NASDAQ futures are unchanged to start the week after an overnight session featuring elevated range and volume. Price briefly traded below last Friday’s cash low before coming into balance.

On the economic calendar today we have pending home sales at 10am and a 3- and 6-month T-bill auction at 11:30am.

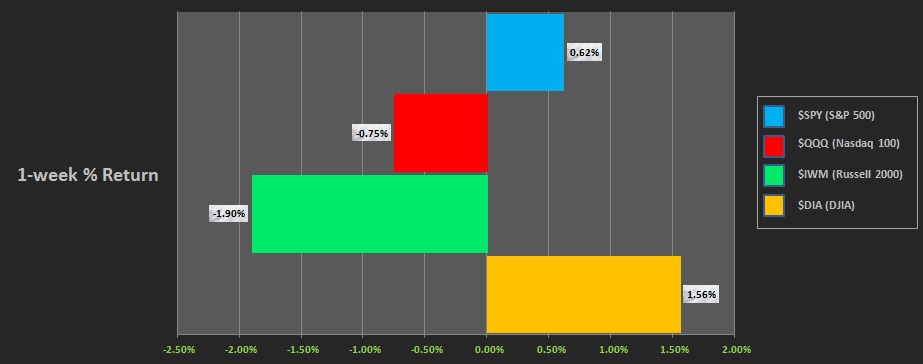

Last week began with markets working higher across the board then selling throughout the second half of the week which was to an extent attributed to post-earnings weakness in Facebook. The Dow Jones was resilient to late-week selling while the Russell showed subtle signs of topping. The last week performance of each major index is shown below:

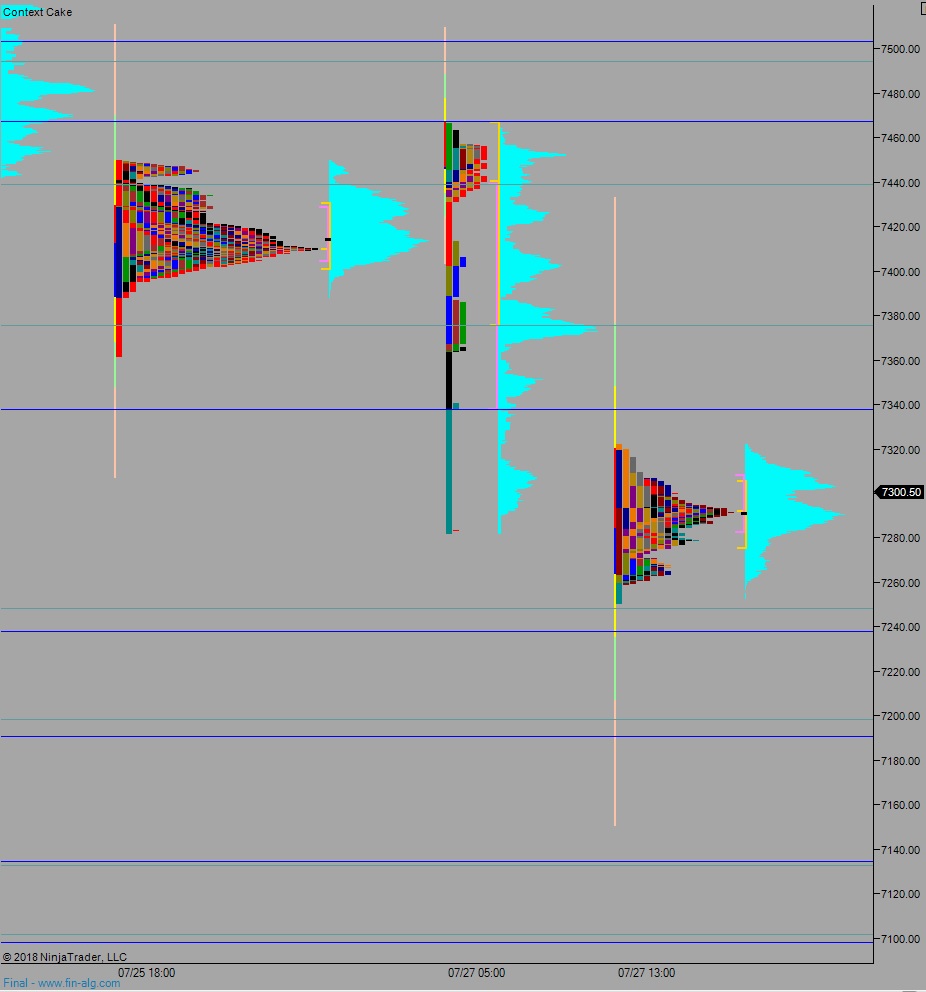

Last Friday the NASDAQ printed a double distribution trend down. The day began gap up and sellers quickly faded the overnight move lower. The selling then continued all morning and accelerated into the afternoon. Price traded down into the 07/11 range before establishing a late-day balance. Had it not established balance it would be considered a full-on trend day.

But I suppose a more accurate description would be a single-distribution trend day, slightly more bearish than a double.

Heading into today my primary expectation is for sellers to work down towards overnight low 7251. Look for buyers down at 7248.25 and two way trade to ensue.

Hypo 2 stronger sellers trade down to the open gap at 7232 before two way trade ensues.

Hypo 3 buyers work up to 7337.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: