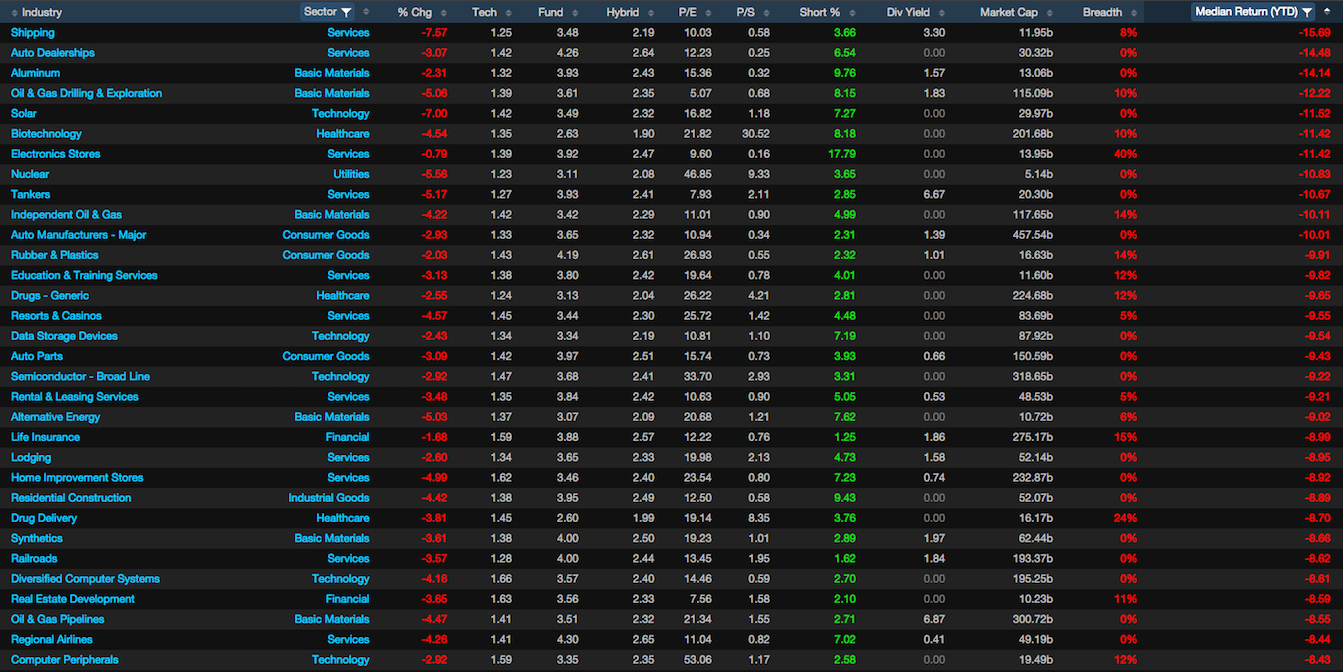

This is a staggering statistic, especially for the people who tell us the market is doing just fine. Over the past 6 months, the median return for stocks with market caps under $1 billion is -24%.

This encompasses over 2,000 equities.

On the large cap front, the median return for stocks with caps over $1 billion is -9.7%.

Again, this data set accounts for over 2,000 stocks.

In other words, the small cap degeneracy class is mired in a horrifically bad bear market–a real kick to the nuts type of tape. The larger cap varietal is in correction mode, smashing old men like accordions–fleecing them for all of their dividend gains.

data provided by Exodus

Comments »