NASDAQ futures are coming into the last Tuesday in June down about-20 after an overnight session featuring elevated range on normal volume. Price was balanced overnight, balancing along the upper quadrant of Monday’s range after briefly exceeding Monday high around 7:45pm New York. As we approach cash open price is hovering about in the upper quad.

On the economic calendar today we have case-shiller home price index at 9am followed by consumer confidence at 10am.

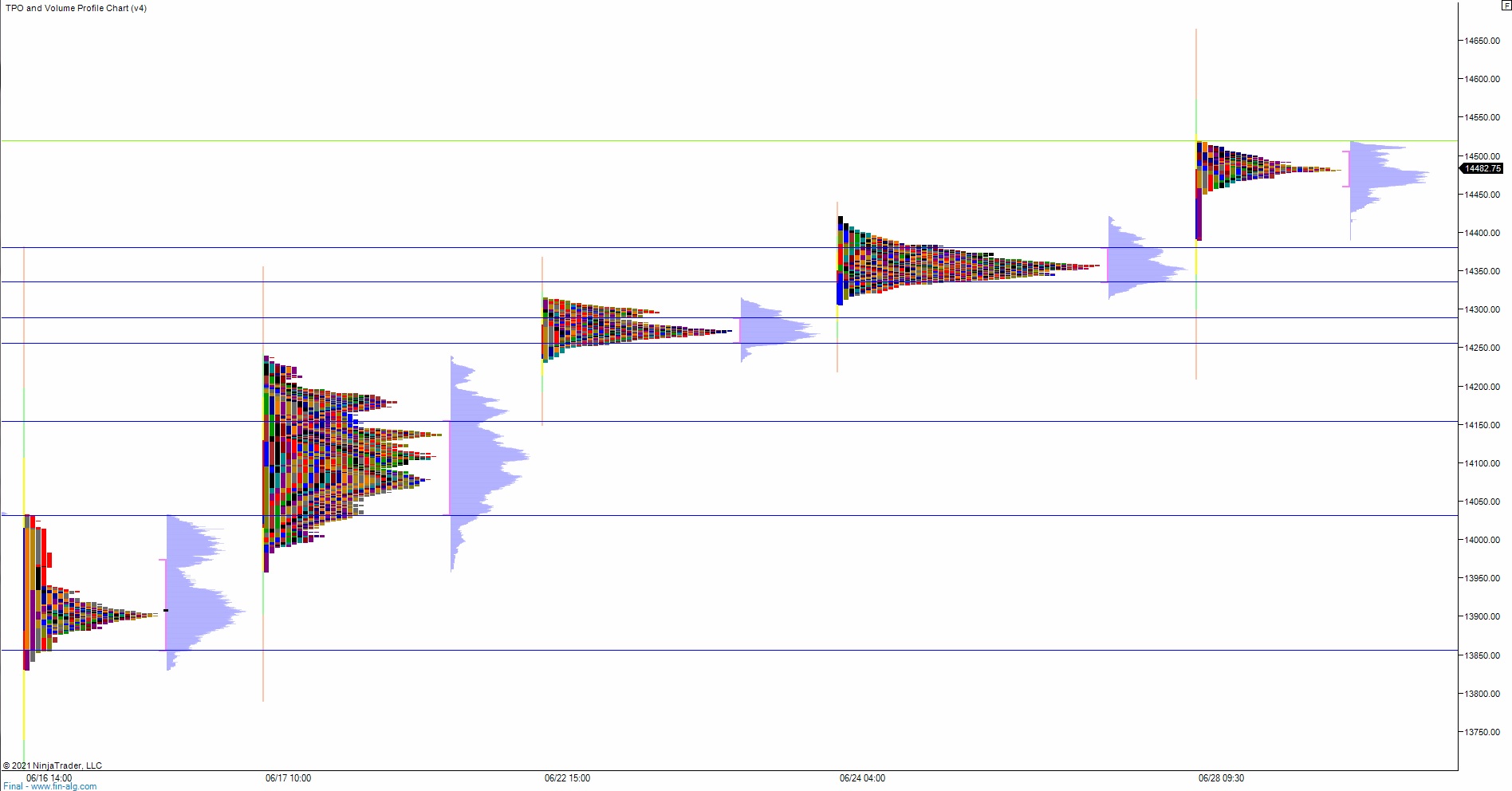

Yesterday we printed a double distribution trend up. The day began with a gap-and-go style drive up shortly after opening bell which saw price to a new all-time high. Then we spent several hours churrning higher before a bit of selling saw price fade a bit lower. Price could not return to the midpoint however before buyers became initiative and made a new high. We ended the session near the high.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap to 14,503.75 on their way to taking out overnight high 14,519.75 before two way trade ensues.

Hypo 2 sellers press down through overnight low 14,468.75. Look for buyers just below at 14,447.50 and for two way trade to ensue.

Hypo 3 stronger sellers reverse the Monday short squeeze by taking out 14,447.50 early on and sustaining trade below it, setting up a quick move down to 14,400.

Levels:

Volume profiles, gaps and measured moves: