As we draw near the close of the week, the Nasdaq performance is well out in front of the other indices, 3x as much performance as the Russell and 50% more performance than the S&P. The strength this week in shares of AAPL [4.31% this week] likely attributed to this behavior, but with bearish Friday on the horizon one has to wonder if the Nasdaq is bluffing or truly taking the reigns of this bull. One would be wise to keep a watchful eye on Apple.

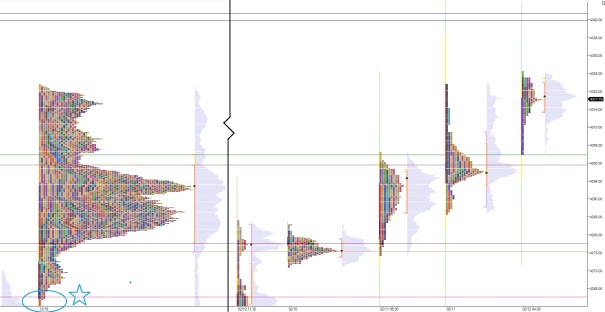

Futures are higher as we head into cash open. There was a flurry of buying yesterday just after cash close as participants received more news about the Greek situation. The action came to an end just before 5pm after it tagged the Christmas Eve (12/26) HOD 4322 to the tick. We then reversed lower and cut into yesterday’s range a bit, down just below the MID 4288.75 before reversing and trading all the way back up through the 4322 high. Despite the seemly big overnight action, the range managed to stay 1st sigma, although range is elevated to slightly abnormal 2nd sigma levels.

Price was at this level when Advance Retail Sales came out well below consensus. The bad news received a positive reaction. Bad news-positive reaction is a v.bullish behavior.

We are trading on the upper end of a range dating back to late October. The market behavior leading up to today would lead one to expect range high to be defended, sending us back lower. However, the range is mature, thus it is possible we shift into a discovery phase up.

The market profile structures leading into today are anything but normal. We have printed FOUR neutral days in a row, and several more in the last few days. This speaks volumes to the compression taking place and the battles it’s creating.

Early on I will look for sellers to press into this overnight inventory and work back to around 4305. There I will look for responsive buyers to take us back to to target the overnight high 4325.50 and close the gap up at 4333.

Hypo 2 is buyers are more aggressive on the open and drive higher at the start, take out 4333 early and look to make new swing high.

Hypo 3 is sellers push down into yesterday range and close the overnight gap to below 4298.25, and continue lower to target the overnight low 4285.75.

These levels are highlighted below:

If you enjoy the content at iBankCoin, please follow us on Twitter