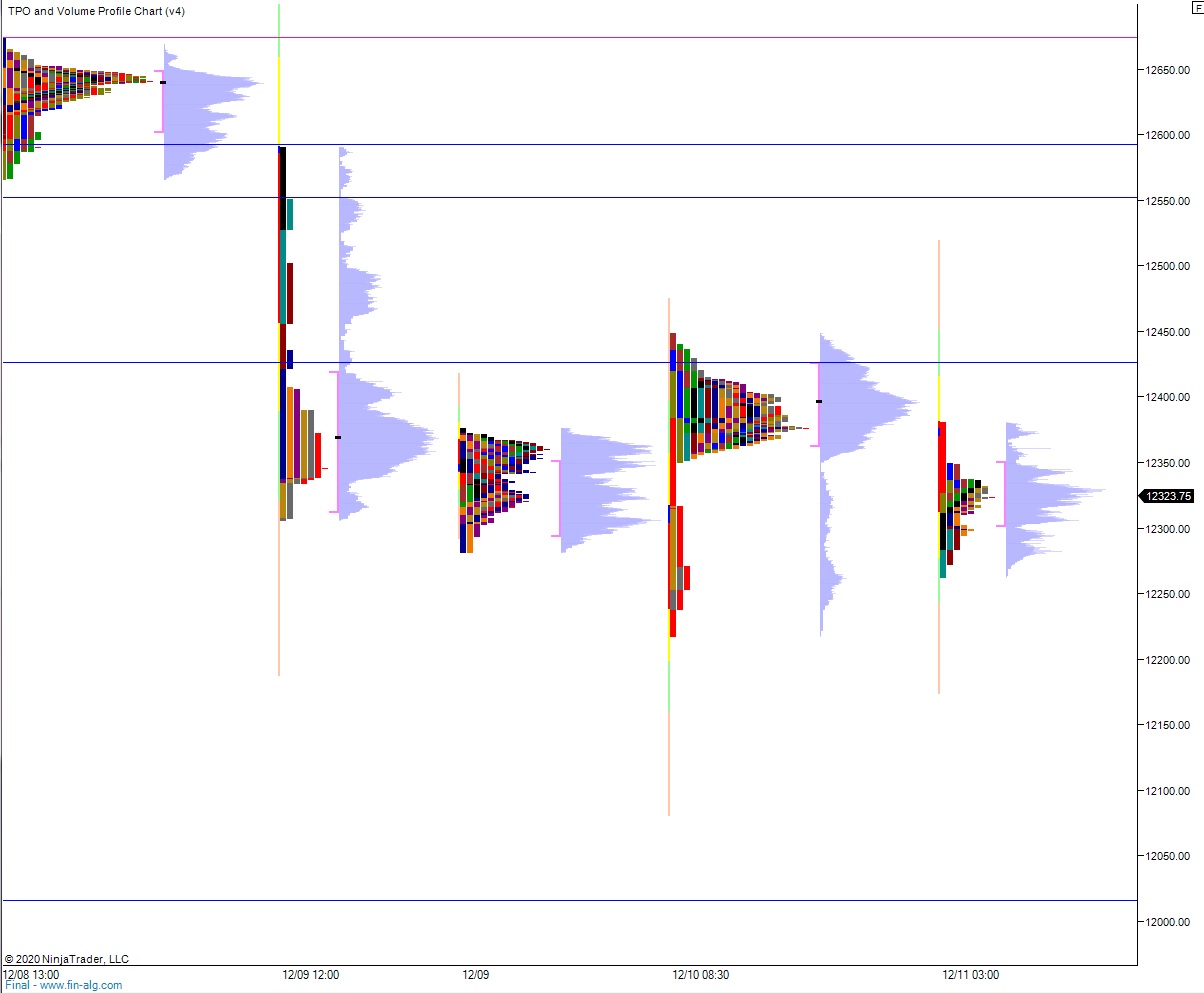

NASDAQ futures are coming into the final day of the first full week of December gap down after an overnight session featuring extreme range on elevated volume. Price worked lower overnight, unidrectionally rotating lower until catching a bid around 6:30am New York. As we approach cash open price is hovering just below the Thursday midpoint.

On the economic calendar today we have consumer sentiment at 10am.

Yesterday we printed a normal variation up. The day began with a gap down outside of Wednesday’s range. After an open two-way auction sellers made a sharp move lower, briefly trading down into the December 1st range before a sharp excess low formed. From then until about 11:40am price rallied hard, trading back up into the Wednesday range a checking back to the fast liquidation zone. Sellers defended their recently claimed territory, and we spent the rest of the session chopping along the upper quadrant of range.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 12,384.75. From there buyers continue a bit higher, tagging 12,400 before two way trade ensues.

Hypo 2 stronger buyers tag 12,425 before two way trade ensues.

Hypo 3 continuation selling. Sellers take out overnight low 12,263.25 setting up a move down to 12,200. Stretch targets if we begin to liquidate are 12,100 then 12,016.

Levels:

Volume profiles, gaps and measured moves: