When you build a launch pad, delicately attending to every detail, and then it doesn’t make you any moneys – you want to take a bulldozer and smash it to bits.

Like when your do-it-yourself plumbing job goes surprisingly well until the end when you over torque a pipe and break everything. Your inner monkey emerges and chucking the channel locks through the mirror seems the only logical reaction.

It’s better to tidy up your work, retool everything, and have another go at it.

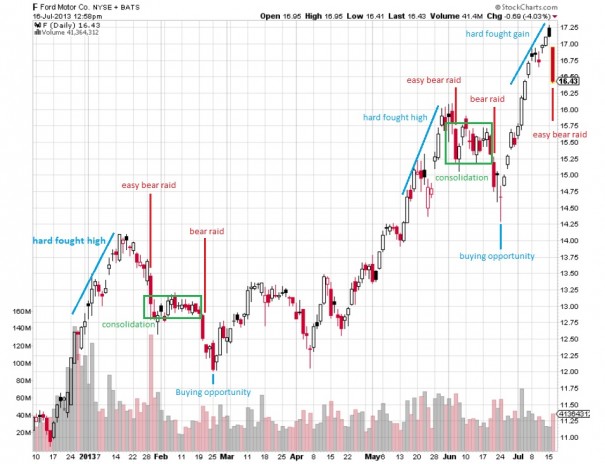

GOOG and MSFT both disappointed after hours and are down. QQQ and SPY are both pressing up against your favorite overbought indicator, and leaders are lagged all day.

We may see a down day or two…

The Philli Fed pumped up the market with vigor, only for us to spend the remainder of the day giving it back. I suppose I state all of this because I’m near fully vested and only holding FXY as a pseudo-hedge.

My swing portfolio is red on the day, championed by TPX getting poleaxed. Everything else did nothing fun.

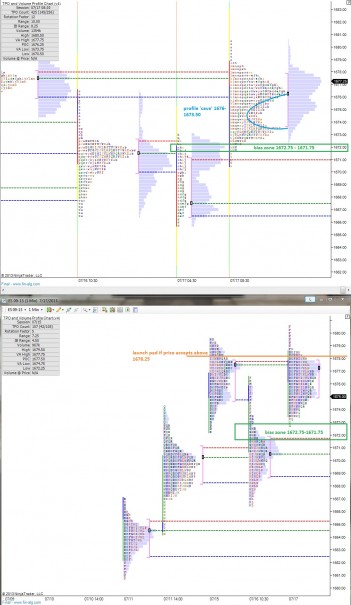

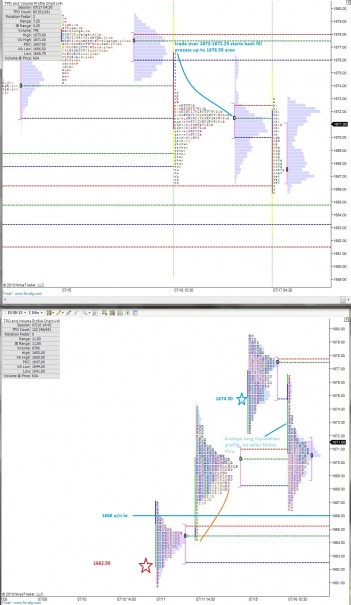

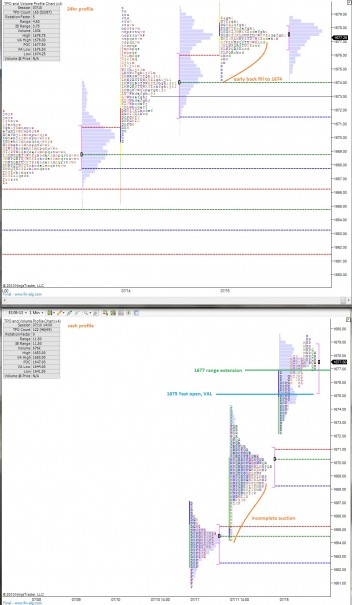

I get a long on in the futures at a decent bargain and then the momentum vanishes and I sit around, not eating, waiting for like $100 more in profit. Then I finally settle for my pittance and go eat a taco.

I’m still trading within the confines of my plan and I’m mildly profitable 4 out of 4 days as a result. Somebody has to hold me accountable and that somebody is me. Hell, I’m used to talking to myself what with the twitter and the blog, so self-enforced discipline feels normal.

I bulked up on ENPH and closed out DDD and Z. I’m convinced the best way to play DDD is to buy some every quarter and never sell, but that doesn’t fit my fringe lifestyle.

Comments »