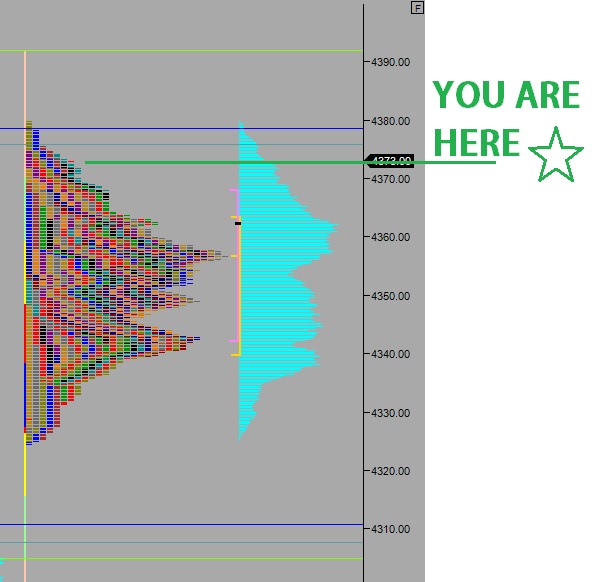

NASDAQ futures suggest stocks are set to start the week slightly higher. The globex session featured a normal range and volume, despite several financial institutions being closed in observation of Columbus Day. Price managed to briefly exceed Friday’s high, and as we approach opening bell price is hovering in the upper quadrant of Friday’s range.

There are no economic events today. There are a few low impact Fed speakers.

Last week the market opened gap up and pushed higher. Then Tuesday through Thursday afternoon we traded sideways. After Thursday afternoon’s Fed minutes we pushed higher. Friday extended the gain by printing a normal variation up. Price managed to go up and close the 09/17 open gap at 4366.25 before stalling into two-way trade.

If you recall, 09/17 was the day the FOMC rate decision came out unexpectedly unchanged. Price spiked higher, NYSE TICK was extreme, and we faded all afternoon—effectively printing a swing high that lasted several weeks. Thus to revisit this level we have to imagine short sellers are on their heels.

Heading into today, my primary expectation is for sellers to push down into the overnight inventory and close the gap down to 4357.75. Look for buyers to defend north of the overnight low 4346.25 setting up a move to take out overnight high 4371.75 and target 4376.

Hypo 2 sellers push down through overnight low 4346.25. They continue lower to test below Friday’s low 4331.25 and find responsive buyers below the level setting up two-way trade south of 4360.

Hypo 3 buyers gap-and-go up, take out 4378.50 early and set their sights on 4392.

Levels:

Comments »