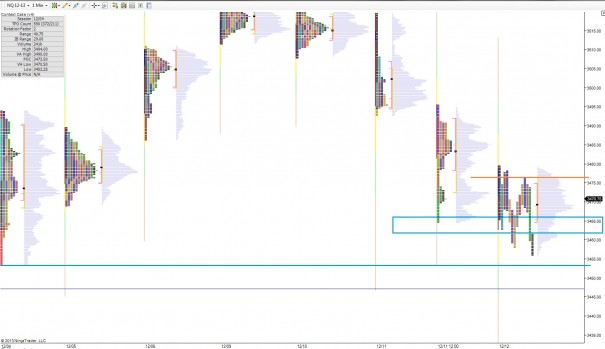

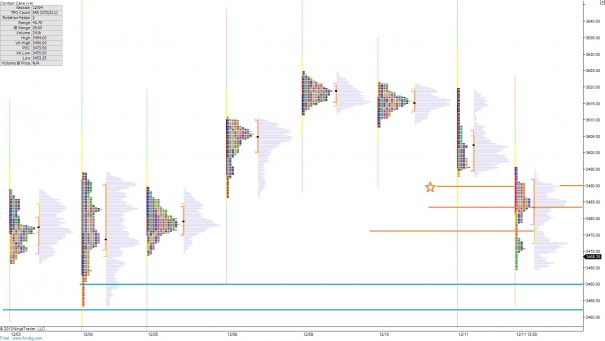

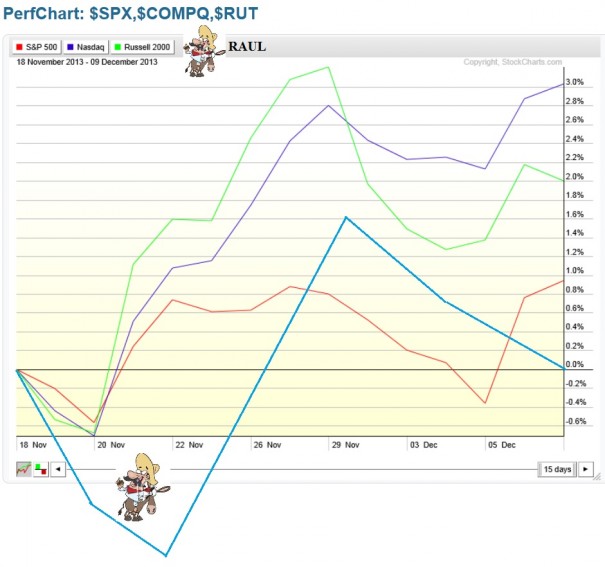

We continued working through a correction yesterday in the NASDAQ where sellers continued to their control. Their success in controlling yesterday’s auction can be seen in yesterday’s RTH market profile print. Assessing their control boils down to the following points:

Range extension lower

Value overlap/lower

VPOC migration lower

Lower high and lower low

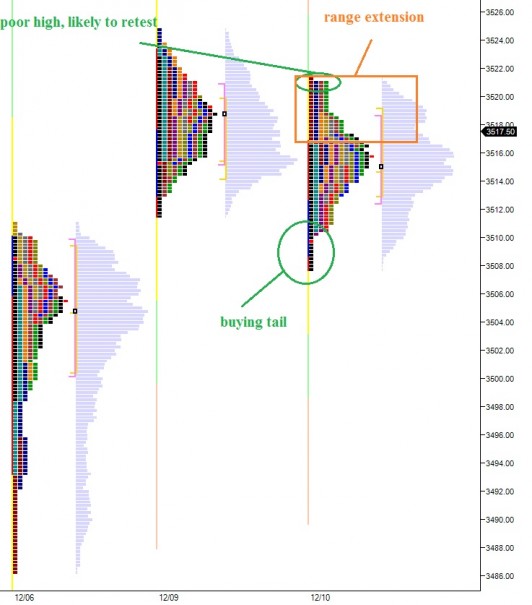

The positive news for longs is price has begun the pinball process of discouragement, where price is chopping around and taking no prisoners on either side. If my read on sentiment is correct, I will be looking for a higher low to setup soon on the NASDAQ. This may occur as soon as today.

The S&P has a very similar sentimental context.

Buyers came in overnight and bid the markets up a bit, but we are still trading inside of yesterday’s value, thus it has been accepted. Early on, I will be looking for sellers to reemerge and press price lower. I will be gauging their sentiment between 3465.50 – 3462.50. Should their pressure abate in this range, I will be looking for long exposure. Should their selling campaign continue, I will look for sellers to push into our 12/04 low at 3453.25.

On the upside, I will look for any signs of trade sustaining above 3476.50 our value area high from yesterday and also a low volume node left behind during Wednesday’s liquidation.

I have highlighted these levels on the following market profile chart:

Comments »