NASDAQ futures are coming into Tuesday gap up after an overnight session featuring normal range and volume. Price worked higher overnight—initially with a burst of buying just after U.S. cash market close yesterday (which was faded) then by a slow march higher for the remainder of the evening.

Janet Yellen has to testify to the Senate Banking Committee about monetary policy today at 10am. We have 4- and 52-week T-Bill auctions at 11:30am and a 5-year Note auction at 1pm.

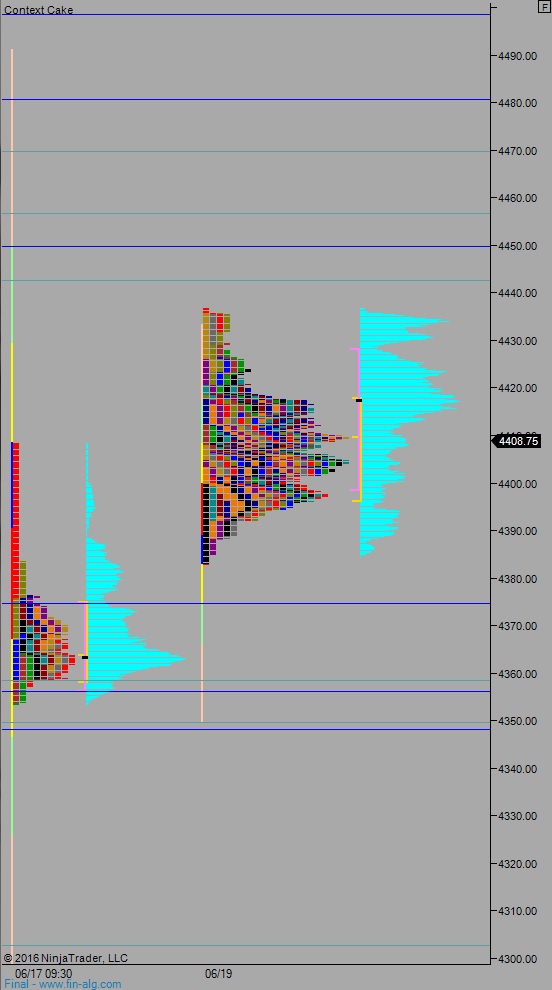

Yesterday we printed a neutral extreme down. The week began with a pro gap up and buyers drove price higher off the open. Just after the first hour of trade, and rather briefly, the market went range extension up. Shortly after strong responsive selling came in, first working price down through the daily range then accelerating the liquidation down into the open gap.

Heading into today my primary expectation is for sellers to work into the overnight inventory and test the 4400 century mark. Look for buyers here and then a move to take out overnight high 4415.75. Look for price to continue higher, up to 4429 before two way trade ensues.

Hypo 2 sellers complete a full gap fill down to 4389.50 then take out overnight low 4388.25 setting up a test of Monday’s low 4385. Look for responsive buyers down at 4374.75 and two way trade to ensue.

Hypo 3 buyers gap-and-go higher, take out overnight high 4415.75 and sustain trade above 4429 setting up a move to target 4442.50 then 4450.

Levels:

Volume profiles, gaps, and measured moves: