I will once again, likely in vain, attempt to help you help yourselves.

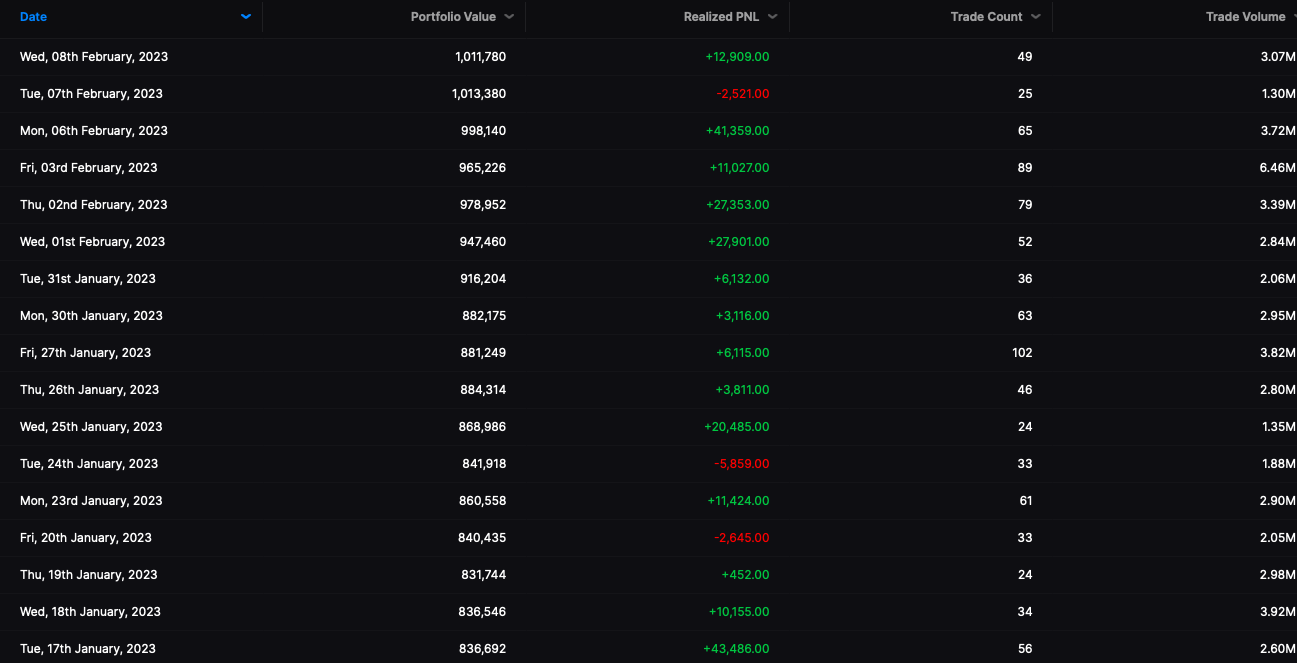

How did I turn $100k into $1m since late 2020?

I am able to scan the market with perfect alacrity thanks to the software I built — Stocklabs. Without it, there is no way in hell I could’ve done it.

Yes this is an endorsement and yes you should join and if you’re asking me seriously — no you should not only depend upon my picks but instead develop your own skills, which will take a lot of time and set backs and unending experiments. Providing you are always in the game, you should be ok. The way to stay in the game is by avoiding overly concentrated positions (greater than 10%) and sector allocations. If you have 20 positions at 5% weight each and they’re all in tech — are you not egregiously over-concentrated?

If you want to know the secret to my success in trading — here it is.

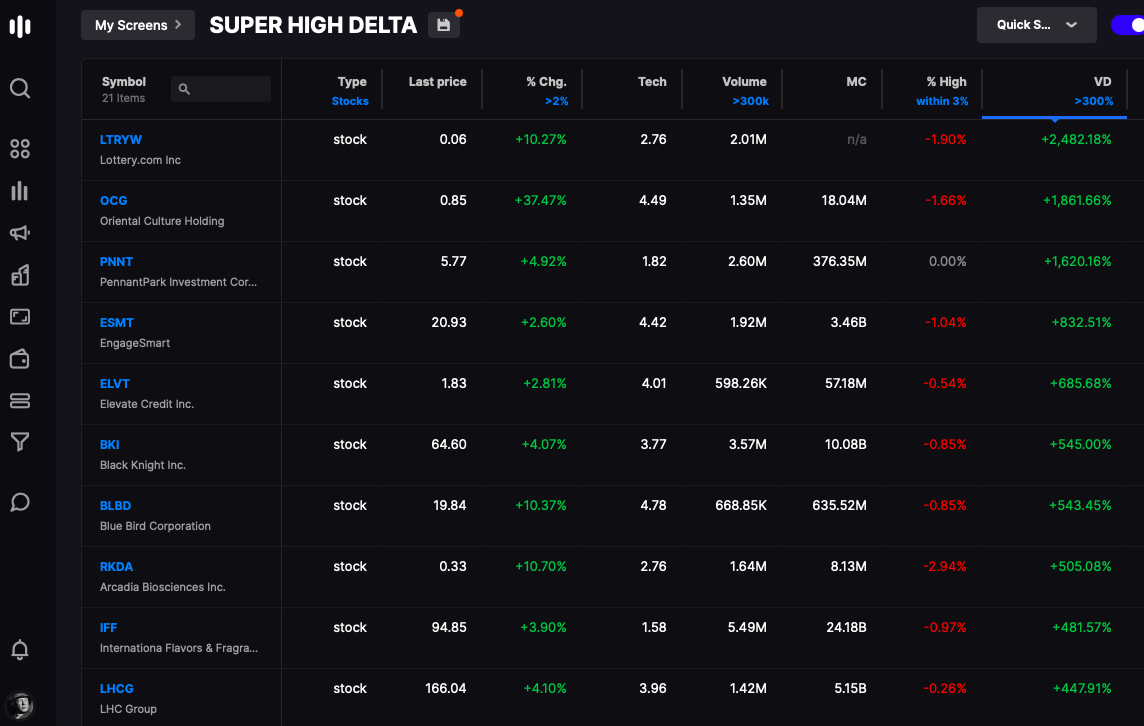

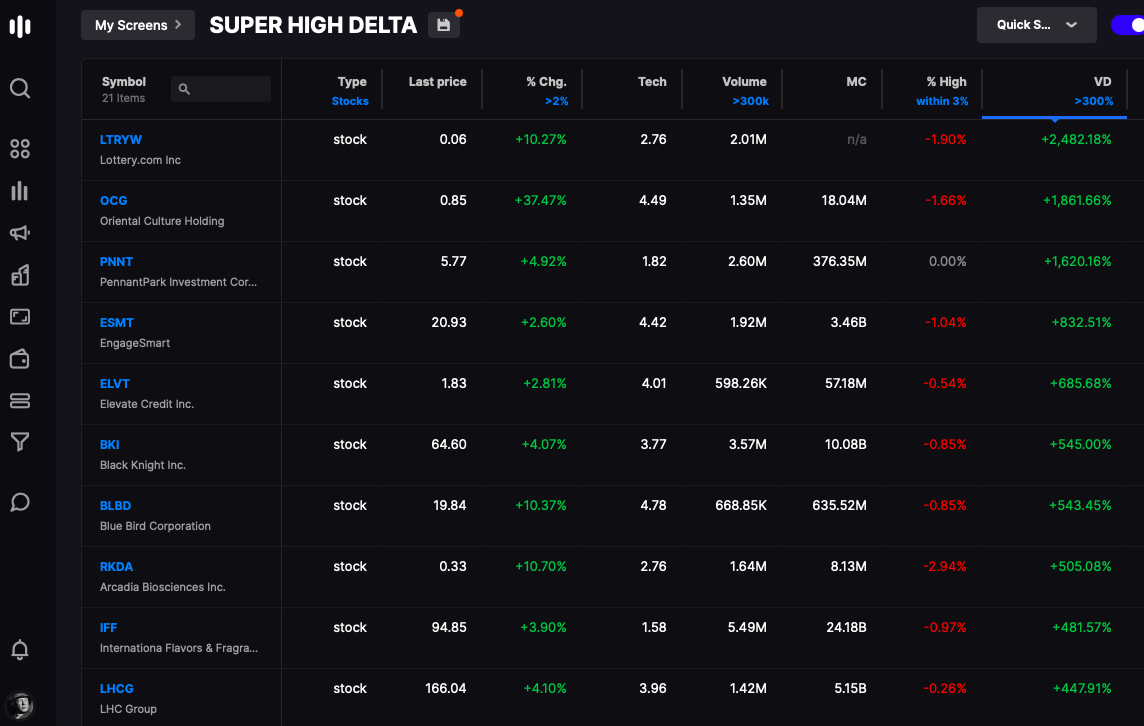

I use our dynamic screens to find fast movers. The best way to find runners is by analyzing the volume. If XYZ trades 1 million shares per day, but has 900,000 shares trade by 10am, ordinary screeners will not show a volume spike. What I have done is pro-rated the volume of a stock by the minute — using a 30 day average. I named it “volume delta” and I use these screens to help me find stocks moving higher on aggressive volume.

During the bear, the delta screens were useless. I resorted to other screens for my ideas, such as finding mega cap stocks near session highs, in an attempt to squeeze out 2 or 3 percent. But with this market, I am able to find 10% runners inside minutes and it’s important to capitalize on this now, whilst the times are good.

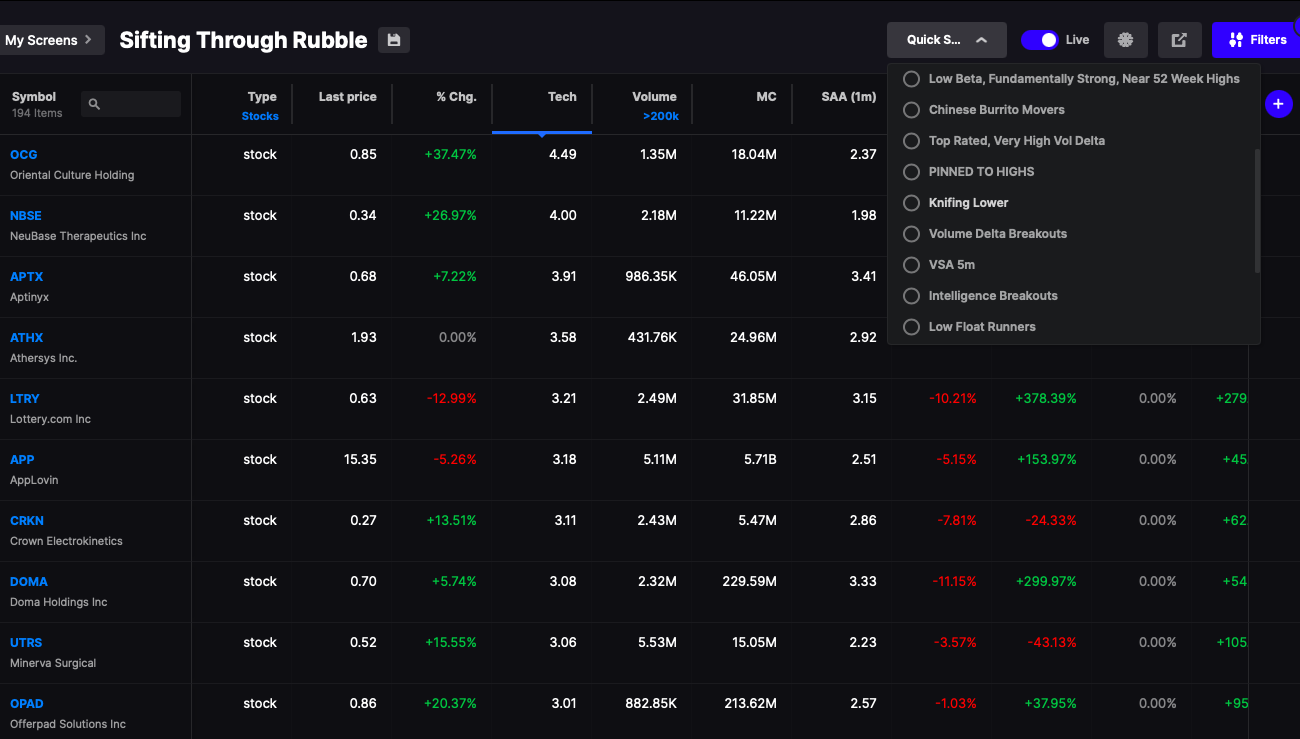

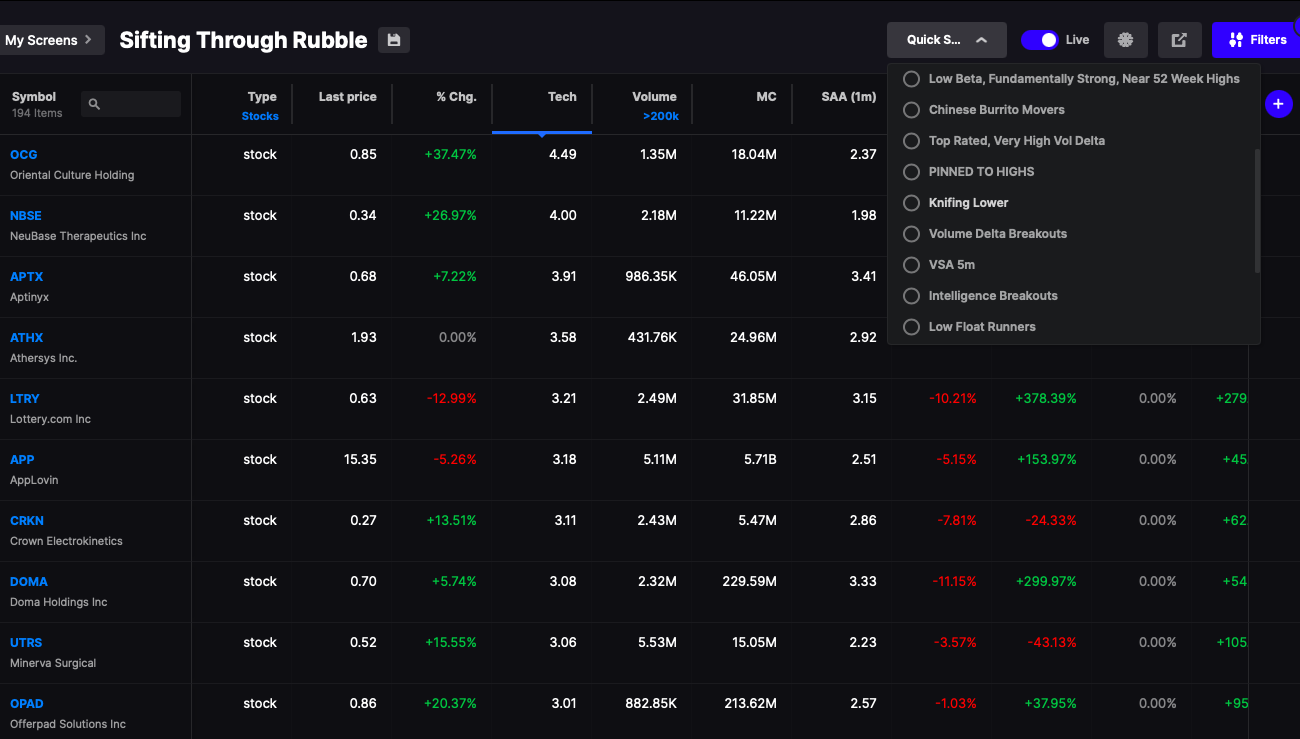

I have a wide array of screens that I made and keep in the default screener for members, in a drop down.

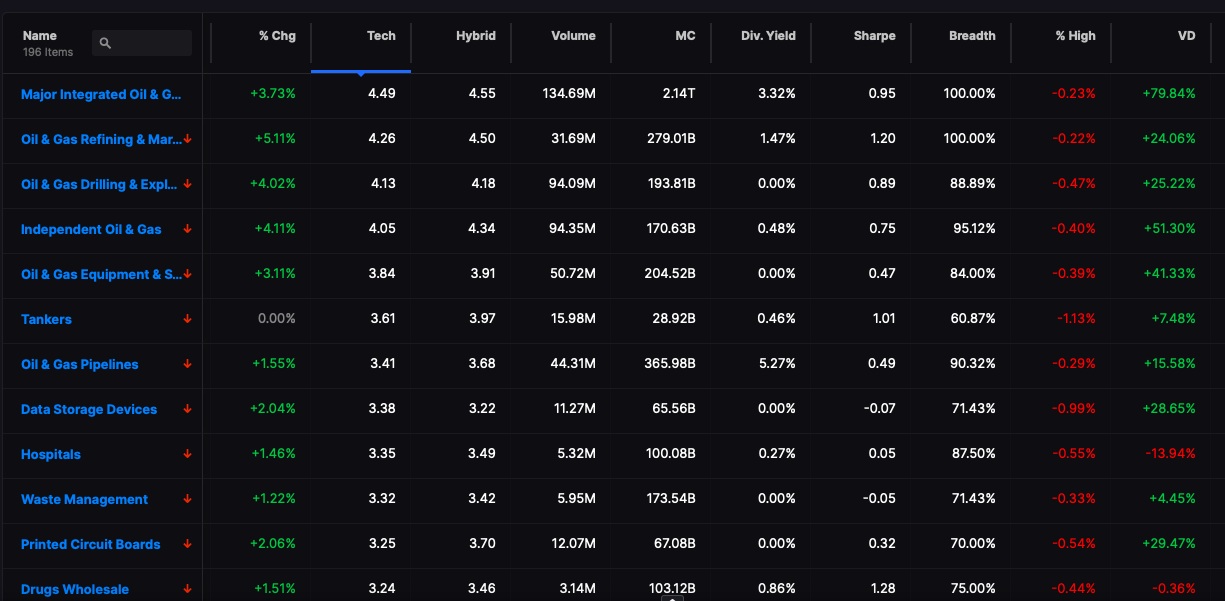

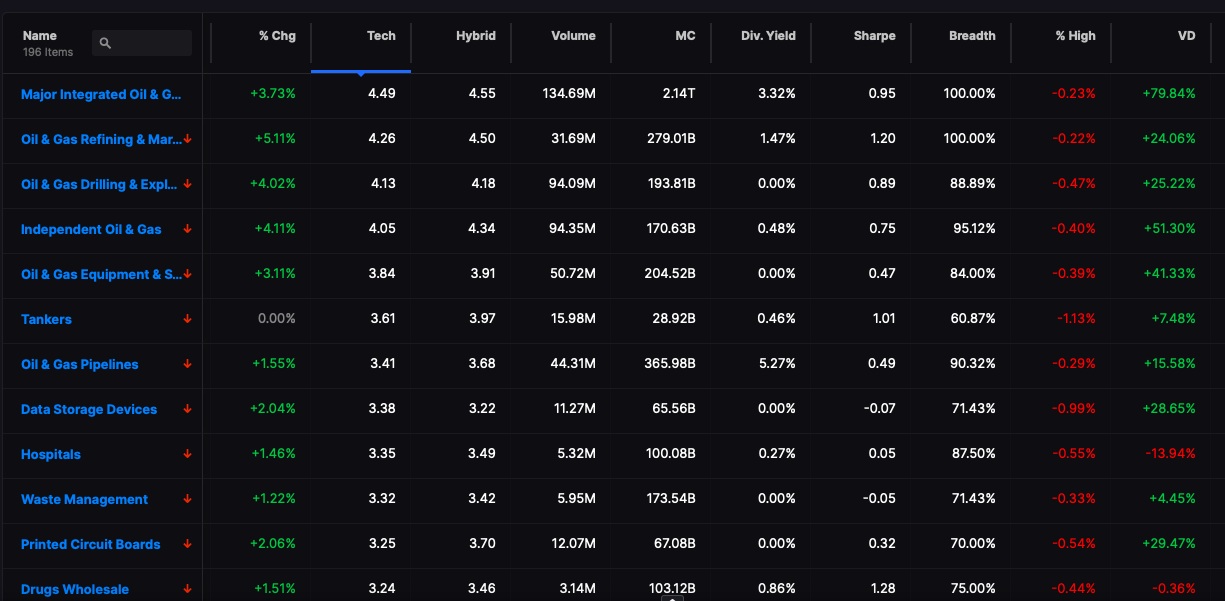

Another thing I utilize frequently is thematic trend analysis. This is best achieved by creating baskets of stocks in a certain genre, in addition to micro-managing industries. I have over 100 watchlists of stocks created that can be viewed upon to analyze movements over timeframes ranging from 30 seconds to 30 minutes, same with industries (198) and sectors (8). If Artificial Intelligence stocks are moving higher with aggressive volume, I am able to see it via % change 5 min and volume surge analyzer (5 min) tools inside my watchlists tab.

The volume surge analyzer (VSA 5m) measures the volume in a stock over the past 5 mins compared to previous. We provide this information ranging from 30 seconds to 30 mins.

(VD=volume delta)

I rarely buy runners down more than 10% in any given session. Some people have success in buying dips — but I prefer momentum. I find it easier to extricate a little more from a runner blasting at session highs on aggressive volume than one knifing lower amidst panic selling.

This might all end next week and we might be back in a bear rape tape. For that, I analyze what I call an “Alpha ETF” screen, which produces ETF runners over a 5 min times frame (my preferred time frame to view). I often use ETFs to hedge my longs and take quick rips. The trick, I have found, is to take very large positions — sometimes as much as 40% of assets. While this might seem reckless — it’s not. If you have a 100% long book — anything less than 40% is still a net long position. I often take 10% weighted positions in SQQQ or TZA or UVIX or LABD in an attempt to slow down the losses I am enduring in my longs. Many times these hedges end up as losses, and that’s 100% acceptable. If markets look to be turning back up, I simply close out the hedges and sit on the my existing longs for recovery. In many cases, I close out my hedges for small percentage gains, anywhere from 0.5 to 2% is my goal. While 1% gain might seem like nothing, when you have 20% of your book in it, that is on par with booking a 4% winner in an ordinary sized position. At any rate, the whole point of a hedge isn’t to “make money” but to slow down the losses and/or make small gains in an attempt to eventually make the greater sum on the long side.

Comments »