Nasdaq futures are down a bit into the open. Trade was mostly lower overnight, with not many counter rotations to the upside. Early this morning Chinese CPI and PPI came in a bit lower than expected but that does not appear to be the “reason” for the selling. It simply appears we had more sellers than buyers in the overnight session.

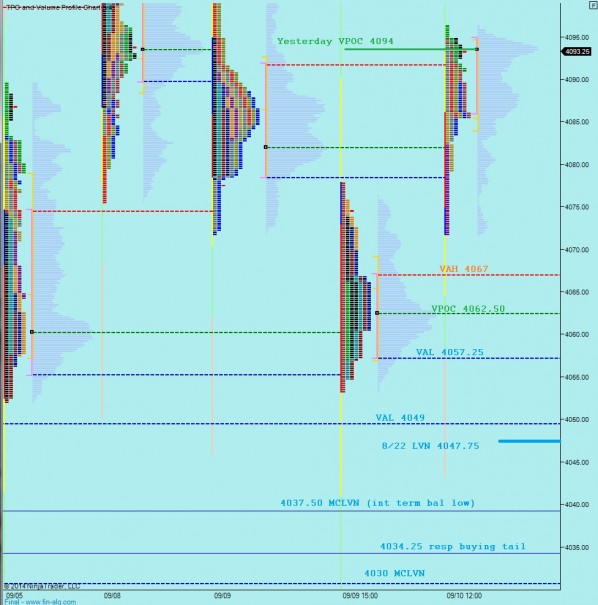

Intermediate term we are in a maturing balance area, and area which is becoming increasingly prone to breakage as it ages. I have highlighted the key price levels on this balance on the following volume profile chart:

I have also noted the key levels I will be observing using the following market profile chart. Note, I have made a few splits to Tuesday and Wednesday’s profiles to have a better view of the action:

If you enjoy the content at iBankCoin, please follow us on Twitter

back when i was a predominate /ES trader there was a ridiculous streak how the thursday before opex week dictated the OPEX in opposite fashion. (ie, green thursday red opex). This was like 08-09

the day holds an air of mystery, no doubt about it

for an option pricing standpoint, it’s the best bang for buck if you wanna go short dated and there’s movement. But this was the time before weekly options existed.

weeklies really take some of the spice away from OPEX, but we also have the September index futures expiring next week so perhaps this one is more special-er