Stocks are being lit the fuck up. A full reversal of fortune is happening. This was somewhat predictable, being that NKE was the Dow points and breadth stood at a paltry 51% at the highs of the session.

This downslide is being led by biotech stocks, following news that money isn’t all that valuable for the industry anymore. Bernard Sanders, prospective President of the United Steaks, will transfer the profits from the biotechs into homeless shelters and hospices.

Seriously, though, the Fed Chair is seizing out in public, Russia is moving drones into Syria, Iran is shitting on American flags while accepting our peace offerings, and Obama is the Manchurian candidate– a Kenyan who snuck into the White House to fuck it.

THIS IS THE WORST FUCKING WEEK EVER, for biotech. Come look at the carnage, son.

Here’s big pharma

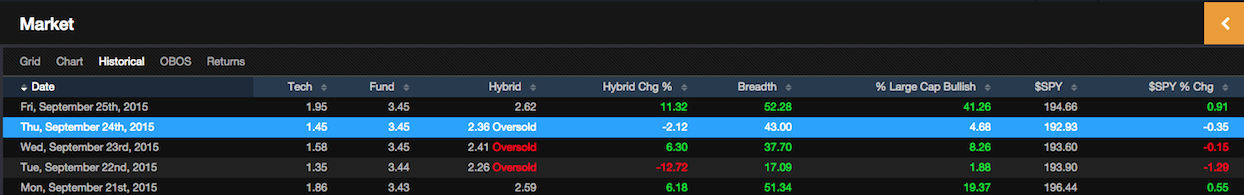

Data provided by Exodus.

In my experience, these types of drops are either immense buying opportunities or a prelude of hideous things to come. The banks endured this type of pin action in early 2008, before melting the fuck down in the latter part of the year.

We all know the biotech sector is overvalued. Why is that? It’s Fred Wilson’s fault. All of the tech IPO’s are incubated for years, jacked up by assholes, then dumped onto an unsuspecting public who provide liquidity for the VC devils. So we became keen to this game and opted to steer clear of the scams. We bought up the biotechs because the FDA offered us extreme upside, upside that wasn’t controlled by Mr. Wilson.

It was a high risk trade and it’s dead now. This is a bear market, 100%. Position for recession. Stocks like CLX, CL and PG might do okay. I think it’s abundantly clear that you should be selling short the rips now. The Fed put was swallowed by the incompetent Janet Yellen– and mouth vomited– on stage, for the world to see.

https://youtu.be/lrcj_4_k0Vc?t=194

Comments »