If you have been sidelined in cash with risk capital you otherwise desire to be committing to equities, you may be coming into today with a shopping list of stocks.

Perhaps however, you should not simply buy at the open. If instead you have the option to watch the day develop, I have two downside targets in mind for adding exposure. The following prices are in reference to the

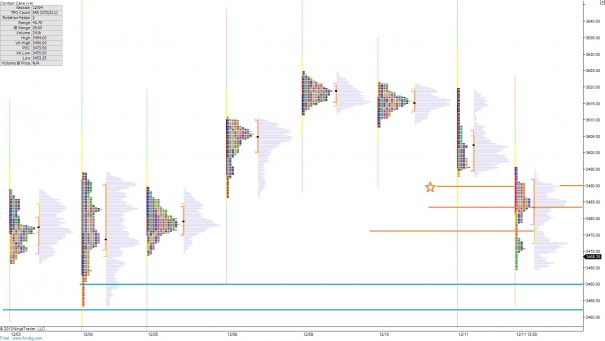

The first is 3460 and the second is 3453.50. These price levels represent targets algorithms will have in mind when they attempt to liquidate any holdouts to the long side. The market went up for quite some time, lacked follow-through conviction, and is now testing lower to gauge buyers’ appetite. A step taken by the market place to do this is pressing into existing longs to see if they liquidate.

The overnight market was on the move and slightly lower. The short term momentum favors seller control. Therefore we can measure their conviction verse the above to support levels. Should sellers abate early on, they may be waiting to see the auction first. In this event, look for their presence at 3476.25, the low volume node just above our overnight high, then 3483 which is yesterday’s VPOC.

Should strength rip through the market, my upside target is 3490.

I have highlighted these prices on the following Market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

swords out, sir. let’s go to war.

sweet

stock pick 2013..(who’s laughing now, Mayan man ..Mr. Goldsocks?..just funny, alright)

😉

posting entries/ exits/managing position(2.5 yrs now)

and here after death spiral only 4wks ago..11/13/2013

$20.195 65.73% $12.19

Day High $20.7900(so far)

freakin Beautiful..