What if I told you I’ve spent the entire weekend devising a new scheme for investing my hard earned pesos? If every hot summer minute was spend brooding in a cold office behind computer screens and reams of paper?

There were 57 biotech stocks up over 10 percent last week. Fifty seven. The Nasdaq is literally at all-time highs—not bearish. Last week’s rally was propelled by tech and finance, two pillars of modern society.

I am committed to the stocked market. There are fortunes to be made in these waters. But at the same time I know there are powerful ways to be milked.

There are intelligent ways to generate alpha, and I don’t think it wise to completely abscond from that hard-earned wisdom. So I’m retooling my process of exposing myself to individual stocks. This is all still developing, very much developing. Like always, I’m hoping for the best and planning for the bitter worst.

As for these markets, heading into potentially the hottest week of the year, I don’t like the look. Everyone’s coming into the week with rose colored sunglasses on certain the fix is in.

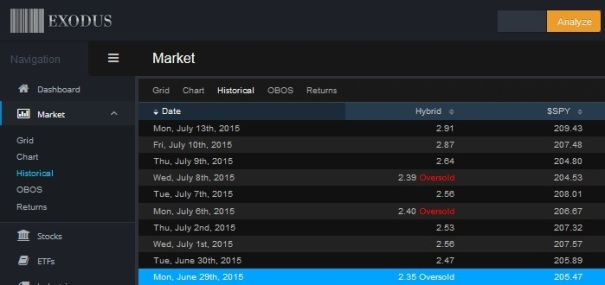

We shall see. In the meantime, this week’s Exodus Strategy Session is published. Inside it we recap last week’s action and build out the context for the week to come.

Comments »