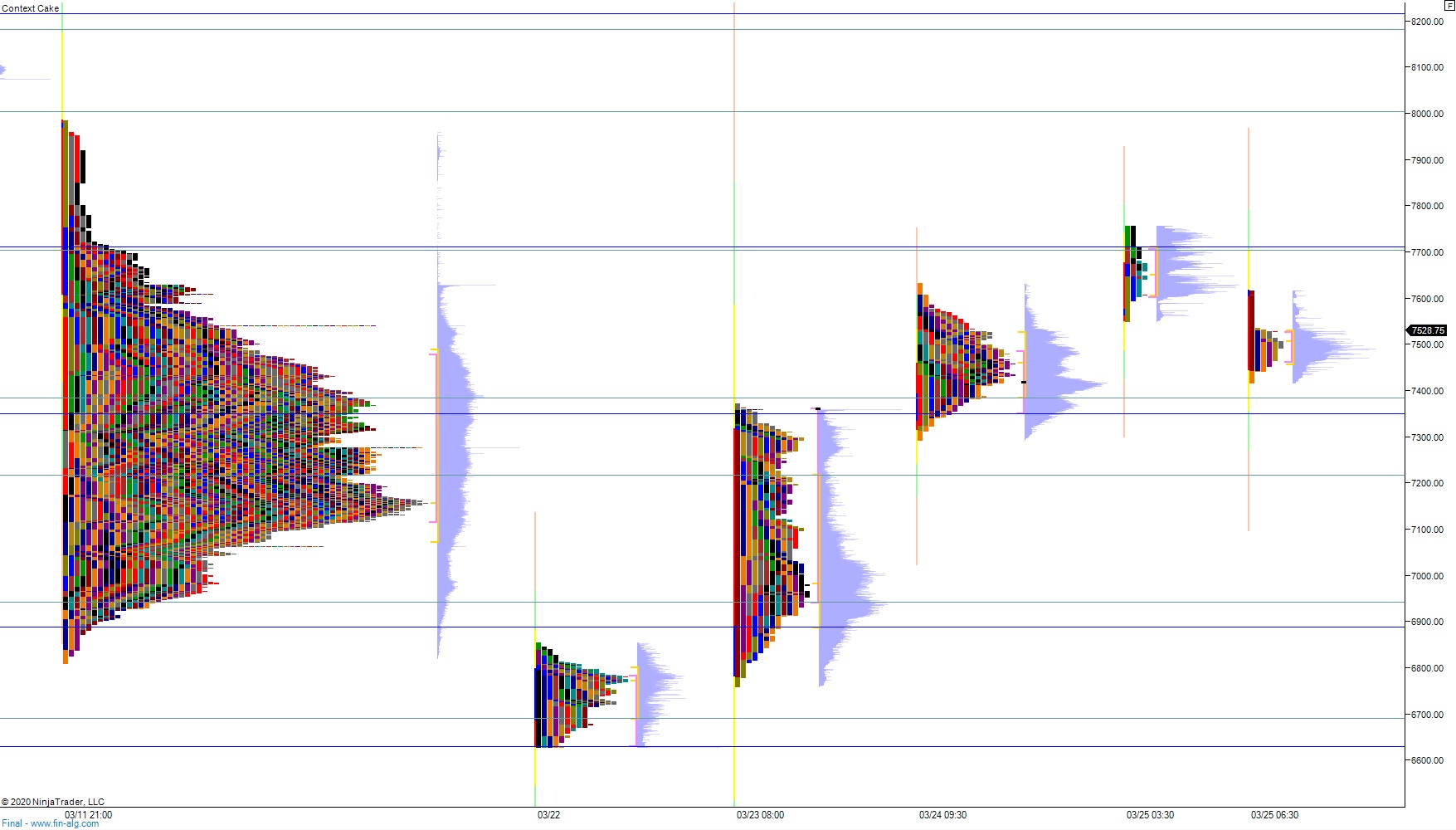

NASDAQ futures are coming into Wednesday with a slight gap down after an overnight session featuring extreme range and volume. The overnight was balanced until about 4am New York, balancing in the upper half of Tuesday’s range before spiking higher. The spike saw price trade to levels unseen since Friday the 13th before sellers stepped in and returned us back into balance. At 8:30am durable goods orders came out stronger than expected. At 9am house price index came out a touch below expectations. As we approach cash pen, price is hovering in the upper quad of Tuesday’s range.

Also on the economic calendar today we have crude oil inventories at 10:30am, 2-year note auction at 11:30am and a 5-year note auction at 1pm.

Yesterday we printed a neutral extreme up. The day began with a gap up into the top quad of Monday’s range. After a two way open auction buyers stepped in and worked up through the Monday high, tagging the upper weekly atr band before sellers stepped in and reversed the entire daily range, putting us neutral. Sellers stalled out just a few ticks below low of day and we ramped higher for the rest of the session, closing at high of day.

Neutral extreme.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up to 7700 before two way trade ensues.

Hypo 2 stronger buyers close the Friday the 13th gap up at 7901 before two way trade ensues.

Hypo 3 sellers press down through overnight low 7377 setting up a move down to 7216.75 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves:

If you enjoy the content at iBankCoin, please follow us on Twitter