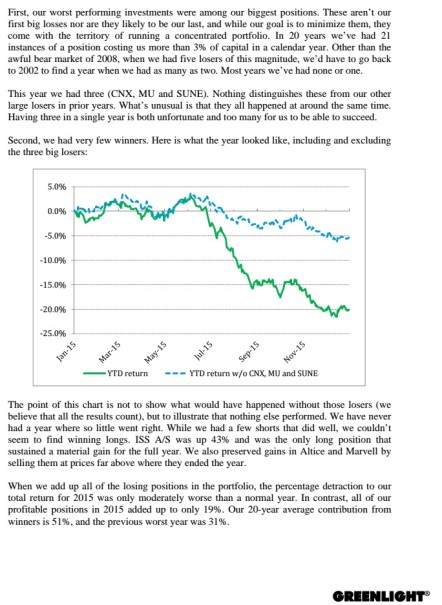

I have been maiming bears today inside the NASDAQ, and I’ve had enough. I am blood soaked and while this may seem like a ‘late-update’ on the situation, I had strong feeling early that today was the day.

A few things happened. First, and I will name names because why the hell not? Mr. @allstarcharts was so smug early this morning I almost had to vom. In the past, I would get all worked up and throw a kanipshin on the Twitters and be no better off because of it. Instead I would look like a jerk and be too busy to make money. Today I just let it marinate, how arrogant he was about his stupid head and shoulders pattern, and I went to work.

Next was the velocity downward. Finally some real speed! My man RaginCajun was all over it. Even his comments featured some folks throwing shade on the market. Sentiment was real nasty this morning. I even got some random, one word texts from friends, “Scheisse!” …he’s in Germany.

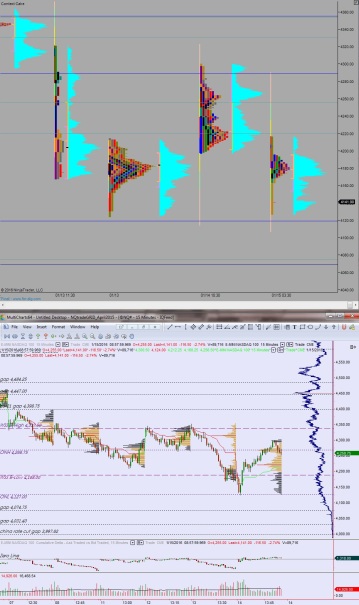

Then, for the second time this year, we had one of those bursts off the lows that says, “MASH THE RISK ON BUTTON.” I even said so on Twitter. Again, more negativity commenced.

Finally, some big, and I mean huge, ticks started rolling through the New York Stock Exchange. Audio alerts I haven’t heard since the summer were going off, “PUNCH THE LOAD” “ALTITUDE” …the mothership is a wonderful creation.

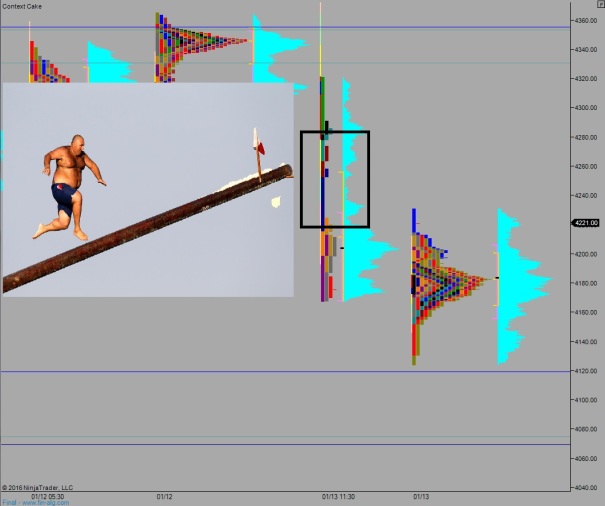

So yes, I might be sticking my dick through an uncertain glory hole, but I think this one can stick for a day or two. I KNOW, CRAZY TALK.

If this post offends you, you might want to consider the fact that none of this matters. Soon your reactions will blow away, like a dried up leaf. However I am a stone, 10 tons in weight, fortified by logic, patience, and love for the game.

RISK ON

Comments »