NASDAQ futures are up heading into a busy day. The overnight action was balanced and occurred on normal range and volume. Price worked up through the Tuesday range to briefly exceed yesterday’s high by two ticks before falling back into range.

The biggest economic event into year end is scheduled for 2pm today, when the Federal Open Market Committee is expected to lift interest rates by 25 basis points. The event also has a post-press conference with Yellen scheduled for 2:30pm. Today’s agenda is also spattered with medium impact events including Housing Starts and Building Permits at 8:30am, Industrial/Manufacturing Production at 9:15am, Manufacturing PMI at 9:45am, and Crude Oil Inventories at 10:30am.

Yesterday we printed a neutral extreme down, albeit an odd one with narrow range after a big gap up. Nevertheless, this day type carried some negative directional conviction for the day-time frame participants. Therefore the gap up this morning is a bit of a surprise.

Heading into today my primary expectation is for choppy conditions as the market digests all the morning news and goes into a holding pattern ahead of the FOMC decision. Look for sellers to work into the overnight inventory and close the gap down to 4602.75. Expect responsive buyers around 4600 and a move to briefly take out overnight high 4633.50 before falling back into range/chop.

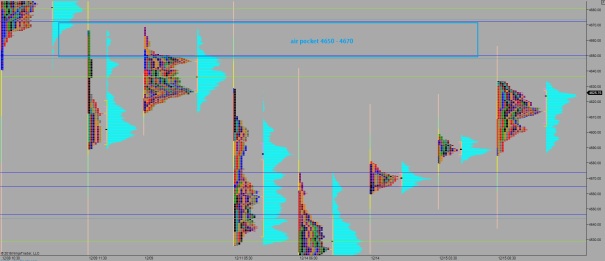

Hypo 2 buyers take out overnight high 4633.50 early on and work up to target 4650 before two way trade ensues–leaving the overnight gap open while we await the 2pm rate decision.

Hypo 3 buyers sustain trade above 4650 opening up the air pocket up to 4672.

Hypo 4 gap fill accelerates as seller take out overnight low 4597 and test below Tuesday low 4587 to set up a gap fill down to the Monday close at 4560.50.

Levels:

If you enjoy the content at iBankCoin, please follow us on Twitter