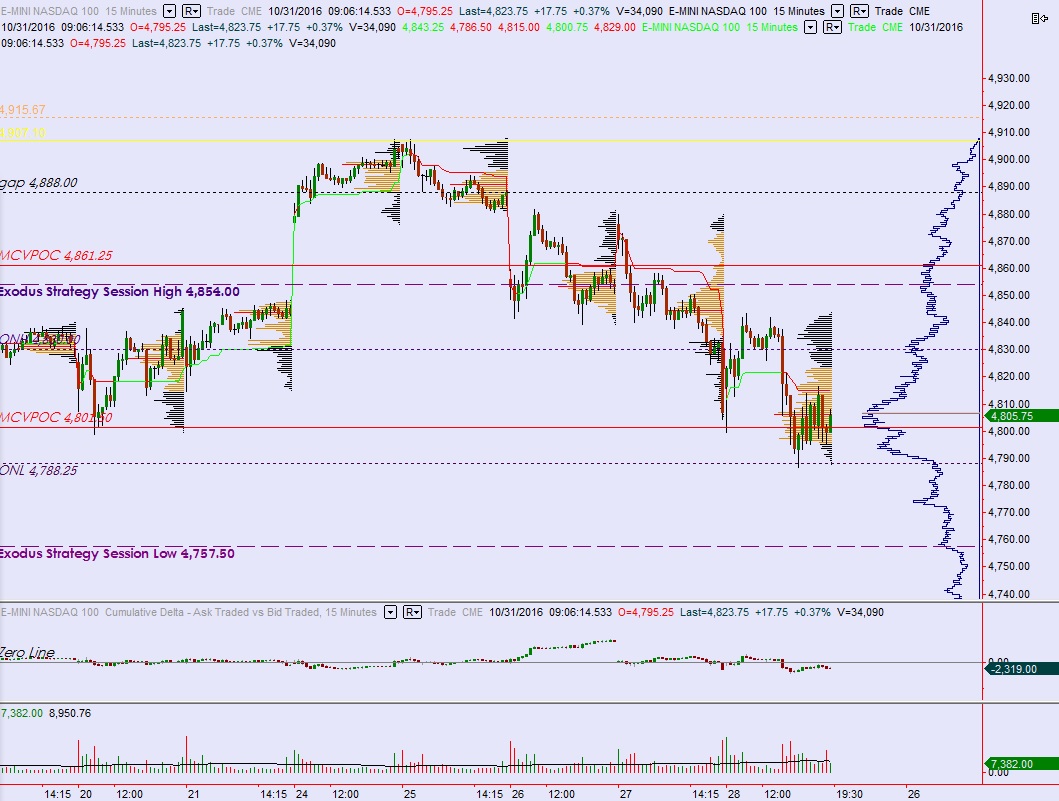

NASDAQ futures are coming into Monday gap up after an overnight session featuring elevated range on normal volume. Price held the Friday low then made a strong push higher before midnight New York. The move was contained within Friday’s range, finding sellers along the upper quadrant of Friday’s range. At 8:30am Personal Income data was in line with expectations and Personal Spending was better than expected, calling last Friday’s Personal Consumption miss into question.

Also on the economic docket today we have both 3- and 6-month T-bill auction coming to auction at 11:30am.

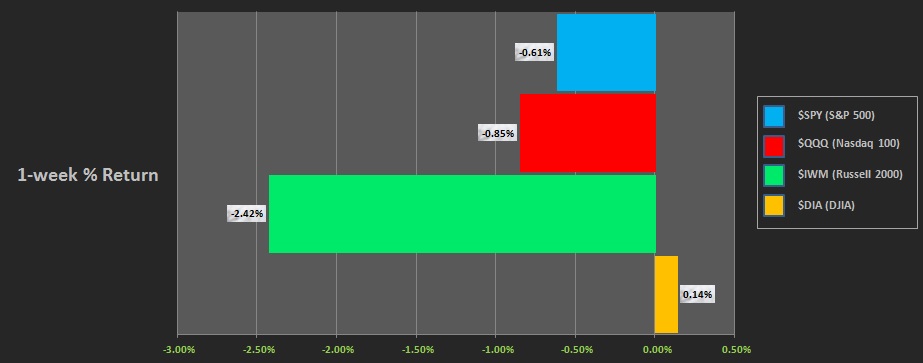

Last week the Russell moved lower and the Dow Jones held its tight balance while the other two indices sustained minor losses:

On Friday the NASDAQ printed a neutral day. Early buying was reversed around 1pm when news of FBI Director Comey re-opening his instigation of the Clinton emails hit the wires. Buyers near the end of the session managed to push the market out of a neutral extreme print.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4805.75. The market catches a bid right around here and works up through overnight high 4830 to target 4853.75 MCVPOC before two way trade ensues.

Hypo 2 sellers work gap fill down to 4805.75 then take out overnight low 4788.25 and continue down to 4780.50 before two way trade ensues.

Hypo 3 buyers gap and go, up through overnight high 4830 and tag 4853.75 MCVPOC before settling into balanced trade.

Hypo 4 choppy range from 4826 to 4795.

Levels:

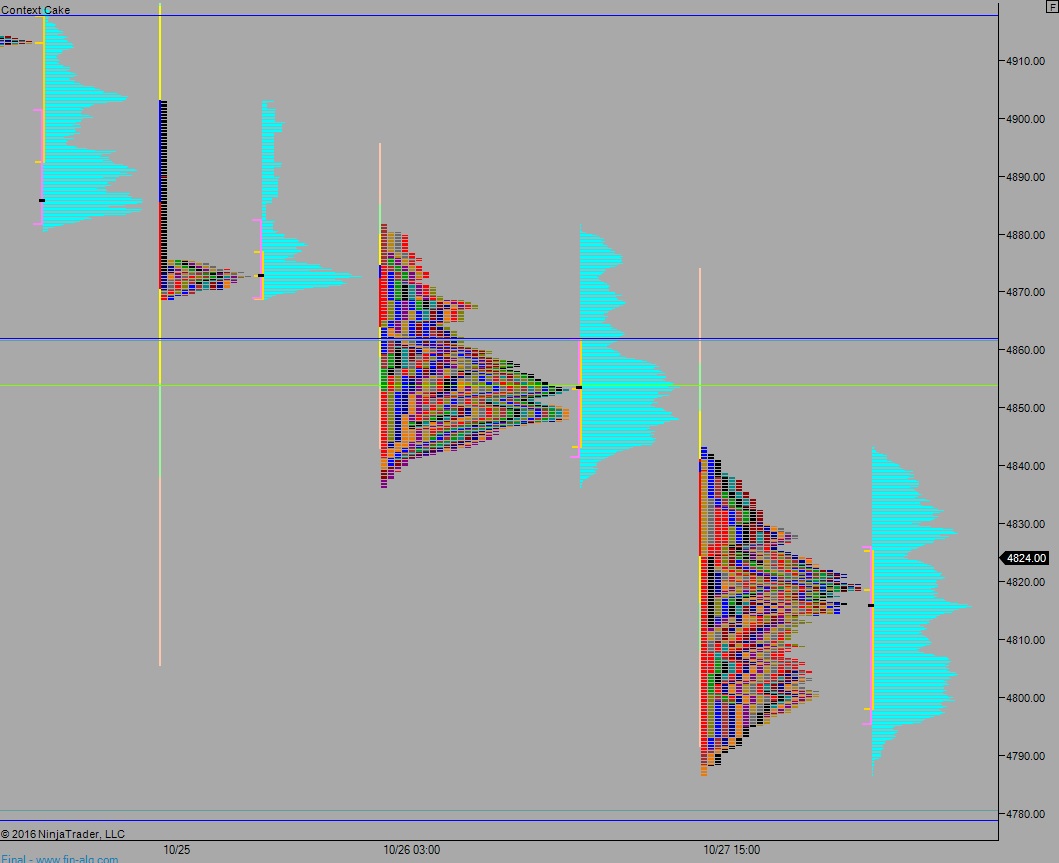

Volume profiles, gaps, and measured moves: