NASDAQ futures are coming into Wednesday flat after an overnight session featuring normal range and volume. Price held range overnight with bidders working onto the tape ahead of the excess low printed Tuesday. At 8:15am ADP Employment came in below expectations.

USA ADP Employment Change for Oct 147.0K vs 165.0K Est; Prior 154.0K

On the economic calendar today we have the FOMC rate decision at 2pm. Fed fund futures suggest this is not a live meeting, currently pricing a 7.2% chance of a rate hike. We also have crude oil inventories at 10:30am.

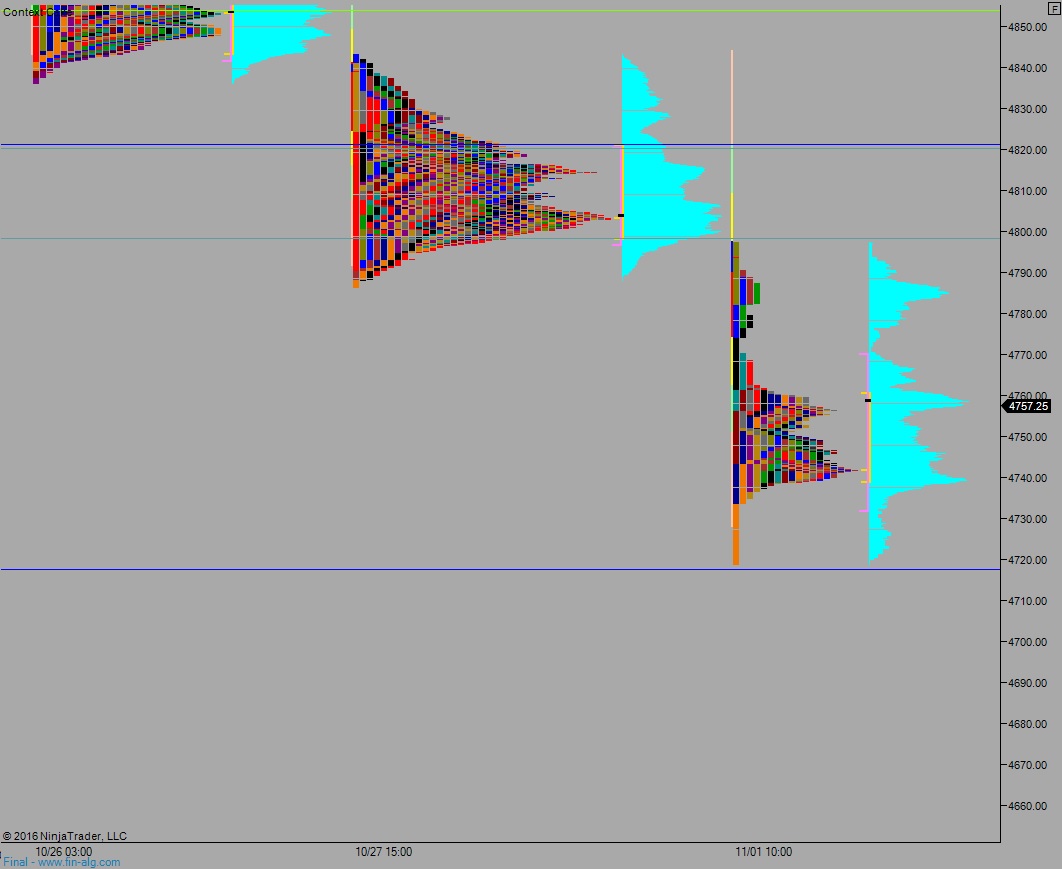

Yesterday we printed a double distribution trend down. Price opened gap up and sellers quickly drove the market lower and continued pressing into the tape and took out October’s lows before finding a responsive bid inside the 9/13 range. Price then recovered back to the daily mid before the closing bell.

Heading into today my primary expectation is for buyers to take out overnight high 4761.25 and work up to 4770 before balance and two way trade ensues as we wait the FOMC decision.

Hypo 2 sellers work down through overnight low 4737.50 and target 4717.75 before we balance out ahead of the FOMC.

Hypo 3 strong buying pushes up to 4800 before we balance into the Fed.

Look for the third reaction post FOMC rate decision to dictate market direction into the close.

Levels:

Volume profiles, gaps, and measured moves: