At our core, we are most optimistic about the future, even the most glum and downtrodden amongst us. In the face of hardship and unrelenting resistance, the vast majority of people push forward and thru in search of a better future. It’s the reason why the American spirit of aspiration made us into the greatest empire to be destroyed by monsters today. They don’t hate us for our freedom or our success, but by right. Ergo, the country is being gutted, first by its soul and then the body.

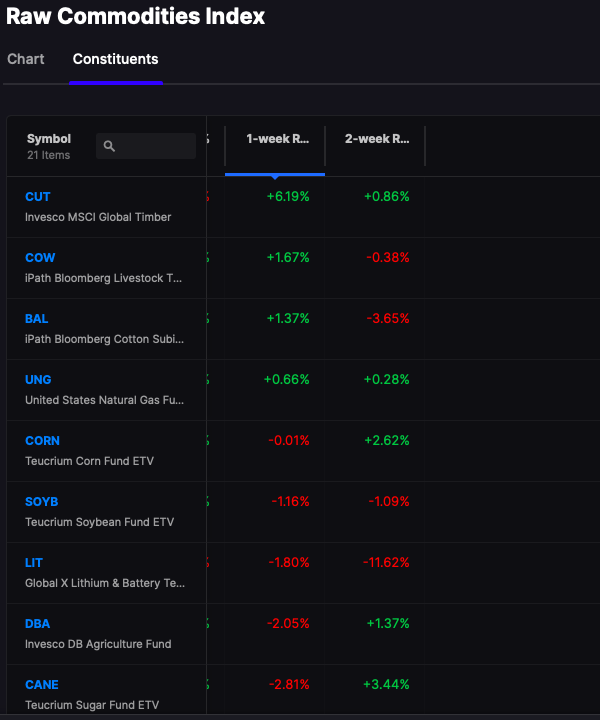

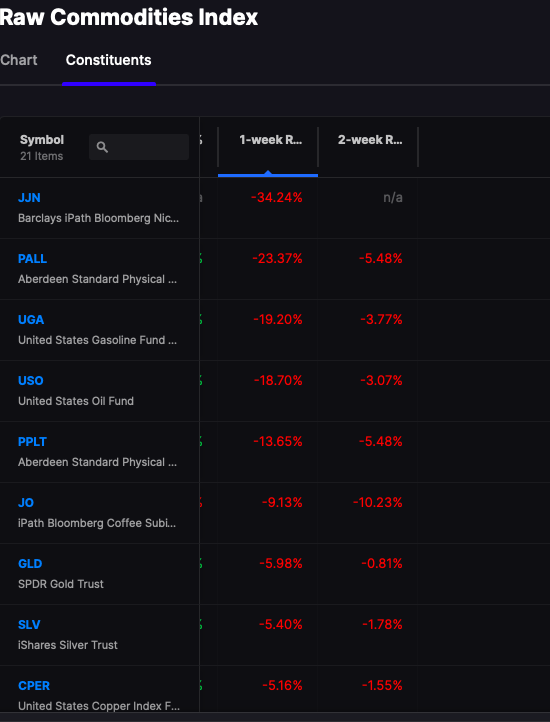

This is just 1 trading day out of many and it was perfect, with barely any semblance of panic. I was mostly cash, but still managed +91bs, with 10% TZA hedge into the close.

In my Quant, I lost 90bps due to oil exposure and in my new algo account, which only buys based off Stocklabs oversold flags, it gained 7% for the day, fully long TQQQ. As a point in fact, and I mentioned this earlier in the room, today was a rare day where the oversold signal flashed even when the NASDAQ was +230. I bought my final tranche at around 1pm with gains of 3.5%. My gains doubled into the close.

I believe markets are fine up until the banks get hit in earnest and then it’s lights out. The interest rates are also an issue, too damned high, and of course the war. There is friction all around us, yet we’re managing to hang in there — eternal hope shining thru because the alternative isn’t fun at all.

Comments »