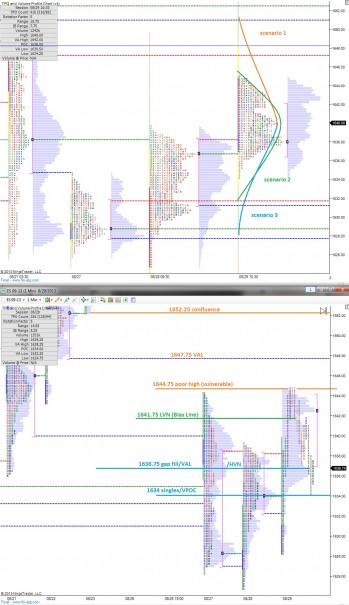

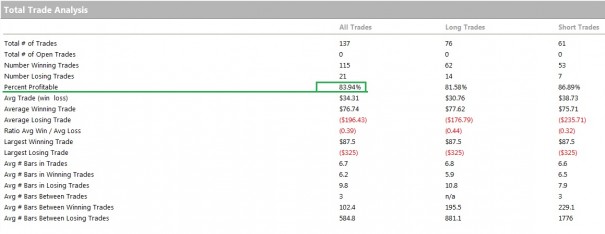

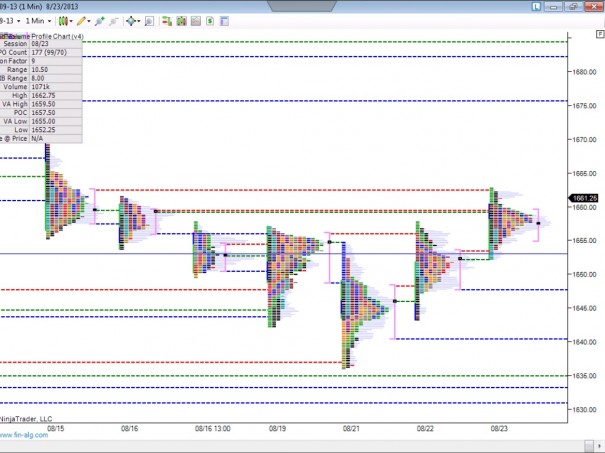

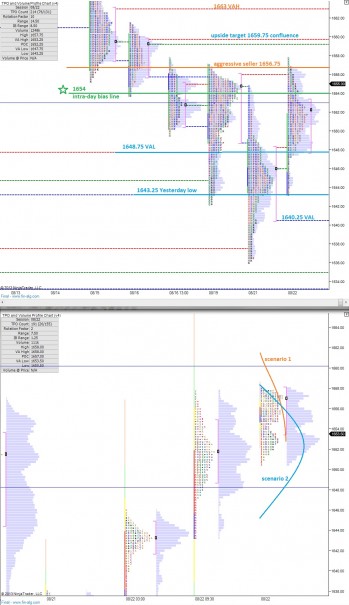

The overnight session printed large chop, nearly nine handles wide. A wave of buy flow swept though the market around midnight EST pressing the market above yesterday’s high briefly before the move was faded back to the midpoint. The overall action is indecisive but slightly favoring the bulls.

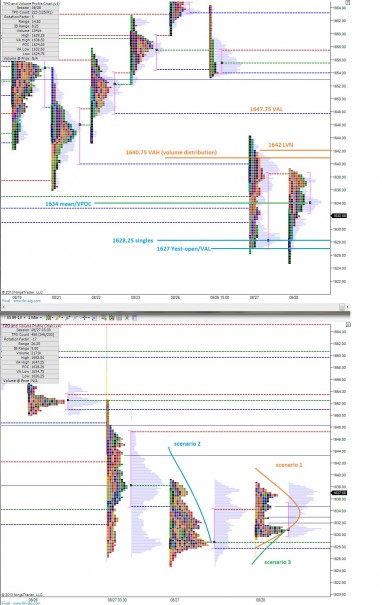

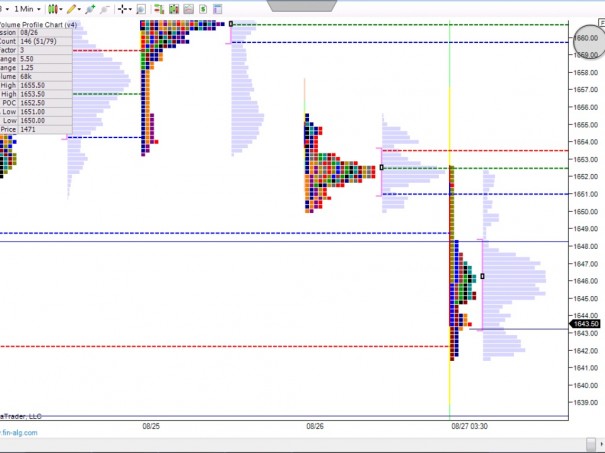

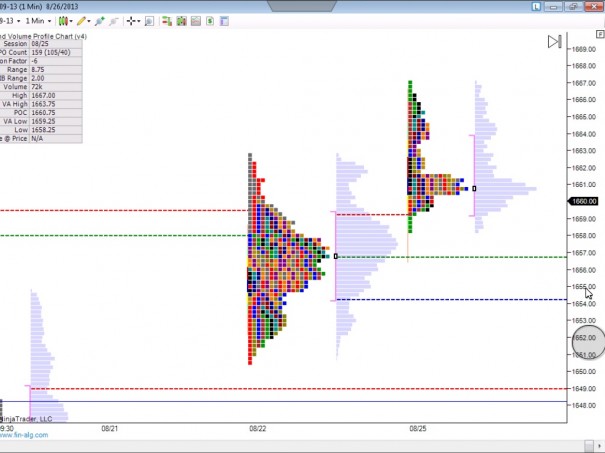

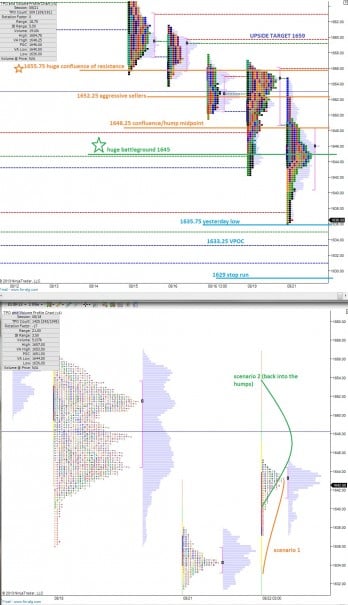

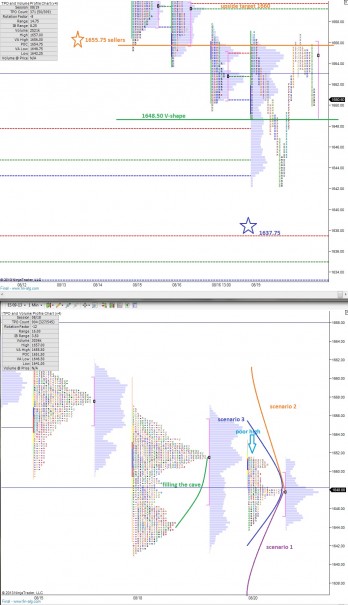

A key price level to keep in your mind as we approach the weekend is 1641.75. The level behaved as support several times since 8/21 before giving way and becoming resistance. On yesterday’s tape the level formed a low volume node which clues us in that the level is perceived in a unique manner by the market. The sellers consider it a wholesale entry point aka it’s where the pros are at work. If price can be sustained above this level during today’s session, it may force short covering into the weekend and change the overall perception of value in the marketplace.

At this point we could explore higher, searching for value in the large gap above.

Conversely, if price cannot sustain trade above 1641.75, we may rotate back through the last three day’s of value to make sure the buyers are confident enough to react to the discounted prices.

If not, a retest of the swing low is on the docket.

I’ve highlighted this price level and a few scenarios on the following market profile charts:

Comments »