This is my least enjoyable year in more than a decade trading. Despite being up 15 some odd percent, I hated 2015, even more than my big drawdown year of 2014.

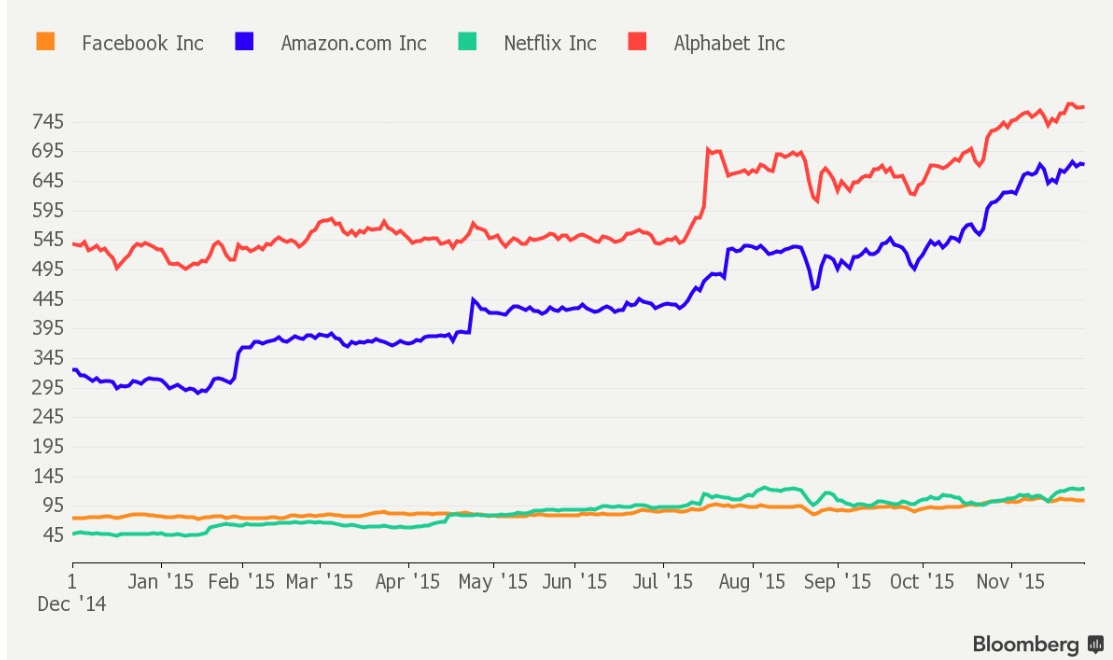

For more than 6 month’s, I’ve labored in this market, dodging bullets and absorbing knife wounds to the stomach, all for nothing. I made all of my gains before May, and then have watched the market morph into a FANG fest, where only a handful of stocks went higher and where my holdings never seem to get a break.

Granted, I am grateful for not getting David Einhorn’d this year and life could be worse; but it’s not fun managing money right now.

I’ll tell you what is fun: advertising on Twitter can becoming a phenom in places like Mongolia and Turkey.

For the first time ever, iBankCoin is beginning to advertise on both Facebook and Twitter, just to expand our tentacles. Thus far, our FB experience was no different from tossing bags of money into flaming barrels of garbage. Twitter, on the othe hand, netted tanglible results, but were skewed by the fact that foreign bot accounts plague the ecosystem.

Before I screened my target audience, dumb shits from all over the globe started to follow me, in response to my ad campaign.

Here I am rambling about some shit that 99.5% of you couldn’t care less about. Geez.

Rule #1 when blogging: talk about what the people want to hear, not what you want to write about.

With that in mind, FCX popped out of nowhere, as did my PAH position. This is the time of year, when volume thins out, big hedge funds push stocks around, in an effort to salvage their pathetic year’s and ingratiate themselves with monstrous sized paychecks.

God bless America.

Comments »