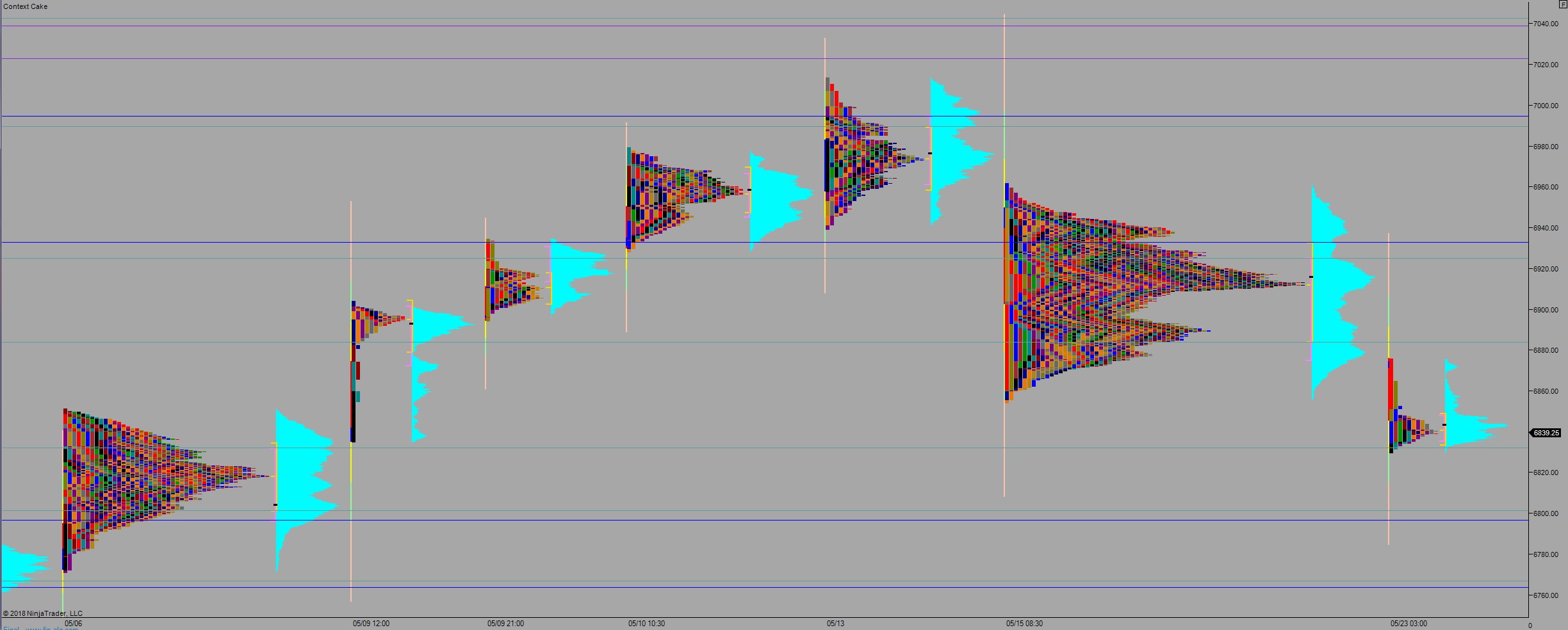

NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, driving fast at times, discovering lower prices. As we approach cash open the auction profile resembles a lowercase letter-b which suggests a long liquidation occurred—a temporary market phenomenon like a short squeeze but in the other direction. Price is hovering on the topside of a multi-day value area formed in early May and showing short-term balance.

The economic calendar is loaded today. At 9:45am we have Markit manufacturing/service/composite PMI. New home sales data comes out at 10am, crude oil inventories at 10:30am. At 11:30am the US Treasury will auction off $26 billion in 52-week bills and $16 billion in floating rate 2-year notes. Then at 1pm they will auction off another $36 billion in 5-year notes.

Then, at 2pm the Federal Reserve will release the minutes from their May 2nd meeting.

Yesterday the NASDAQ printed a normal variation down. The day began gap up and after a brief 2-way auction sellers stepped in and closed the gap. We spent most the rest of the day chopping sideways until some late afternoon selling made new daily lows.

Heading into today my primary expectation is for buyers to push off the open. Look for sellers to reject a move back into the 5/18 low, likely defending at the open gap left behind at 6874.25. Then look for 3rd reaction after the FOMC minutes to dictate direction into end-of-day.

Hypo 2 gap-and-go lower, press through overnight low 6829.75 setting up a move to target 6801.25 before two way trade ensues. Then look for 3rd reaction after the FOMC minutes to dictate direction into end-of-day.

Hypo 3 stronger buyers work a full gap fill up to 6909.25 then continue higher, up through overnight high 6913.25. Look for sellers up at 6925.25 and two way trade to ensue. Then look for 3rd reaction after the FOMC minutes to dictate direction into end-of-day.

Levels:

Volume profiles, gaps, and measured moves: