NASDAQ futures are gap up about +40 heading into Monday after an overnight session featuring normal range on elevated volume. Price worked higher during a balanced session, working up record highs. As we approach cash open, price is right up at globex high.

On the economic calendar today we have 13- and 26-week T-bill auctions at 11:30am.

We also have Google parent Alphabet, Inc. set to report earnings after-the-bell.

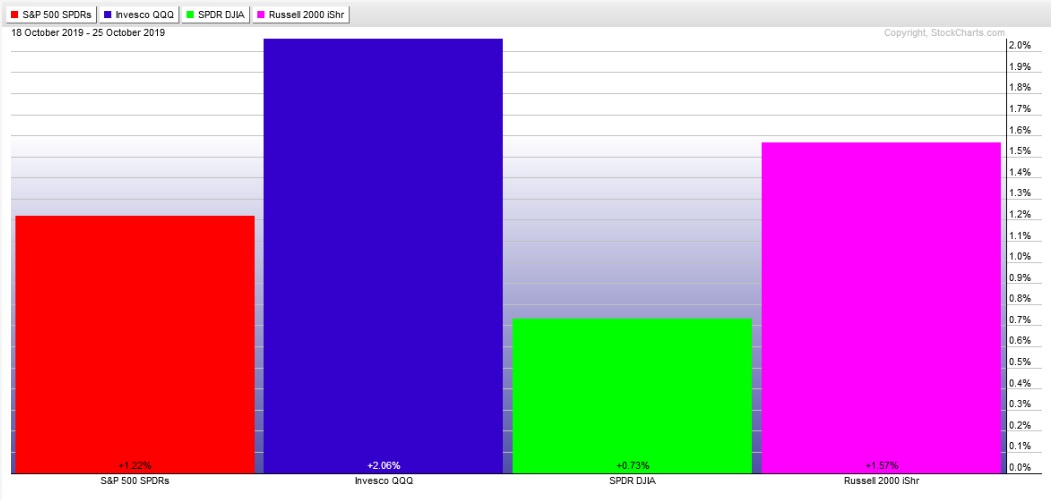

Last week featured a quiet Monday, with a slight up drift. Tuesday was a trend down that ended on the lows. Wednesday price consolidated in the lower quad of Tuesday for most of the day before ramping into the bell. The rest of the week was spent auctioning higher, with relative strength seen in the NASDAQ. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a double distribution trend up. The day began with a slight gap up and drive higher, trading up through the weekly highs by late morning and continuing to extend the gains into New York lunch. Then we flagged along the highs, balancing for the rest of the day before ramping into the close.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up to 8100 before two way trade ensues.

Hypo 2 stronger buyers trade up to 8131.75 before two way trade ensues.

Hypo 3 sellers work into the overnight inventor and close the gap down to8034.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: