NASDAQ futures are coming into the week gap up after an overnight session featuring extreme range and volume. Price began the Globex session gap down by about -150 handles. Since then price worked higher, trading up to the Friday midpoint before coming into balance. As we approach cash open, price is hovering just below the Friday midpoint.

On the economic calendar today we have pending home sales at 10am followed by 13- and 26-week T-bill auctions at 11:30am.

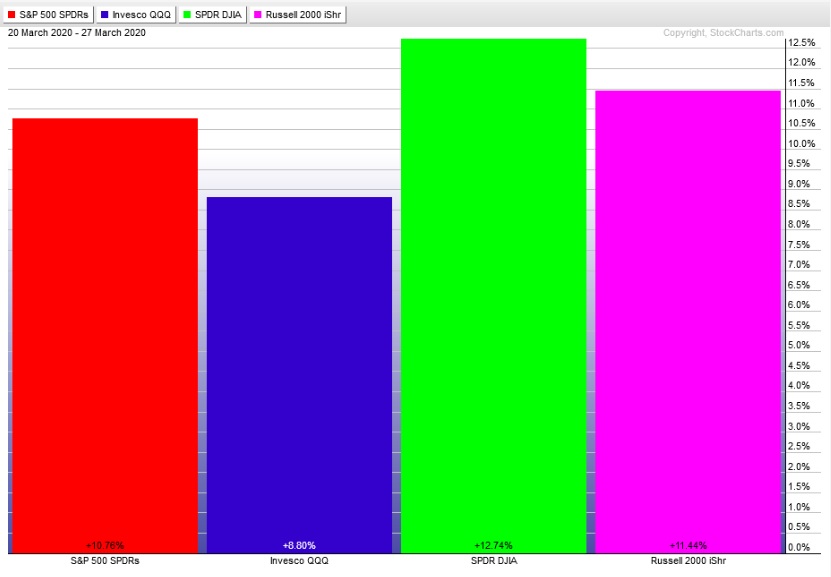

Last week the broad market bounced after nearly a month of discovering lower prices. Monday began with choppy weakness. Tuesday was gap up and buyers were in control through Thursday. Friday was choppy and two way before a sharp move lower took us into the weekend. The last week performance of each major index is shown below:

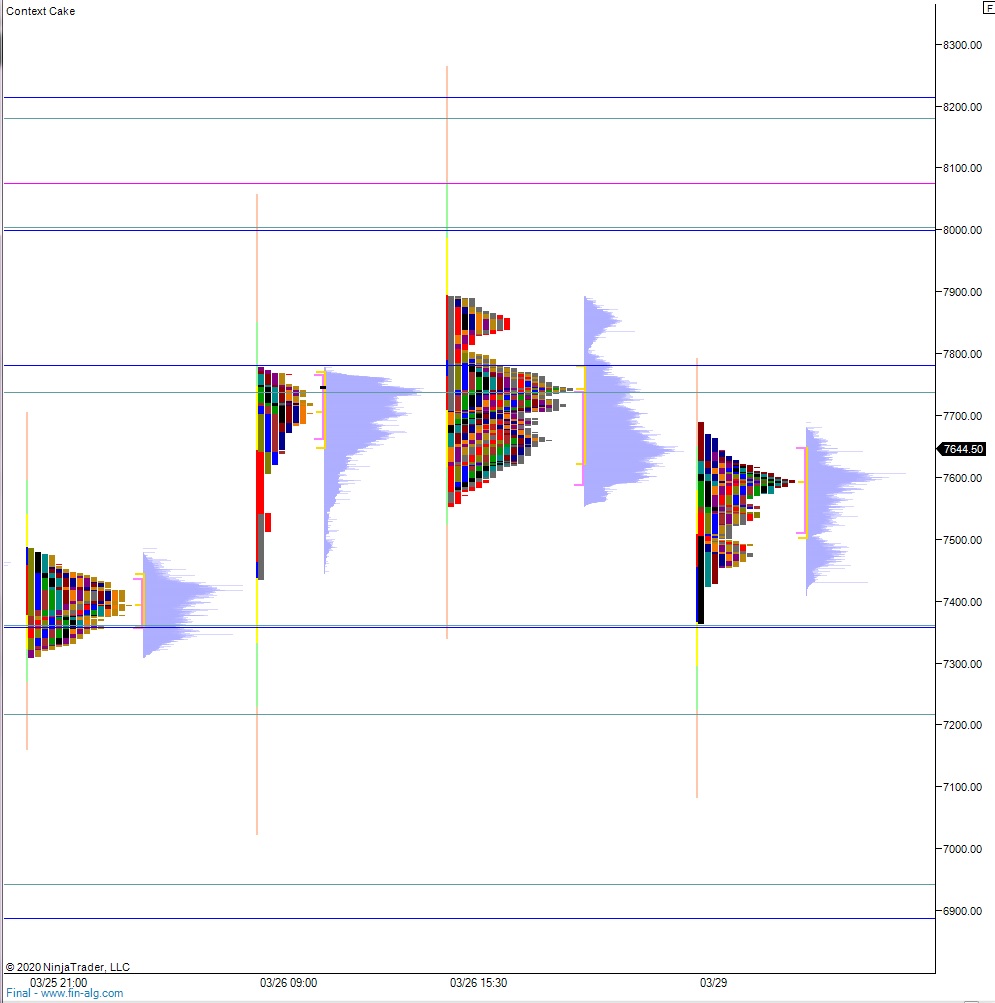

On Friday the NASDAQ printed a neutral extreme down. The day began with a gap down into the lower quad of Thursday’s range. After a tight chop for most of the day buyers stepped in and worked higher but were unable to close the overnight gap before that selling spike hit late in the day. We ended at low of day, in a neutral print.

Neutral extreme down. Inside day.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7572.25. Buyers show up ahead of 7500 and two way trade ensues.

Hypo 2 stronger sellers trade down through overnight low 7365. Buyers show up just below, around 7360 and two way trade ensues.

Hypo 3 buyers gap-and-go higher, trading up through overnight high 7690, tagging 7700 on the way to 7738.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: