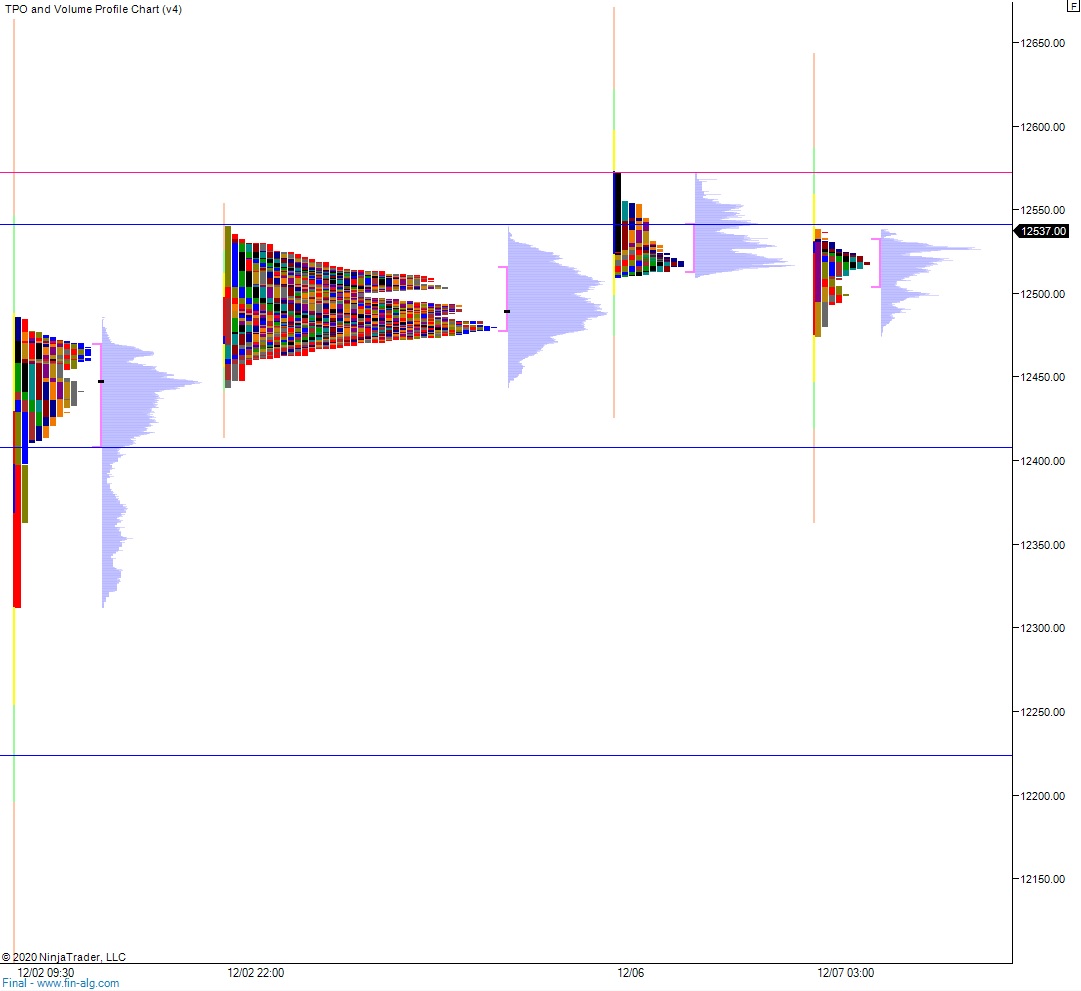

NASDAQ futures are coming into the first full week of December with a slight gap up after an overnight session featuring elevated range and volume. Price was balanced overnight. First-off it ran up to a new record high print, then after about 20 minutes of being open price fell back into the Friday range. That sell rotation carried clean through to 3:45am New York, when buyers stepped in near Friday’s midpoint. Since then we’ve slowly drifted higher and as we approach cash open price is hovering near the Friday high.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am followed by consumer credit at 3pm.

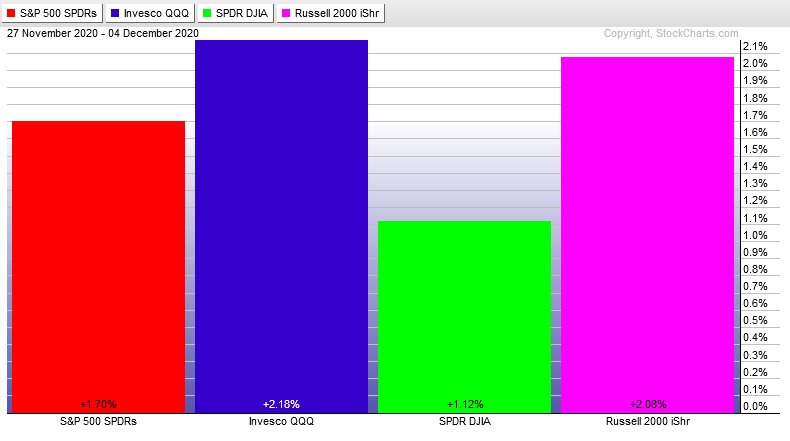

Last week kicked off with some strong selling early Monday that discovered a strong responsive bid. The rest of the week is spent rallying then holding along the highs. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation down. The day began with a slight gap down and after an open two-way auction buyers stepped in. Resolved the gap and continued higher, trudging along at the highs for several hours before checking back to the midpoint around 2:45pm. Sellers couldn’t quite tag the mid before buyers defended and eventually rallied back to the daily high.

Heading into today my primary expectation is for buyers to work up through 12,541.50 early on and sustain trade above it, setting up a run up through overnight high 12,572.50 before two way trade ensues.

Hypo 2 stronger buyers tag 12,600 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 12.507.75 then continue lower, down through overnight low 12,474.75. Look for buyers down at 12,450 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: