God damned ingrates. For all Marc Benioff has done for Salesforce.com, transforming it from a piece of shit, low level, retard tier software company, into a Madoff like profit making machine, shareholders don’t want him to have a lot of their money.

The board SLASHED his pay by 60%, from $33.4m to a paltry $13.2m, hardly enough to finance a proper yacht, to be stored, raced, and flaunted when summering in Newport, RI.

The board approved this draconian measure by 53% majority.

“After the 2016 meeting, we sought additional feedback from our stockholders,” the compensation committee said in the filing. “The two main themes we heard were that, notwithstanding recognition of the enormous contributions and leadership provided by our CEO, the overall magnitude of CEO pay remained high, and that it would be beneficial to expand’ the use of performance-related stock units for Benioff and other executives.

Poor Benioff only owns 5% of his companies shares — putting his net worth barely above $4b. Year to date, the stock is higher by 24% to all-time, record, highs, yet Marc’s compensation is down by 60%.

Hardly appropriate for a man of his stature.

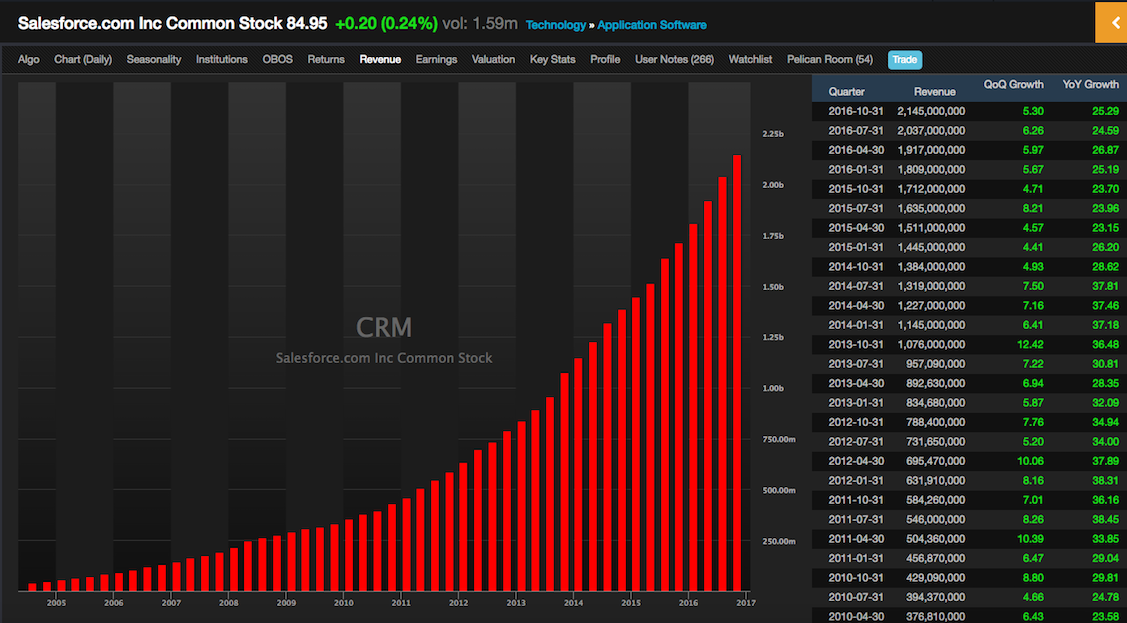

This is what his leadership has produced over the years.

Good luck finding a replacement.

Comments »