Good day —

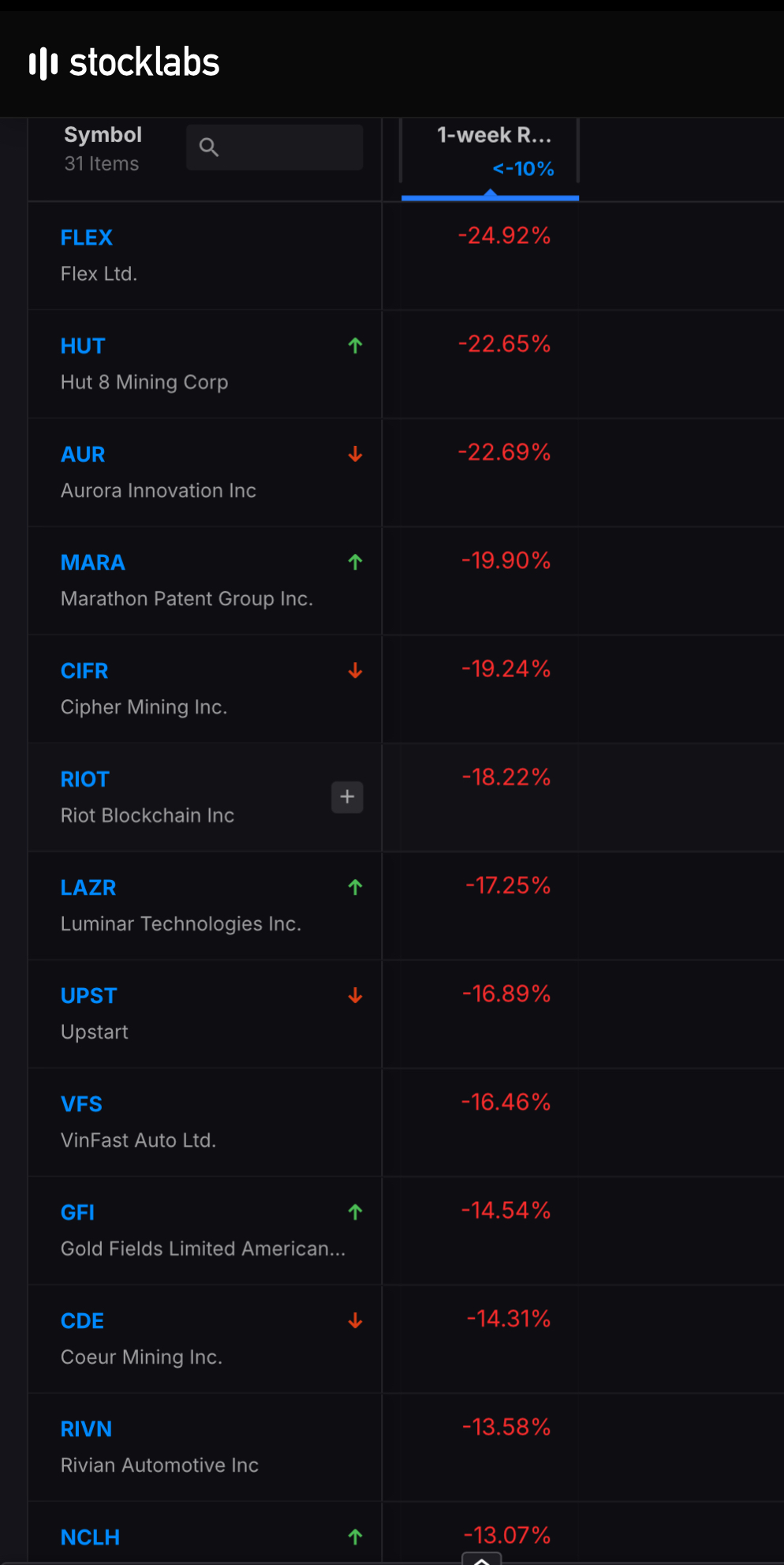

This morning we were entreated to a garden varietal market bounce, starring all of the usual suspects save crypto miners and biotech. Although breadth is at 67% upside, the rally is somewhat selective. Nevertheless, a rally is a rally and the banks are very happy in this environ and continue to trade up.

I haven’t given up on my shorts yet — because I have faith that all will collapse. This assumption of mine is rooted in the idea that you, the weak hobbled long, will have second and third doubts the second chinks in the armor present themselves — causing a cascade and rush out of risk and back into my inverse ETFs.

Perhaps I’ll end up wrong. It certainly wouldn’t be the first time and the idea of rallying after diving 3% to start the year isn’t exactly novel. We are supposed to rally. After all, why not? This is as far as I can go to explain the bull case logically.

But in the off-chance you do get scared into the afternoon hours, thinking about the weekend to come and your losses stacked heavily for the week, I will be here like an usher at church to collect your donations.

All sorts of things can happen: Houthis and their rockets, Russia and their missiles, Gazans and their RPGs.

For the session, I am down 43bps, which is acceptable given the fact I am +32bps for the week and didn’t succumb to the small fires that sprouted up to begin 2024.

Comments »