NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. Price was balanced overnight, balancing along the lower half of Tuesday’s range until 8:30am New York. At 8:30am retail sales data came out much stronger than expected and the producer price index came out higher than expectations. The data was met with selling, selling that knocked the overnight session out of balance. As we approach cash open price is hovering down near last Friday’s low.

Busy day on the economic calendar. Today we also have business inventories and housing market index at 10am, a 20-year bond auction at 1pm and FOMC minutes at 2pm.

Major U.S. employer and retail giant Wal-Mart is set to report earnings tomorrow morning before the bell.

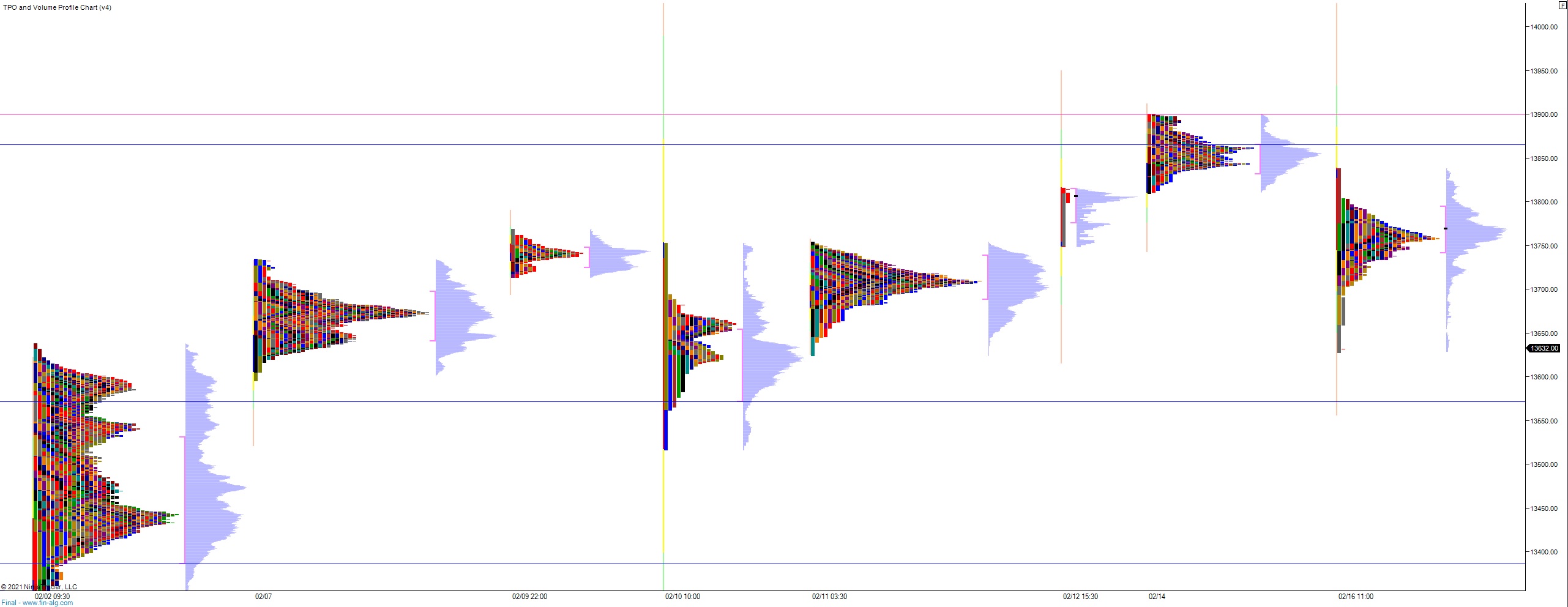

Yesterday we printed a double distribution trend down. The day began with a gap up beyond all prior highs. There was a sell spike on the open that successfully closed the overnight gap before buyers stepped in and formed an excess low. The first hour of trade was big and choppy, eventually leading to a brief range extension up. The auction reversed shortly after, quickly falling down through the daily mid adn then pressing neutral. The sellers tagged the naked VPOC from last Friday and exceeded it a bit before responsive buyers stepped in. Said buyers worked price back to the midpoint. Sellers defended. Twice. Eventually leading to a sell rotation into the closing bell. We closed off the lows but in the lower quadrant.

Neutral extreme down.

Heading into today my primary expectation is for buyers to press into the overnight inventory and attempt to regain Monday’s low 13,716. Sellers reject a move back into Monday range setting up a move down through overnight low 13,627.75. Look for buyers down at 13,600 and for two way trade to ensue.

Hypo 2 gap-and-go lower, down to 13,571.50 before two way trade ensues.

Hypo 3 buyers work a full gap fill up to 13,749. Eventually working up to 13,800.

Levels:

Volume profiles, gaps and measured moves: