As energetic as the bounces have been in some of the most beaten down momentum studs, you should always have one foot facing the exit and an itchy trigger finger. Case in point: the trading action in ANGI. I was able to book a small win on my options position today before it really went south. It may go higher from here, or lower, but one matter is certain, the context changed from dead cat bounce to violent horror show for both teams…and the sellers seem to have speed on their side.

You have been reminded of these contextual conditions repeatedly by the sage (no Impala) cast members of the iBankCoin hegemony. I had stops in place for SINA today as well, but it behaved well enough to earn a pass to Tuesday’s trade. My only other trade was buying BIS near the open. I am underwater slightly on the name but take solstice in having the position in these precarious times. It helps me hold onto XOM which, goodness, we nailed some kind of entry on. I am up nearly 30% on the name. Of course, I started this position half sized, uneasy with the knife catch but impressed by the story. I am waiting for a pullback of sorts, something that grinds both sides up, so I can add more size. I may not see it until much higher.

I am pressing FCEL right up into the earnings grill, which is tomorrow after market close, if POS, ehm, TOS has the information correct. Finviz also states after market close, but you never truly know with these back ally stocks.

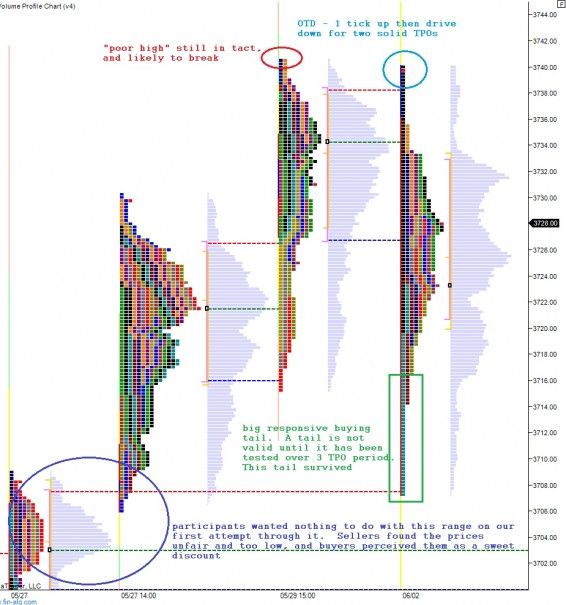

We printed a normal profile today on the NASDAQ. The normal day is classified as having an initial balance which is so wide, so dynamic, the rest of the days’ trade is unable to breach the extremes. The name is deceiving, and I am not sure why Dalton named it as such, because the days are anything but normal. They are actually very rare and an undisrupted initial balance occurs less than 20% of the time. They typically occur when a news driven open makes such a large move we are unable to disrupt it for the remainder of the session. The volume profile is fat and has three different distributions. The actions marks indecision and will certainly give participants something to chew on this week.

We had an open-test-drive where sellers one ticked higher and immediately drove price lower. This suggested strong directional conviction by the shorts. However, we found a strong responsive buyer just below last Wednesday’s low. The two sides duked it out and it looks like the bulls used their intermediate term control to press a ever-so-slight victory on the day. See for yourself, and interpret the profile as you may, this is how we learn:

I was trading /NQ live today, and was actually making money on the long side during the drive lower. There were some healthy counter rotations going on inside the liquidation which was a slight hint we may find a strong responsive buyer. This type of trading takes 100% dedicated focus as I truly was picking up nickels in front of a steamroller. But have you ever seen those little birds who run along the shore break and snipe clams? Nature has a place for the nickel-picker-upper, so don’t hate the player babe.

If you enjoy the content at iBankCoin, please follow us on Twitter

Sir Raul..

FCEL to announce Q2 earnings After Market (Confirmed) Jun 3

*no position just cross referencing for you.

😉

*fidelity^

also:

FCEL Earnings Conference Call at 10:00 AM Jun 4

Sooz, thank you for cross checking the date, much appreciated

Love this volume profile analysis. This is quiet helpful.

I do too, otherwise I would not perform it