It wasn’t my month or my tape. If you’re an avid reader of me you’ll know that I go through periods of drought — not really knowing how to trade — as if I forgot how to do it altogether. Eventually I bust loose and break necks to the upside. This much is all but guaranteed. If you like to buy stocks on a dip and view me as a stock, now is a good time to buy me.

I am fixed on improving my quantitative method — but that wasn’t the reason for my underperformance.

First some stats.

Month to date losses for some of the hottest themes were rancid.

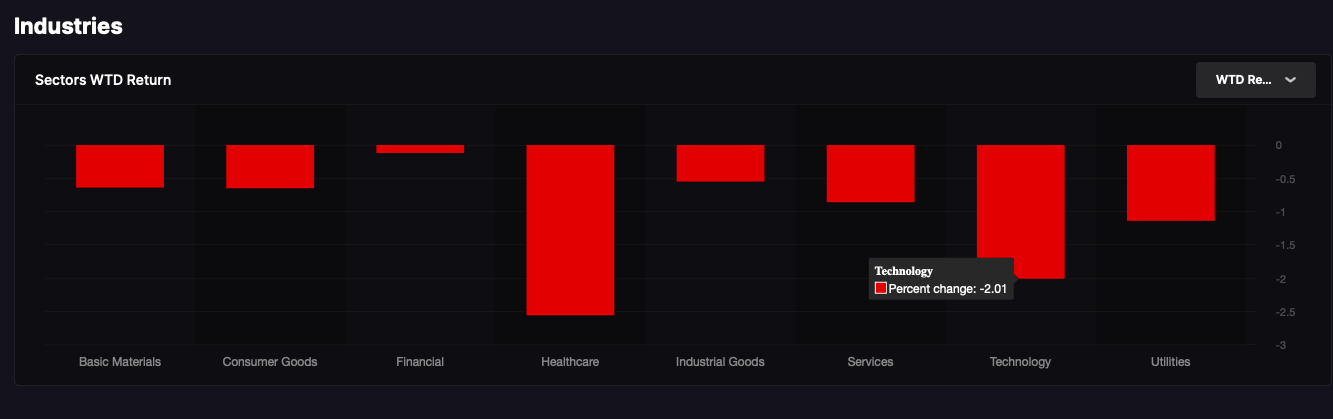

Week to date, red across the board.

Month to date, tech led lower by more than 6%, in line with my losses.

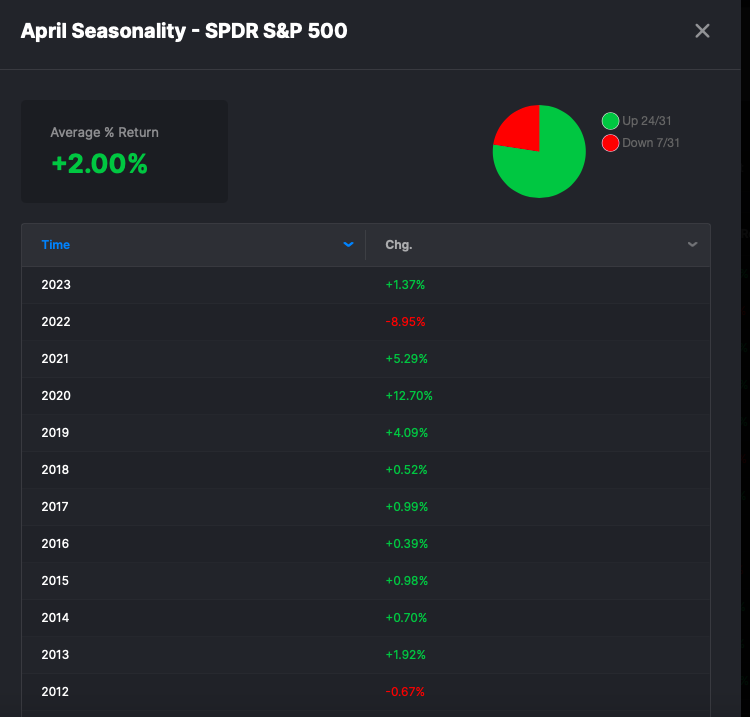

The SPY ended UP 1.37% for April — fulfilling the prophecy of a strong market for the month.

May is supposed to be almost as good.

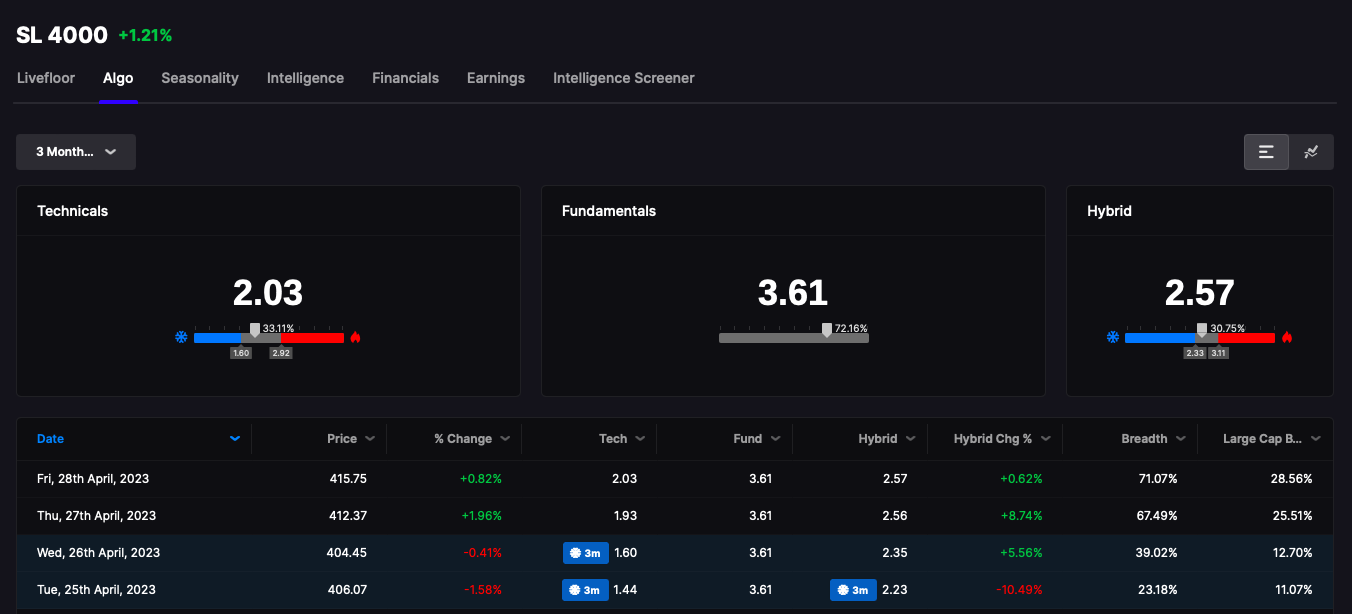

My monthly quant shed 0.26%, which isn’t bad at all. If that is the baseline from which I am to work with, I should’ve made money via trading. But I traded poorly and took large losses in many of my hedges — as markets whipsawed from green to red back to green for most of the month.

YTD: My trading is +31%, Quant +3%

What will I change?

I upped the minimum market cap threshold for the quant to $1b and I’m also, for the first time, going to deploy a hybrid model of growth and low beta. For the month of April risk averse stocks traded up 3.6% — with 10% gains in stocks like CHD, KMB and MDLZ. I missed out on all of those because the quant only looks for growth. But starting May, I am going to choose from my growth pool down to a 3.00 tech score (1-5 range with 5 being tops), and then select from a low beta, good fundy dividend payer aka olde man stock screen of stocks near 52 week highs, and if needed the same screen but without the 52 week high filter. Ideally, the net result would permit the quant to rotate out of growth to secular and back to growth, based on technicals. This has been my dilemma with this system for quite some time and I am not certain this is the answer — but I will try it.

On May 10th, I depart for Europe for two weeks, so trading and blogging will be sparse. I intend to trade from my phone and really annoy Mrs. Fly nevertheless — because I’m addicted.

My trading sucked because markets fooled me for April. The underperformance of growth coupled with outperformance of the SPY and big divvy grandpa fuckers really caught me off guard and the lack of collapse kept me hedging and waiting for resolution. If I could do it over again, I’d likely cut my losses quicker and avoid getting sucked into very large hedges in a market that resisted going down for more than a few days.

Lastly, the Stocklabs mean reversion algorithm nailed another oversold. It should be noted, so I have done so.

Comments »