It isn’t exactly a smoking gun. But by no means was he lavishing himself in the blood of Iraqis like so many others at that time. It was a very emotional time for the country and many of us truly did believe Saddam had that yellow cake.

Comments »October Looms: Is $FCX a Boom or Bust?

Bullish narrative: China figures out how to get out of their banking crisis and grow their economy again. H. Clinton gets elected, providing China with the extra capital they need, gathered by ripping us off, to stockpile more copper. Freeport continues to delever its balance sheet and lives happily ever after.

Or: Freeport is unable to make profits with copper hamstrung at low levels, due to China’s inability to grow. Trump gets elected and declares China a rogue state, which starts a sequence of events that causes Freeport to refinance its $18b debt load during bad, dilutive, conditions.

Copper drops off a mountain and the shares cascade into the mid single digits.

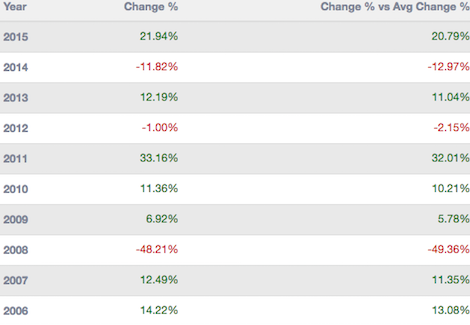

October is the month for wanton volatility. Courtesy of Exodus‘ seasonality engines, FCX has both enjoyed and endured double digit returns and deficits for the month of October in 8 out of the past 10 years.

I am biased. FCX has a giant hole to dig out of at a time when commodity prices are unsupportive and are headwinds for a company seeking to delever. This was one of my largest positions in 2015 and I sold it out to eventually pave the way to sell it short in 2016 –currently a 25% position of mine from $11.60.

Comments »ISIS No Longer Controls Significant Iraqi Oil, But Still Makes $22 Million Per Month in Syria

I remember vividly reading about ISIS crude being smuggled and sold to Turkey when WTI was near $100. Back then, pricing pressures in the region were significant because they’d sell the oil for 50% off, sort of a bargain basement terrorist going out of business sale. Apparently, they’ve lost virtually all major Iraqi oil fields and now have to rely upon Syrian fields, which are coming under severe pressure by government and Russian forces. It’s worth noting, they’re selling the oil for $15-20 per barrel now.

Perhaps it was all just a coincidence, oil dropping after ISIS grabbed control of significant reserves. We’ll know for sure, only after they lose their last field by watching to see if the price of crude runs higher as a result.

Comments »The oil ISIS holds in Syria constitutes 70% of its total income as they hold six key oilfields in the country,” Khinsi explained.

In Syria, ISIS holds three significant oilfields. Of the 80,000 barrels ISIS produces on a daily basis, it sells 50,000 through smuggling and “each barrel sells for $15 to $20.”

According to Khinsi’s figures, the extremist group makes an estimated $750,000 daily and $22.8 million per month.

But oil is not the terrorist group’s only source of income, the Kurdish economist explained. “Euphrates and Al Baath dams produce electricity and the Syrian regime buys it.”

A local from Mosul told Rudaw that ISIS is looking for other ways to gain an income, even playing on the anticipated military operation to liberate the northern Iraqi city.

“It is rumoured among the Mosul people that they will be allowed by ISIS to leave the city if they pay $4000,” a Mosul resident, who declined to reveal his name, told Rudaw, adding that “the Mosul people do not trust ISIS as they believe they will lose both, their lives and money.”

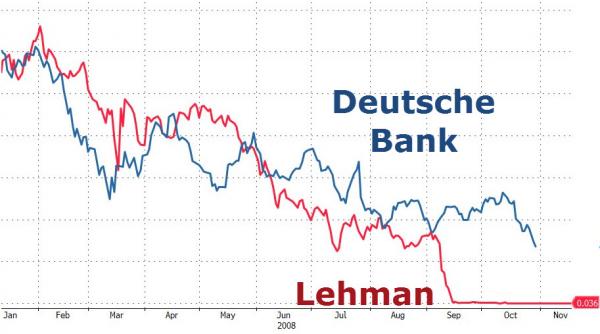

The Deutsche Bank-Lehman Comparison is Comically Startling

Shares of DB are off to record lows again, down about 60% for 2016. Counter party risk is soaring, as investors seek protection against a massive credit event at Europe’s giant piece of shit bag holder of a bank.

Courtesy of Zerohedge, I give you the obligatory Lehman vs Deutsche Bank chart.

And to solidify this narrative, CDS are blowing, mind you, the fuck out.

Credit-default swaps on the German lender’s junior bonds jumped as much as 37 basis points to 536 basis points, the highest level in CMA prices going back to 2007. The lender’s 1.75 billion euros ($2 billion) of 6 percent additional Tier 1 bonds, the first to take losses in a crisis, fell about 2 cents on the euro to a more than seven-month low of 71 cents, according to data compiled by Bloomberg.

“The selloff is gathering its own momentum,” said Suvi Platerink, a senior credit analyst at ING Bank NV. “It’s a reflection of limited market liquidity and a very small number of buyers around.”

Thoughts?

Comments »Citi Thinks the $TWTR Takeover Rumors Are Utter Horseshit

Who wants to buy a company losing hundreds of millions per annum? Apparently no one, according to Mark May at citi.

Mark hates Twitter at these levels and wants you to know the company is worth, at best, $16.

Citi note on Twitter spec:

As a result of Friday’s move, we now believe that the risk-reward skews to the downside for TWTR. While we see some strategic rationale for certain companies to acquire Twitter, the company’s struggles and steep valuation make a deal at a meaningful premium – especially from here – less likely in our view. At the current price of ~$22.50, a potential $26 bid (source: CNBC, unsubstantiated) would represent ~15% upside, but should a bid not materialize we think the stock could retest the lows of late May (~40% downside) given the company’s stagnant user growth, deteriorating financials, and the likelihood of even further downside to consensus forecasts. That said, in the absence of a near term deal, TWTR is likely to continue to trade with some sort of M&A premium. All said, given the fundamental challenges and steep valuation and given the speculative and uncertain nature of M&A, we maintain our Neutral rating.

In other words, Jack Dorsey is a horrible CEO and can only redeem himself by tricking someone into buying his scam. In the event he fails, the downside from current levels are inexorably deleterious.

Comments »Obama’s Weaponized Department of Labor Goes After Peter Thiel’s Palantir

I’m not a fan of Peter Thiel. I don’t like VC guys and I definitely don’t like self admitted gay vampires. That being said, even gay vampires should be afforded basic liberties of speech without a corrupt government targeting him as a form of punishment. As many of you know, Peter was at the RNC convention and is a huge Trump supporter. For Obama, this was unacceptable behavior, especially since he is a gay vampire and is supposed to want to suck his dick and not Donald’s.

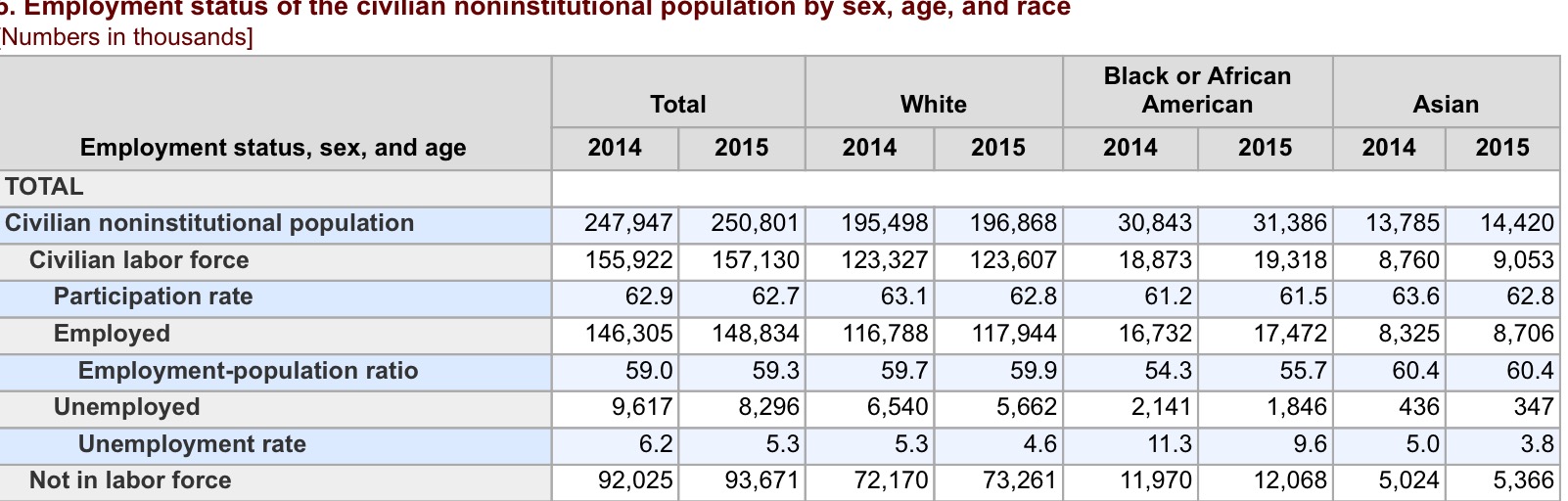

The Department of Labor is suing one of Thiel’s major companies, Palantir, for not having enough Asian engineers. Yes, you heard that right.

Via Breitbart

The lawsuit, filed and announced Monday by the Department of Labor, threatens the complete cancellation of every contract Palantir has with the federal government — a penalty worth $340 million, the lawsuit claims, which would end the company.

The claims in the lawsuit are laughable. The Obama administration alleges that Palantir discriminated against Asians. But it has to admit that Palantir, in fact, hired many Asians — 11 out of 25 software engineers, for example. The government does not even bother to claim that Palantir deliberately excluded Asians. Rather, it argues that since only 44% of Palantir’s software engineers are Asian, but 85% of the applicant pool was Asian, Palantir must, statistically, have discriminated against Asians.

In other words: almost all of the software engineers at Palantir have to be Asian, or else it is guilty of “racial discrimination.” Apparently left-wing concern for “diversity” in the workplace is a flexible concept, based on political expediency.

Just to recap: because Palantir didn’t hire all Asian engineers, they’ve must’ve been racially profiling when hiring employees. The plight of the Asian Americans in this country, hamstrung with the lowest unemployment rate of any race, is evidentially a main priority for this administration — or at least in this very particular and unique case.

BLS stats, employment by race

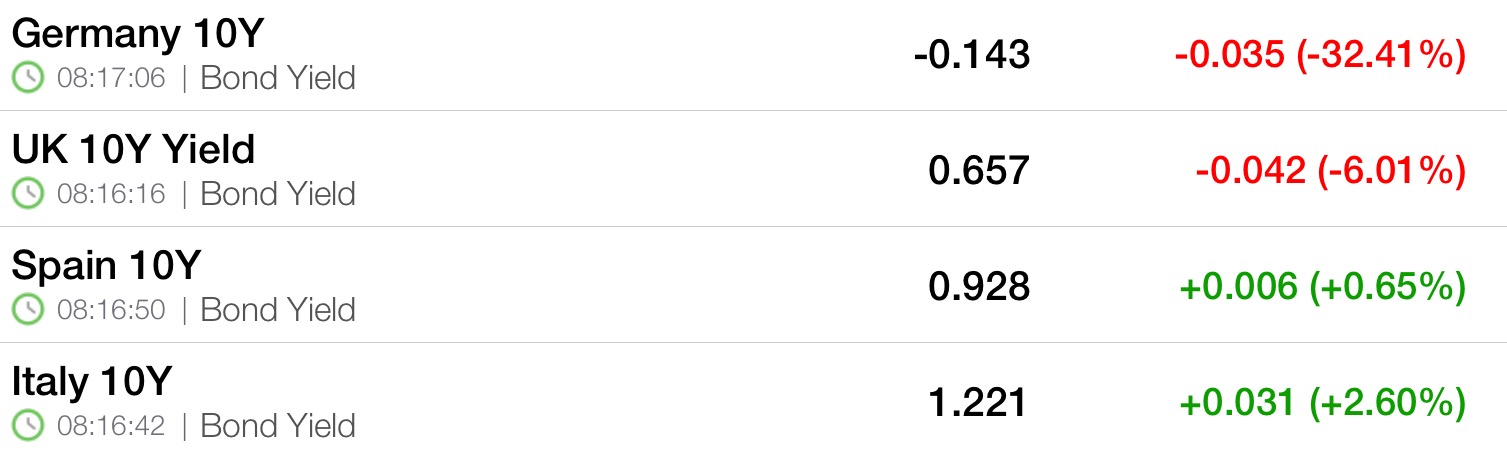

Comments »Italian, Spanish Bond Yields Diverge from German Bunds

This and the debacle at Deutsche Bank are the number 1 stories, because of the complexities. Bunds are soaring today, sending yields below -0.14%. This is a huge issue, especially since just 1 week ago people were celebrating a positive bund yield. That has changed and with these sinking yields are the pangs of miserable deflation.

But the greater vein to this narrative is how the so called piece of shit countries of Europe, Italy and Spain, are reacting to a flight to safety. People are selling their bonds. As German yields sink, theirs rise. As a union, this makes zero sense, unless of course people are starting to really worry about Deutsche Bank and what it could mean for the EU. Remember, without Germany, both Italian and Spanish yields would be anywhere from 5-10x higher from current levels.

Italian 10yr

This might turn out to be nothing, or the biggest story since 2011. It’s certainly worth paying attention to.

Comments »WTO: WORST YEAR FOR GLOBAL TRADE SINCE FINANCIAL CRISIS

In spite of Obama telling us the economy is in epic condition, alongside some Fed officials who want higher rates to slow down this barn burner, the WTO is warning of global trade and also made reference to policies that might make things worse — such as protectionism. As our Asian partners make a mockery of America through unfair trade policies, their spokespeople at the WTO begin to panic –worried the gravy train might soon end.

Comments »Global trade will expand at the slowest pace since the financial crisis this year, the World Trade Organization said, as weakness in key regions and rising protectionism take a toll.

The Geneva-based organization forecasts that trade will expand 1.7 percent in 2016, down from an April estimate of 2.8 percent. It predicts real GDP growth of 2.2 percent, marking the weakest performance since 2009.

Worryingly, the WTO sees a risk that trade won’t pick up next year, cutting its 2017 projection to a range of 1.8 percent to 3.1 percent, down from 3.6 percent previously. It said with increasing wariness of globalization, governments and authorities must do more to support open trading that’s more inclusive.

“The dramatic slowing of trade growth is serious and should serve as a wake-up call,” WTO Director General Roberto Azevedo said in a statement Tuesday. “This is a moment to heed the lessons of history and re-commit to openness in trade, which can help to spur economic growth.”

The revision follows a sharper than expected decline in trade volumes in the first quarter and a smaller than expected rebound in the second quarter as emerging economies such as Brazil and China remained under pressure. North America was also a disappointment, the WTO said, noting a deceleration there this year compared with 2014-2015.

“We need to make sure that this does not translate into misguided policies that could make the situation much worse,” Azevedo said.

JITTERS: Deutsche Bank Continues to Slide

Earlier on, markets were rejoicing in the effervescent youth of Hillary Clinton last night, as she methodically completed the debates last night without incident. Futures were sharply higher and Europe was ripping tits, until Deutsche Bank started to head lower again.

This is definitely starting to feel 2008 ish. The lower the stock goes, the worse off their capital situation becomes, the greater need for them to execute a dilutive rights offering.

The stock is off another 3% this morning and German bunds are sinking in yield again — down 2bps to -0.13%.

Comments »And Here is the Best Moment of the Presidential Debate

Without question, Lester Holt was in the tank for Clinton. That’s not bias speaking, for I couldn’t give two shits about the victor. But where were the questions about the Clinton Foundation and her ties to the women hating regime of Saudi Arabia , the DNC Leaks, Benghazi, her health records, her foreign policy disasters and of course the emails?

Via Heat street:

While ignoring these issues, Holt grilled Trump on stop-and-frisk, the birther story, his comments about women, his many bankruptcies, why he hasn’t released his tax returns — and a host of other issues the media sees as unfriendly to the Republican candidate.

Holt also repeatedly attempted to “fact check” on some of Trump’s positions, such as his claim to have opposed the Iraq War from the beginning. Holt interrupted Trump several times to interject, but rarely succeeded (and may have come across as weak and impotent).

So here was the most transparent and telling moment of the night, like a boss.

Comments »You've got to hand it to Trump https://t.co/30wz5Yj7AO

— Best Vines (@TheFunnyVine) September 27, 2016