Perhaps it’s the crystal crack meth I’m holding in my portfolio, and the fact that each of them is a loser, but what looks like minor damage on the S&P has my portfolio down 1.5 percent today. If I was heavy long, sure, that makes sense, but with cash over 50 percent it comes as a bit of a surprise. It’s like oh hello April, I see you’re coming in like a lion.

So I’ve been forced to take two losses today; first I cut Yelp, and this afternoon Ford. Here’s the gist, at this juncture, I’m not loosening risk and letting setups work. Ford very well could turn around this week, but the daily chart is sloppy, and not something I’m lending patience to right now.

Yelp plum fell on its face, as did most of the social media space. To hold even a trace would be a disgrace. I want only the ace. I want the ace.

My holdings now are (by size) CMG, ANGI, AIG, ZNGA, CREE, and old pokey aka AWK.

We could talk about each and what they’re doing, but you have charts yes? You see much of what I do, no?

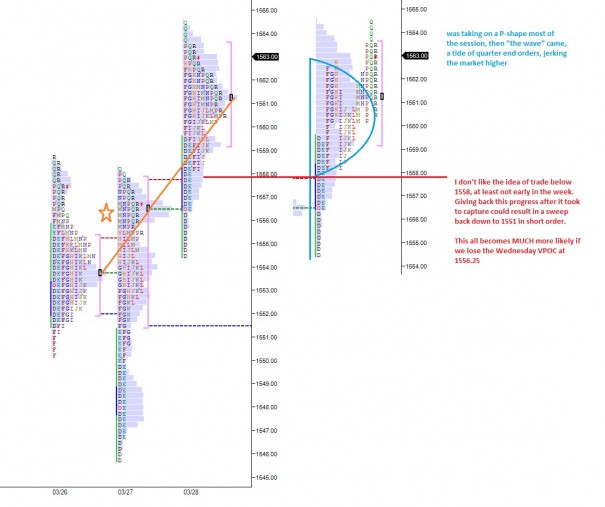

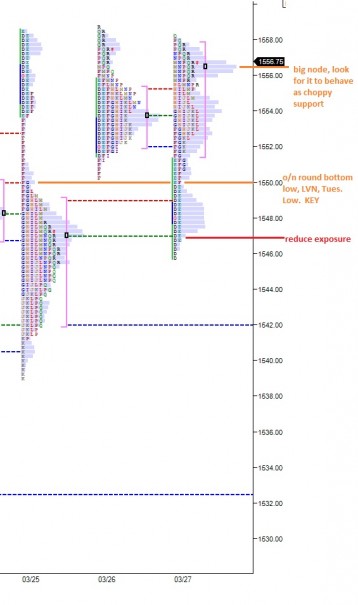

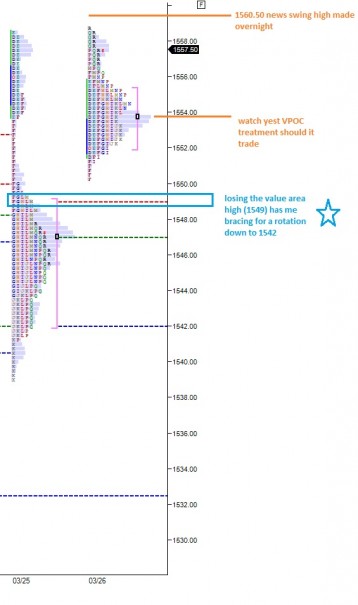

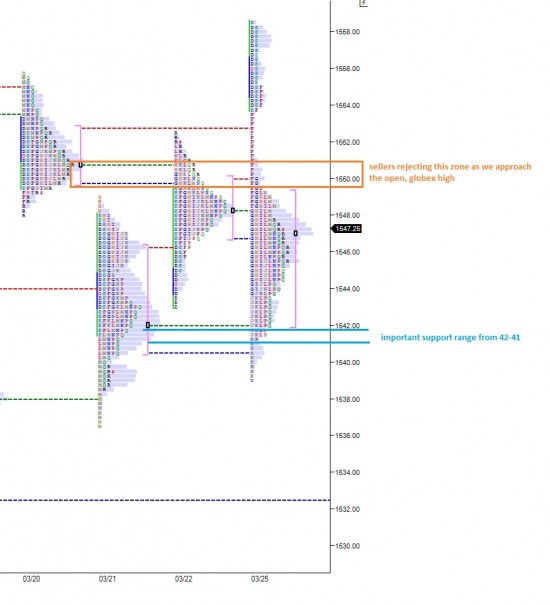

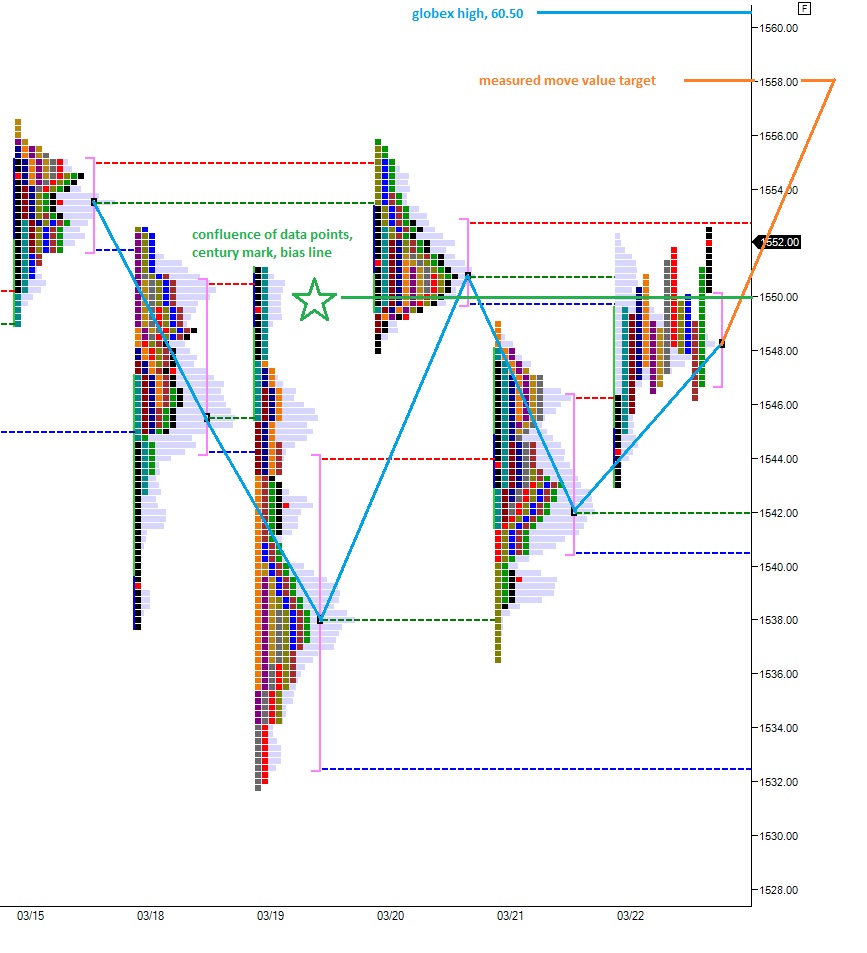

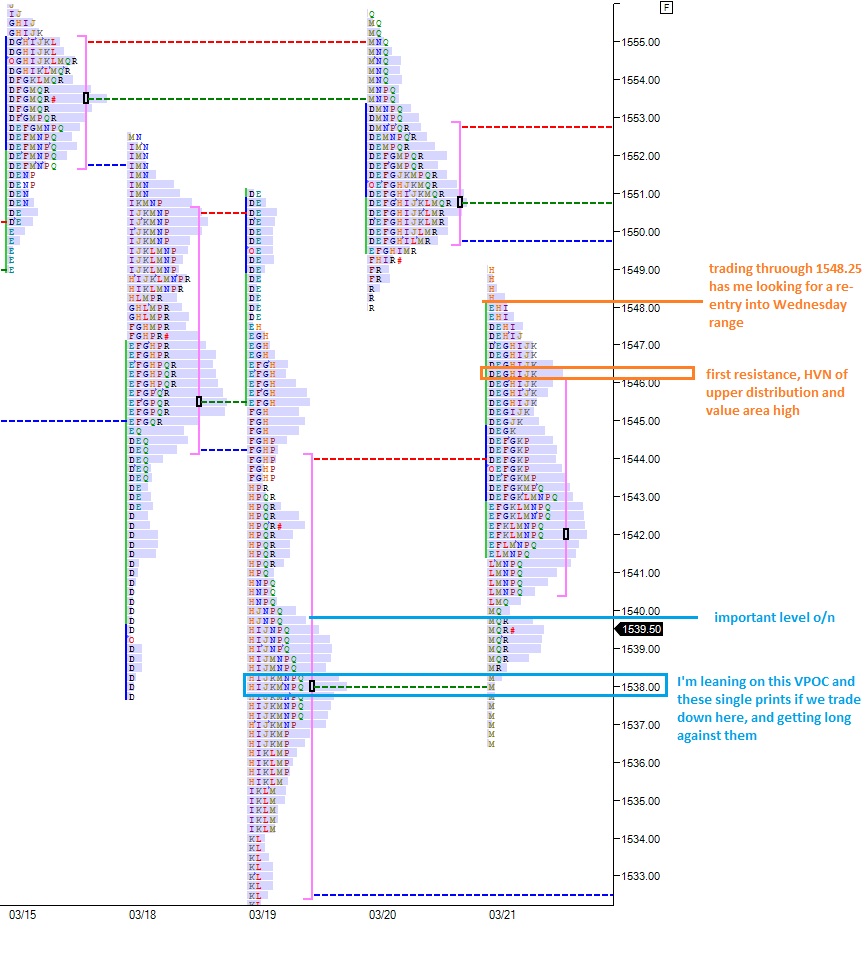

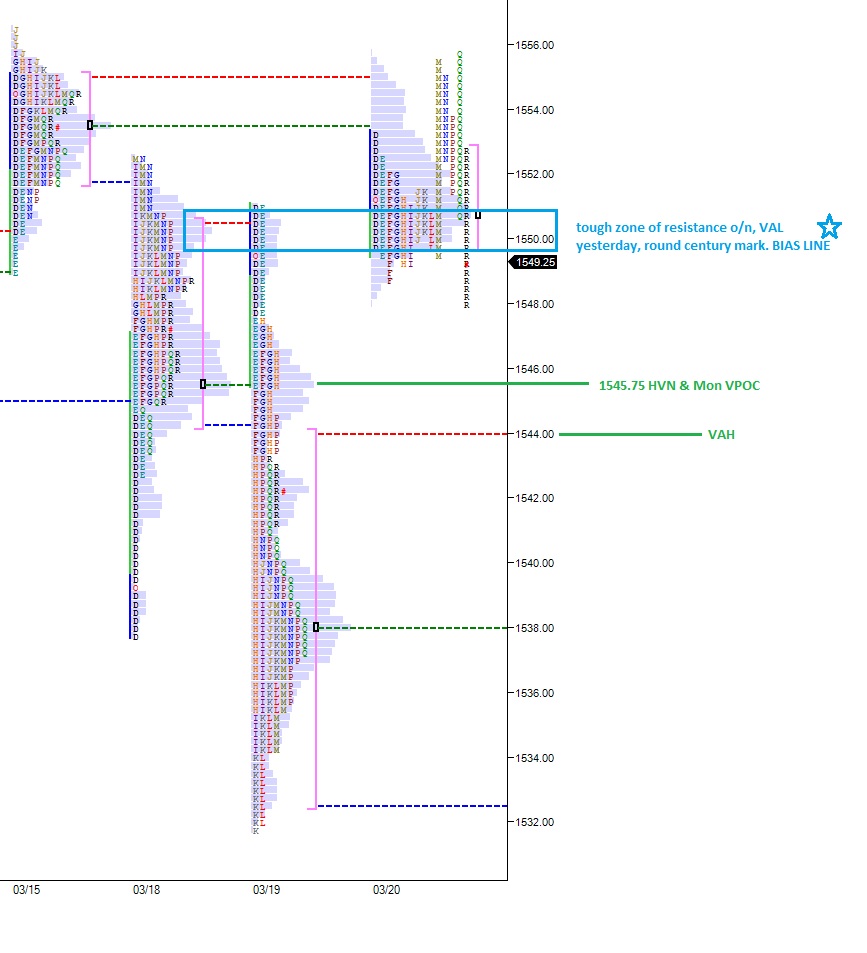

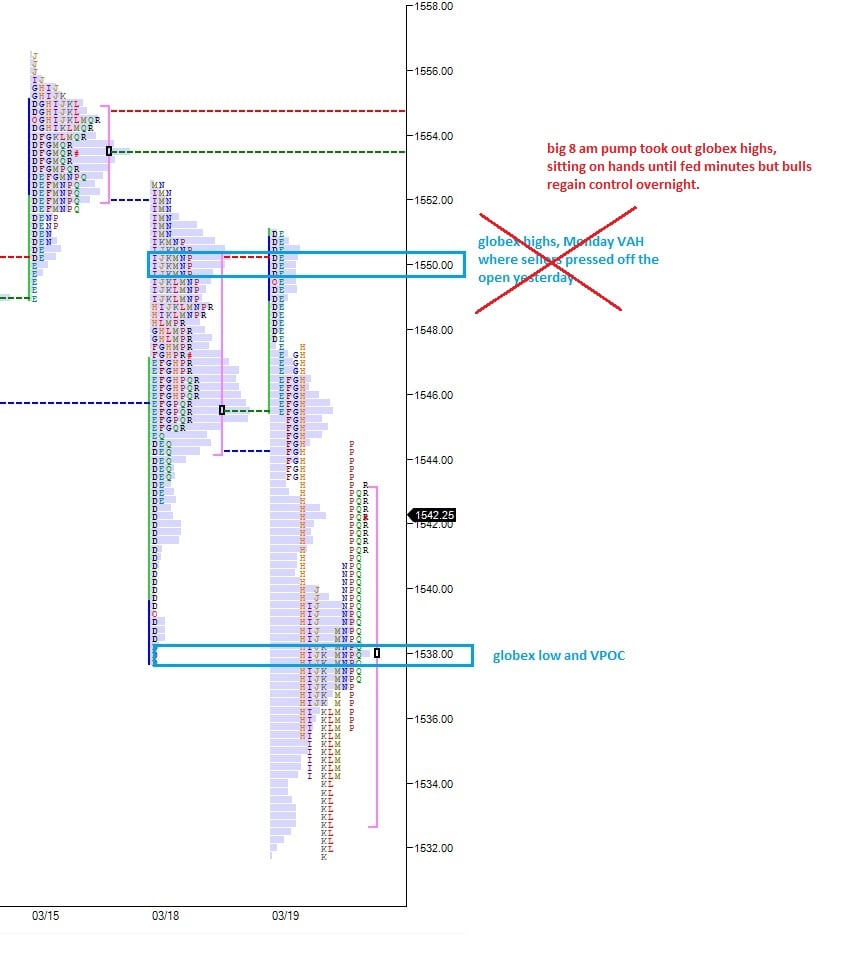

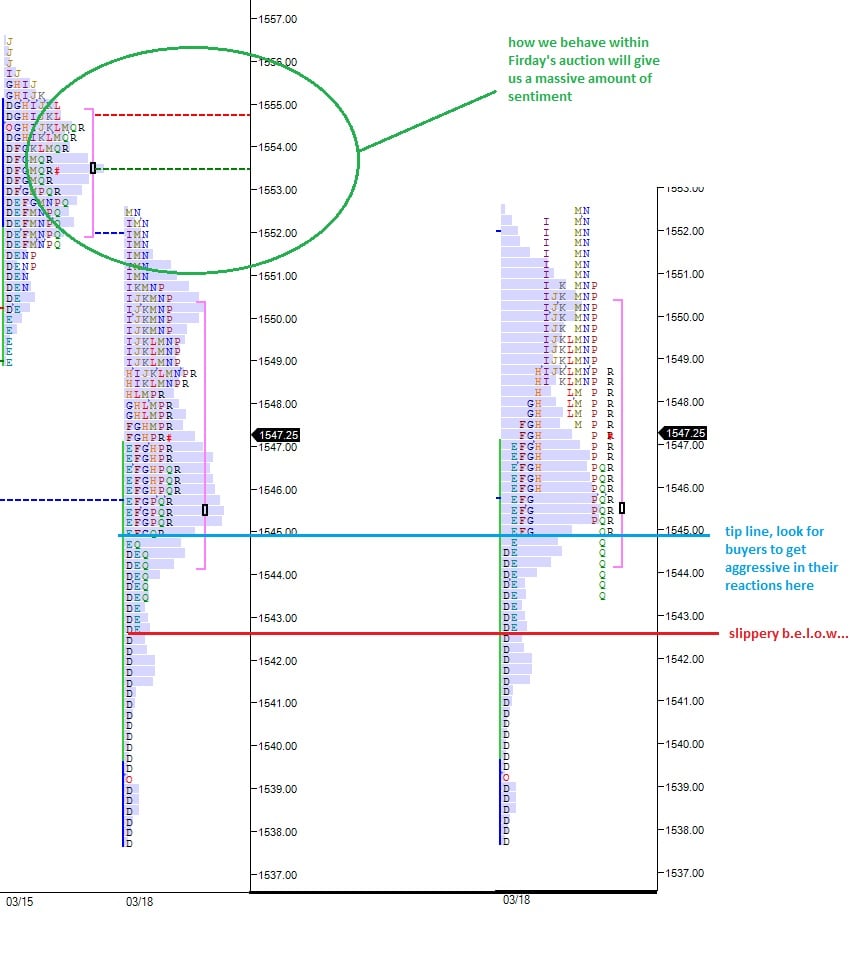

Here’s my bottom line: there’s lots of POMO on tap this month. It’s a strange environment. As we wind down into the close, we’re getting a b-shaped profile, suggesting long liquation and not much more. The sellers made progress on many individual charts, but they haven’t taken the big board yet. Moreover they haven’t controlled the big board all year. However, this is a new quarter, a page turn if you will. Therefore we all need to stay vigilant. Like, why the hell is the Yen so strong today? Just be cognizant of the environment. I’m a bit unsure, hence my huge cash.

Be well.

Comments »