NASDAQ futures are coming into Wednesday with a gap down after an overnight session featuring elevated range and volume. Price was balanced overnight, balancing along the lower half of Tuesday’s range. Price briefly probed below the Wednesday range around 3:30am but as we approach cash open price is hovering in the lower quadrant of Tuesday’s range.

Tech ‘juggernauts’ Microsoft and Alphabet (Google) reported earnings after the bell Tuesday. Shares are -2.5% and +5% respectively in pre-market trade.

On the economic calendar today we have crude oil inventories at 10:30am followed by and FOMC announcement/press conference from 2-2:30pm. CME Fed Fund futures indicated a 0% probability of the Fed adjusting their benchmark borrowing rate.

Tech giants Apple and Facebook are set to report earnings after the bell, and later this evening President Joe Biden will be giving his first speech to Congress.

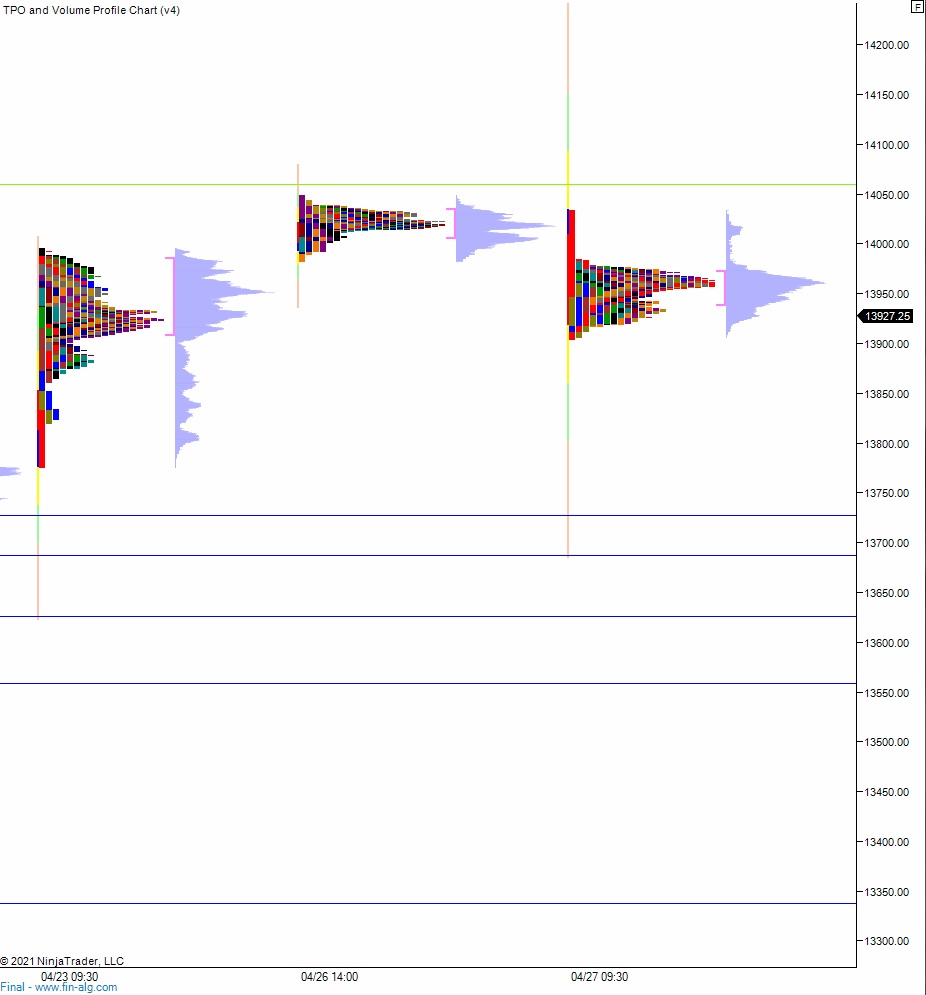

Yesterday we printed a normal variation down. The day began with a slight gap up in range. After a brief open two way auction in range sellers stepped in and worked a gap fill then continued lower, trading down into the lower quadrant of Monday’s range but never exceeding the low. Instead buyers worked price back to the daily midpoint, sellers defended the mid, and we ended the session chopping along the bottom-side of the mid.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 13,946.25. Buyers continue higher, up through overnight high 13,979.25. Then look for third reaction to the FOMC announcement to dictate direction into the afternoon.

Hypo 2 sellers gap-and-go down, taking out overnight low 13,904.75 and tagging 13,900. Then look for third reaction to the FOMC announcement to dictate direction into the afternoon.

Hypo 3 stronger sellers press a liquidation down to 13,800. Then look for third reaction to the FOMC announcement to dictate direction into the afternoon.

Levels:

Volume profiles, gaps and measured moves: