NASDAQ futures are green heading into Monday’s cash open. The globex session spent most of the evening trading flat before turning higher around the time European markets opened. The session featured elevated range and volume. Price managed to push up to the Friday, 9/25 high before sellers came in.

This week is light on economic events but there are a few high impact ones including this morning’s ISM Non-Manufacturing Composite at 10am. Also out at 10am is the Labor Market Conditions Index.

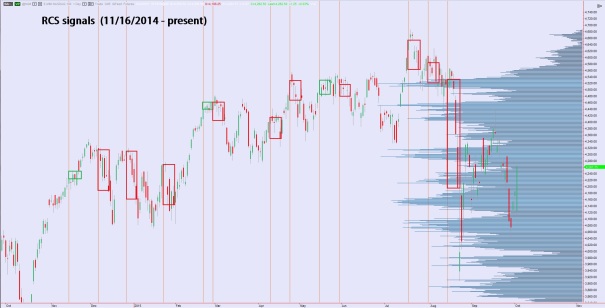

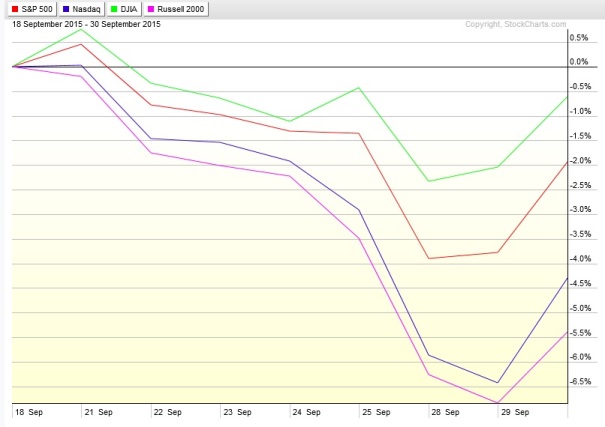

Last week the NASDAQ started with a gap down and sellers drove price lower. They extended beyond Monday’s low Tuesday then price went gap up into Wednesday. Price churned sideways through Thursday and Friday was a trend day up after opening gap down.

Heading into today, my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4261.75. Look for choppy trade early on ahead of the 10am data before sellers push down through 4270 setting up the gap fill. Then look for a move to take out overnight low 4250.50. Stretch target is 4243.75.

Hypo 2 sellers struggle to close overnight gap and cannot push down through 4270. Buyers step in and probe above overnight high 4296.75 and above the 09/25 high at 4298.50. Sellers do not defend up here and price continues working higher to target the open gap up at 4326.25.

Hypo 3 gap and go up. Buyers take out 4298.50 early setting up a strong push to 4326.25. Some churn in this region before continuing higher to close the open gap up at 4341.25. Stretch target is the open gap up at 4366.25.

Hypo 4 when buyers probe above the 09/25 high 4298.50 it discovers sharp responsive selling and we work lower to target 4270 then a gap fill down to 4261.75.

Levels:

Comments »