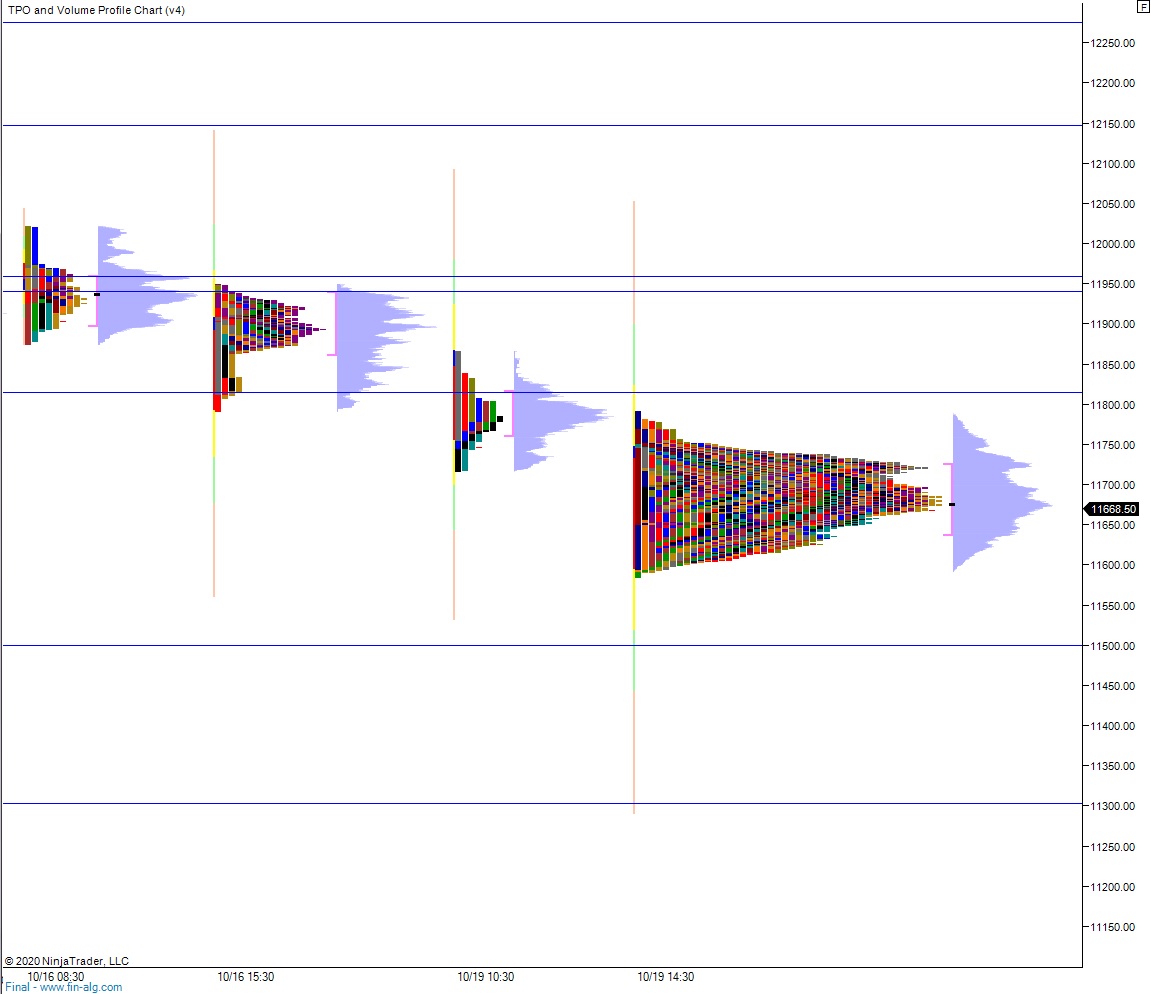

NASDAQ futures are coming into Thursday with a slight gap down after an overnight session featuring elevated volume on extreme range. Price was balanced overnight until about 7:30pm when a sharp sell-spike hit, likely related to some of the COVID-19 relief talks coming out. The move stalled just a few ticks above the current low print down at 11,585 which was set around 5am Wednesday. At 8:30am jobless claims data came out slightly better than expected, and as we approach cash open price is hovering in the middle of Wednesday’s range.

Also on the economic calendar today we have existing home sales at 10am, 4- and 8-week T-bill auctions at 11:30am and a 1-year TIPS auction at 1pm.

Yesterday we printed a normal variation down. The day began with a slight gap up.Sellers resolved the small gap during the open before a strong buy spike sent price up near the Tuesday high. This would be all the rally we could muster, the auction stalled and fell to a new low of day. The action was choppy, staying inside of Tuesday’s range, making time as investors wait to hear updates on the relief bill. The session ended with price smack in the middle of range.

Heading into today my primary expectation is for sellers to work down through overnight low 11,591 setting up a move to target 11,558.50 before two way trade ensues.

Hypo 2 stronger sellers trade down to 11,500 before two way trade ensues.

Hypo 3 buyers work a gap fill up to 11,695.25 then continue higher, trading up through overnight high 11,705.75 on their way to tagging Monday’s naked VPOC at 11,800.

Levels:

Volume profiles, gaps and measured moves: