I am 10% exposed to the market as of now — but that can change at any moment. I am long $SOXL because the market is down heavily and whenever that happens — retards enter the foray and bid it up.

I am +62bps so far in smart trading — very smart indeed. I have been long and short — but mostly right.

The presumption is we are going to cascade lower and detonate the 401k plans of all hard working Americans by Hallow’s Eve. That presumption, dare I say, is exactly right.

The US 10yr is +10bps and all hell is busting loose in the treasury market, further deepening the already crimson losses at the banks. We have an inexorable and palpable crisis evolving and the people are mad as hell about it.

I’d say the mood in America is worse than I’ve ever seen it in my lifetime. People, generally speaking, want upheaval at home and peace abroad.

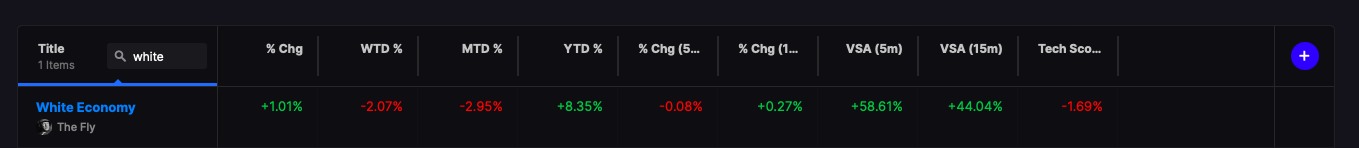

Today’s markets are foisting unbelievable cartoonish sized losses in just about every venue BUT Bitcoin miners and trillion dollar monopolies. If you’re not involved in those niche areas of the market, your losses are in the ball park of -1.5% today.

My gains are handsome because I am handsome and I’ve worked harder than you to perfect my trade. This doesn’t have to be an adversarial relationship, as you are of course welcome to join Stocklabs for as little as $2 per day and glean off my ideas like a chum fish attached to a great white shark.

Audio version of blog

Comments »