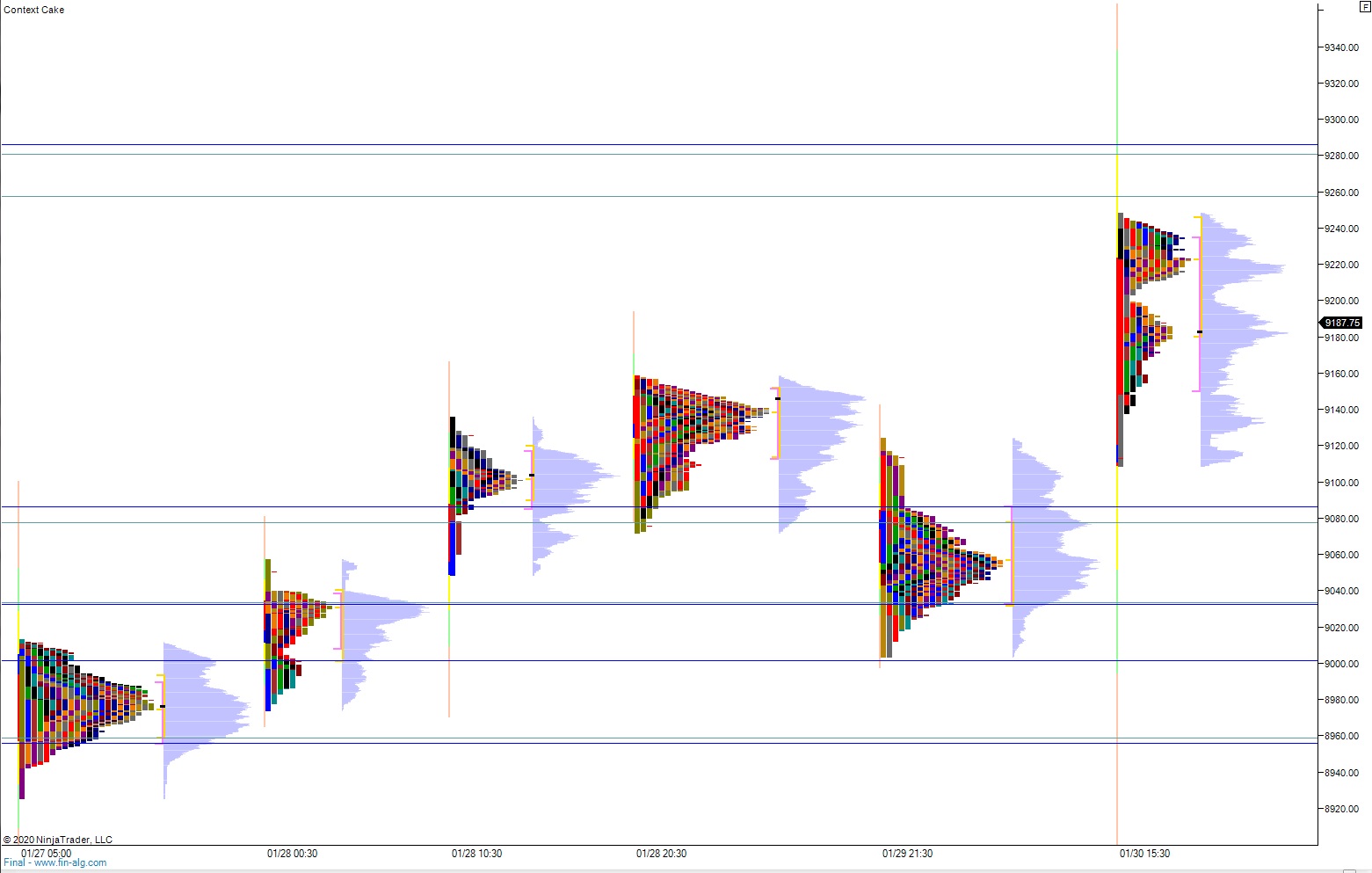

Yesterday we printed a double distribution trend up. The day began with a gap up and two way auction. Sellers were unable to close the overnight gap before buyers stepped in and worked price higher. Said buyers tagged the Tuesday nVPOC then chopped along the midpoint until early afternoon when price squeezed higher. This move had some follow thru late in the day, but we ended up printing an inside day, with the entire range staying inside of Tuesday’s range. We ended near session high.

Heading into today my primary expectation is for sellers to gap-and-go lower, trading down to close the gap at 8581.25 before two way trade ensues.

Hypo 2 buyers work into the overnight inventory and close the gap up to 8895 then continue higher, up through overnight high 8909.75. Look for sellers just above at 8921 and two way trade ensues.

Hypo 3 stronger buyers set up a move to 9000.

Levels:

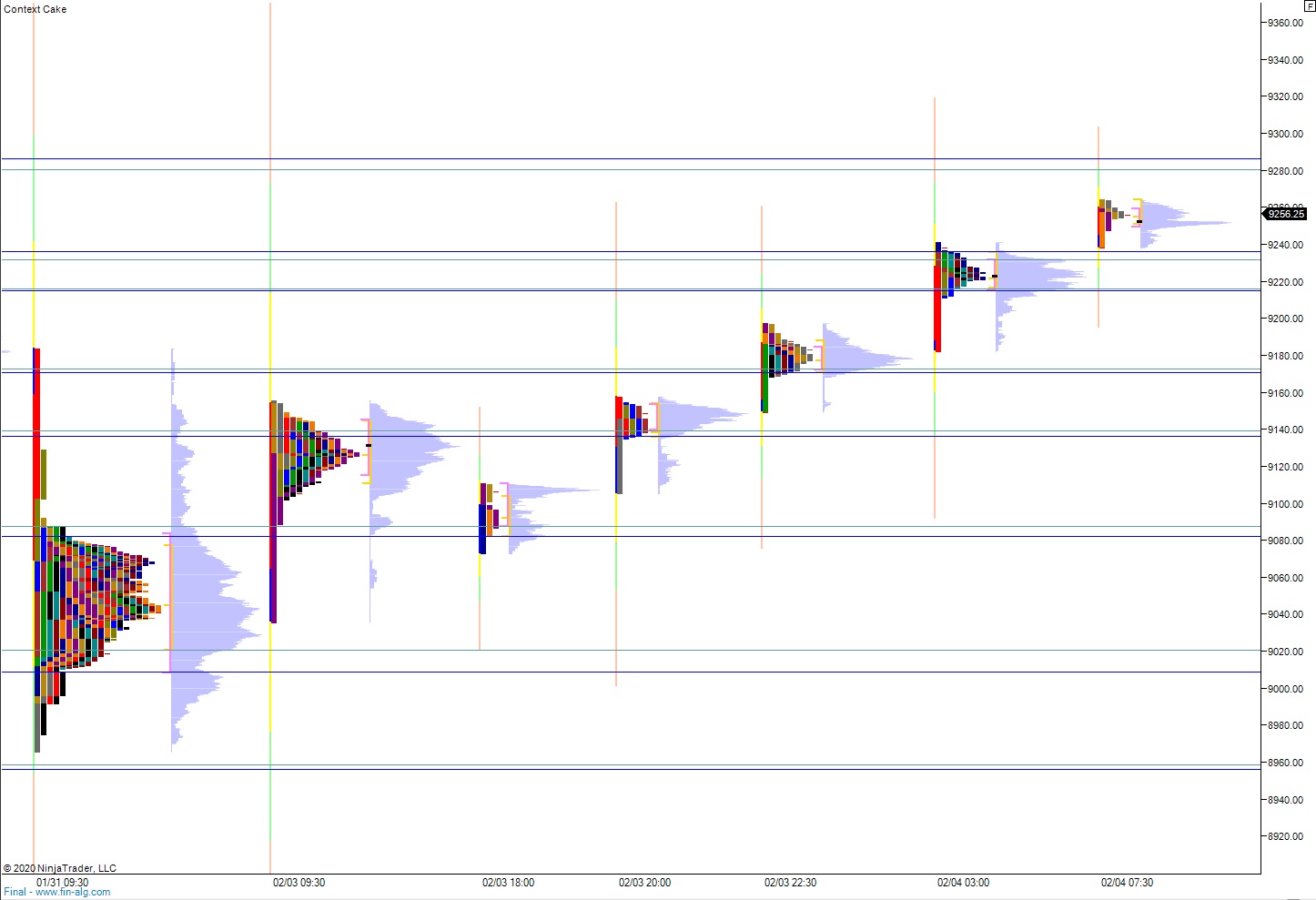

Volume profiles, gaps and measured moves: