The good times are over, apparently. Asset managers and self directed investors should prep themselves for the eventuality of moribund returns, according to Morgan Stanley.

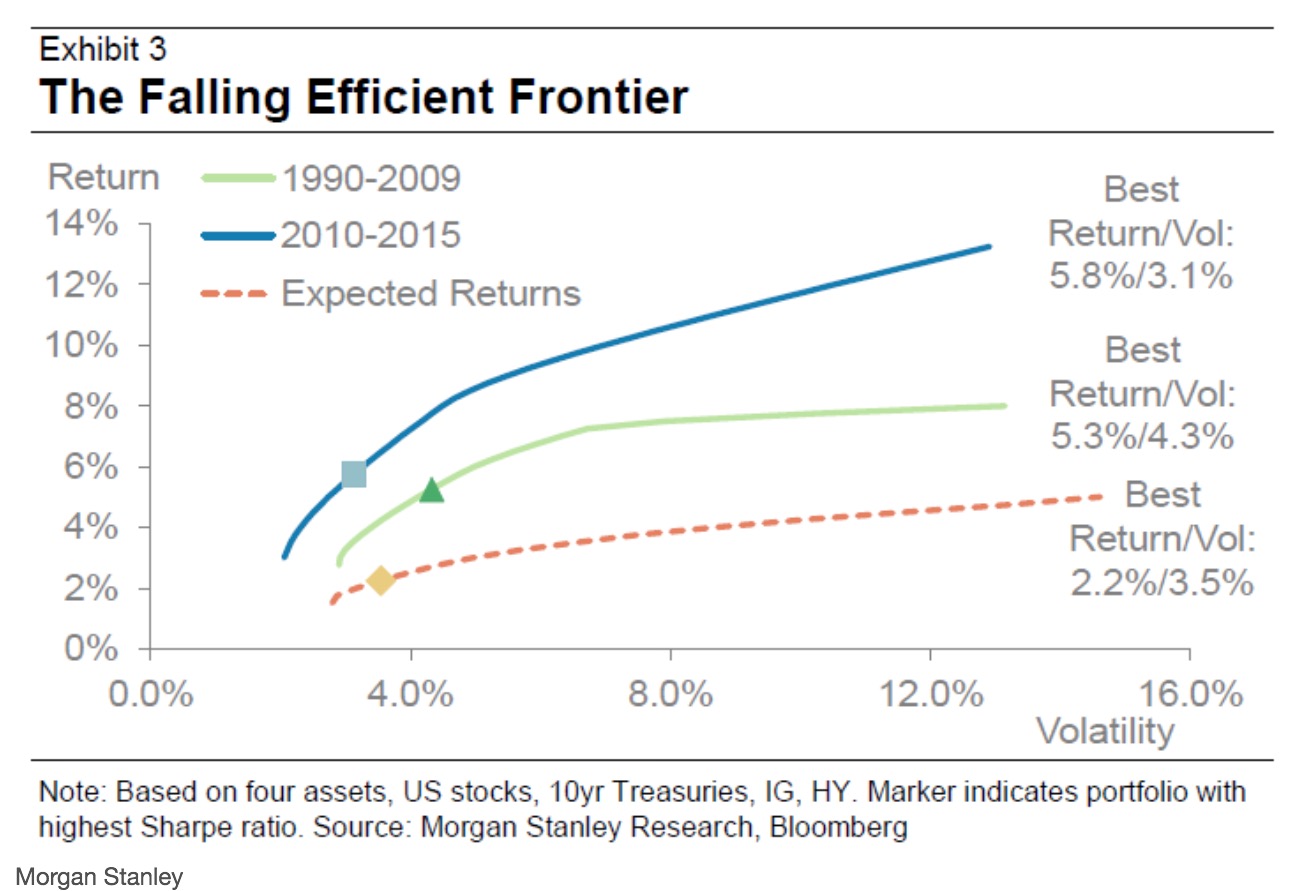

A period of unprecedented monetary stimulus in the wake of the global financial crisis helped spur “an unusually benign” trade-off between the risk a portfolio manager is willing to take and excess returns generated.

That is, returns have been higher for a given level of volatility than the previous 20-year average. What’s more, notes Sheets, is that the slope of the 2010-2015 frontier shows that adding more volatile holdings (like stocks) was a better risk-reward proposition than the period from 1990 to 2009.

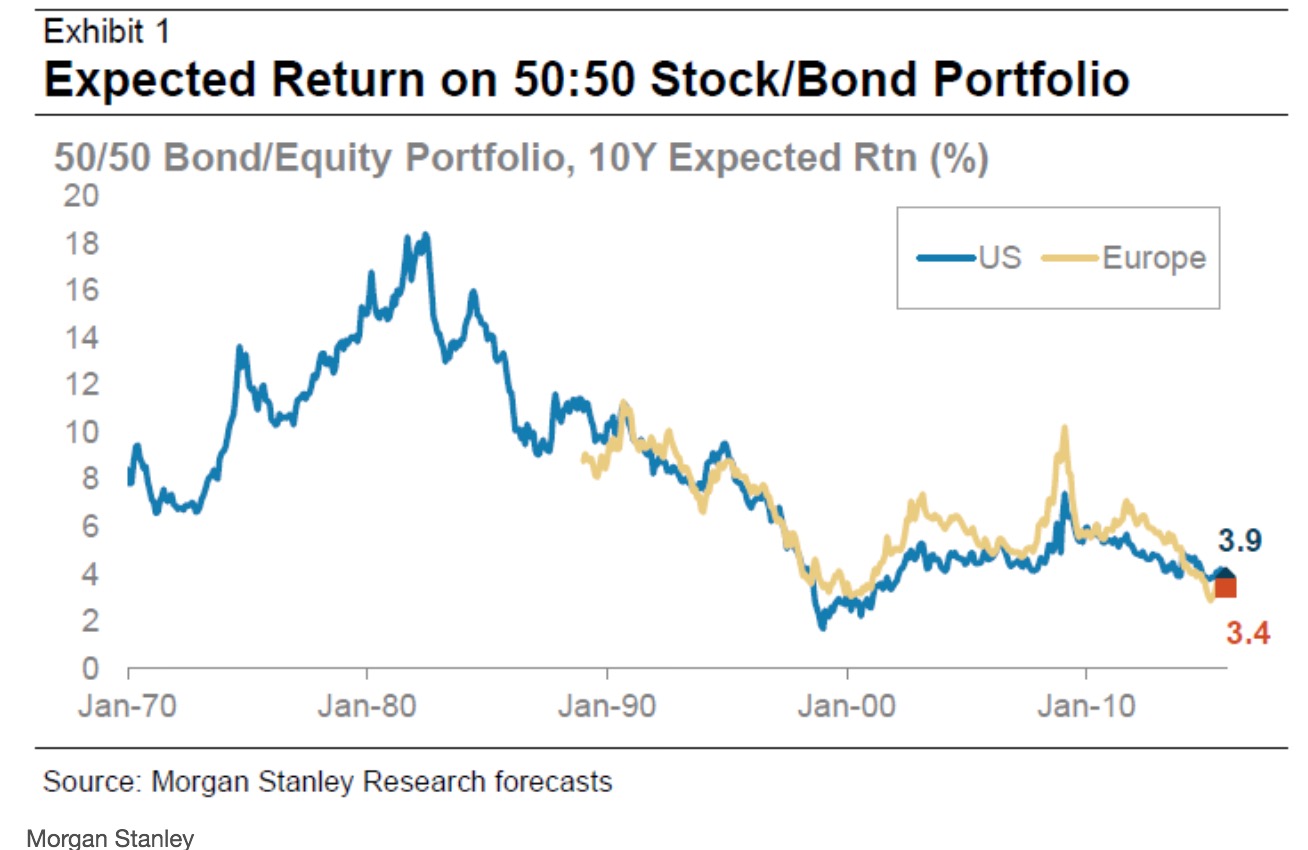

But Morgan Stanley’s forecasts for returns across asset classes suggest this is all about to change. Investors should prepare for an era of below-average returns, in which moving into riskier holdings won’t juice performance as much as it has in the recent past. On either side of the Atlantic, the 10-year return from a portfolio equally divided between stocks and bonds is not expected to break 4 percent.

After the Morgan Stanley analyst, who wrote this gibberish, finished this report, he, reportedly, soiled himself and then went to polish off his crystal ball.

If you enjoy the content at iBankCoin, please follow us on Twitter

The T-day stuffing is also over. I just bit my lip eating the rest.

WGBS +25.3% (Martin Shkreli started to/intends on analyzing WGBS, RPRX, MIRN and DNAI, per the request of the people following his live stream),