My business here has concluded and I’ll be making my way back down south in the morning. My biggest takeaway from visiting DC now is the lack of homeless cavorting the street. Dare I say Biden has cleaned up the city and killed off the homeless issue. The people are profoundly vacuous and annoying, glib and teeming with narcissism; but the city is once again delightful.

In terms of the market, I’m still waiting for a fat pitch. I know, the NASDAQ has shot higher by 12% the past month, up 20% from the lows, and 20 year old punks are scoring absurd coin in BBBY.

So what and fuck off. Quit reminding me of missed opportunities and trades that could’ve happened. I have enough regrets and really need to focus on what I have and the good things I’ve done.

I’m up 47% for the year and that’s something to be proud of. Granted, I was up 212% last year and I haven’t made any money in the past month and a half — but fuck off. You think I didn’t know that?

I’m not gonna force myself into trading like an imbecile just because you want gains. You’ll just have to wait until my brain connects with the market again and delivers a fat pitch.

Good news on the Stocklabs development front.

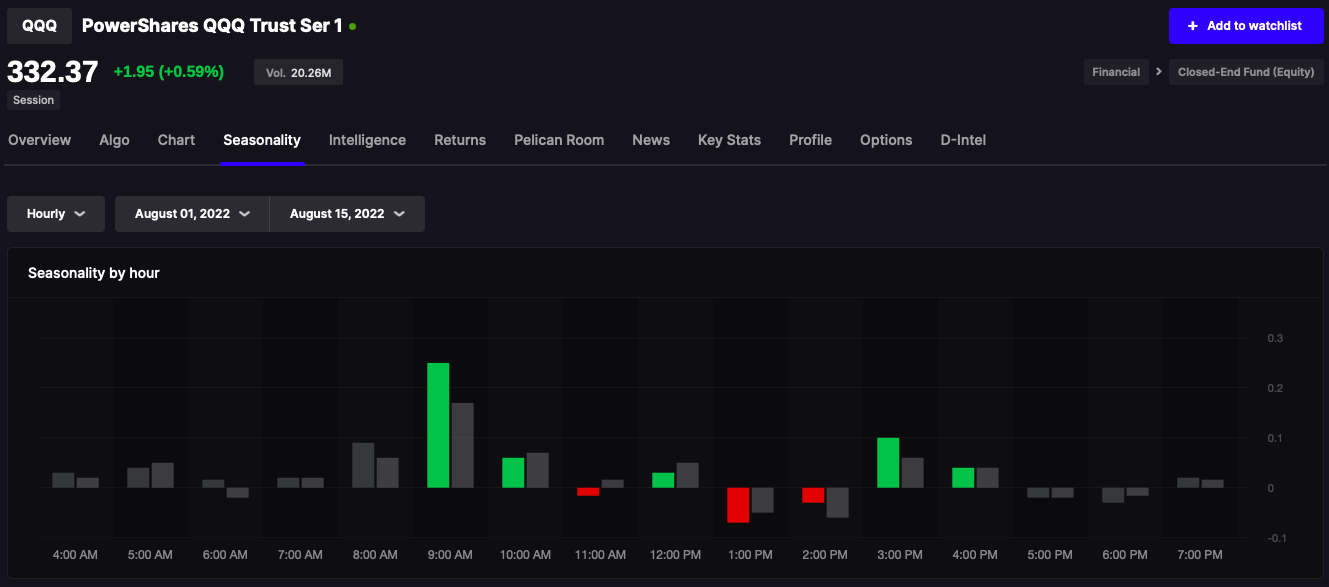

Our options product is steaming ahead and will be ready for beta trials soon. After that we will focus on the AI product, which is a life long dream of mine.

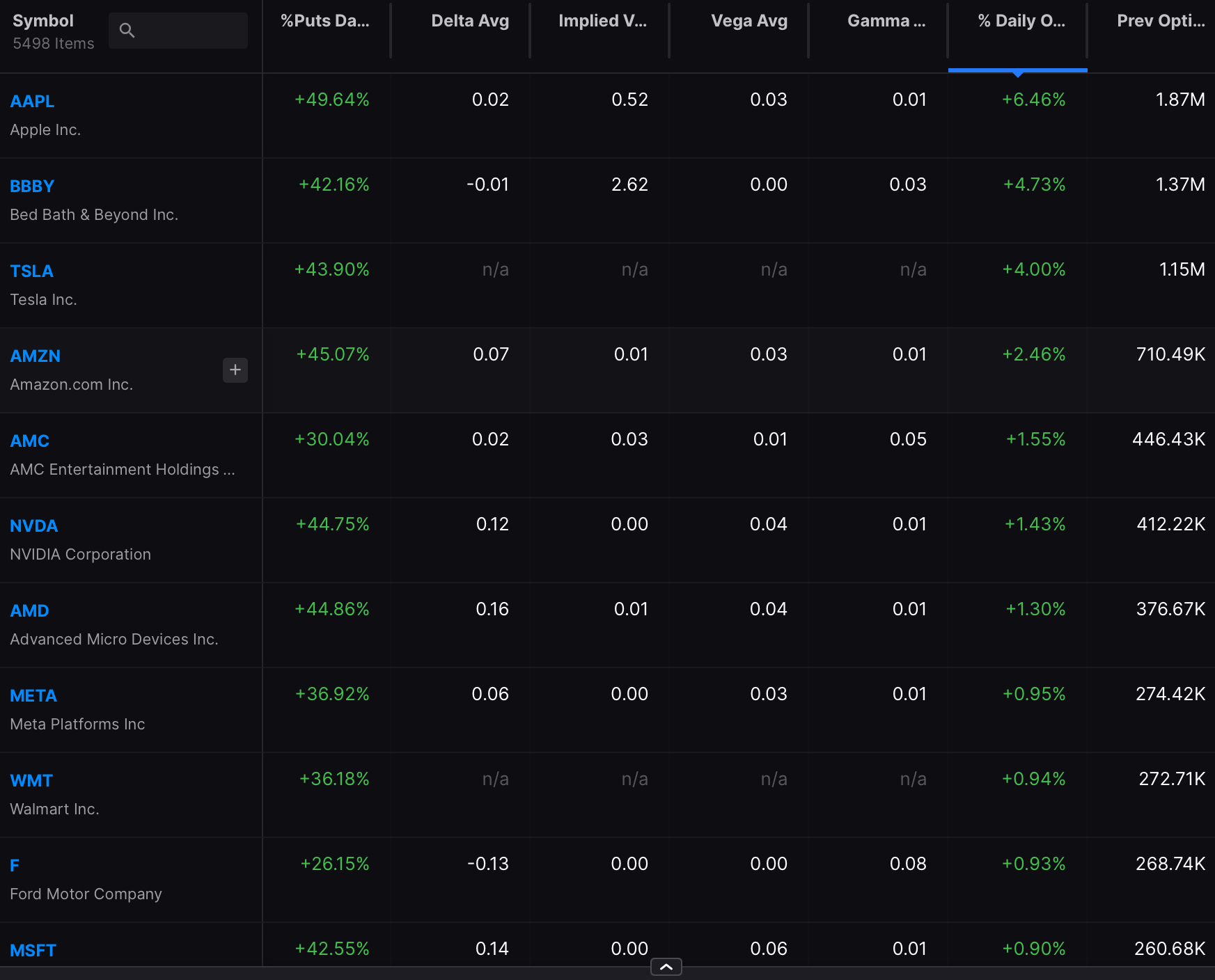

The chart above shows the most active options in the entire market for the session. We’re gonna collect a fuckload of data and parse it and after we are done parsing it, we will parse it again.

With the launch of options I will start to trade options again and dedicate a public portfolio to it. Bear in mind, I’m out of practice and will really need time to catch up and get into the swing of things. But once I do, and after I build the tools necessary to trade them, I can guarantee you’ll I crush.

Comments »